PSD2 changed the payment industry by allowing banks to share customer data with authorised third-party providers. This shift enabled the development of new features and more efficient payment processing.

The European regulation introduced several open banking terms, including PIS. In this article, we provide a clear payment initiation services definition and explain their functions and benefits for e-commerce merchants.

Curious about how PIS could benefit your business? Read on to learn how it can help you streamline payments and improve your customers' experience.

What Is Payment Initiation Service (PIS)?

In open banking, and specifically the PSD2, a Payment Initiation Service (PIS) is a service typically provided by a fintech company that’s authorised as a PIS provider, or PISP. Noda is a licensed PISP.

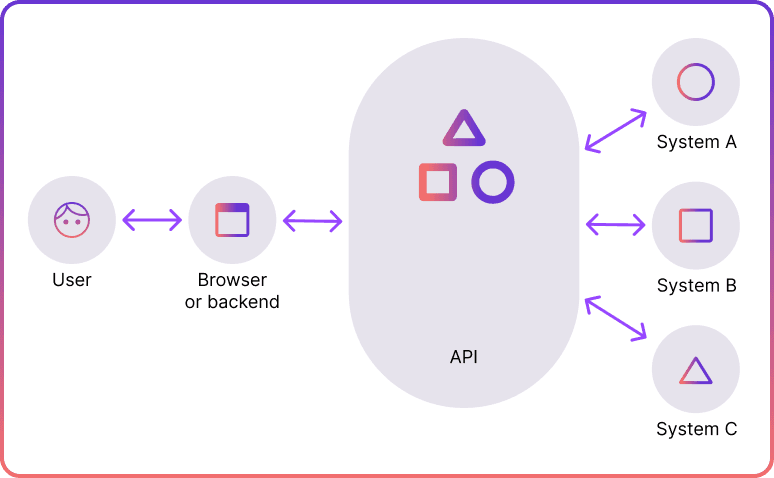

These companies can access read-only customer data shared by traditional banks via application programming interfaces (APIs), and initiate payments on customers’ behalf. Customers must consent to the data sharing and can withdraw consent anytime.

PIS are used by merchants who want to streamline payments. For example, PIS could help simplify e-commerce checkout, automate bank transfers for savings and investments, and much more.

How Does Payment Initiation Services Work?

As mentioned before, banks share data via APIs.They are sets of rules that enable software to communicate with each other. Under PSD2, banks are legally required to open their APIs, which are regulated and must adhere to a unified standard.

When the APIs are integrated, PISPs are able to communicate to the issuing bank within the transaction. If the payment is accepted, the funds are transferred to the merchant’s bank.

Pay-by-Bank

One of the great innovations of PIS is the payment method often referred to as “pay-by-bank” or “instant bank transfer”. In it, customers can log-in to their online banking app to authorise the payment.

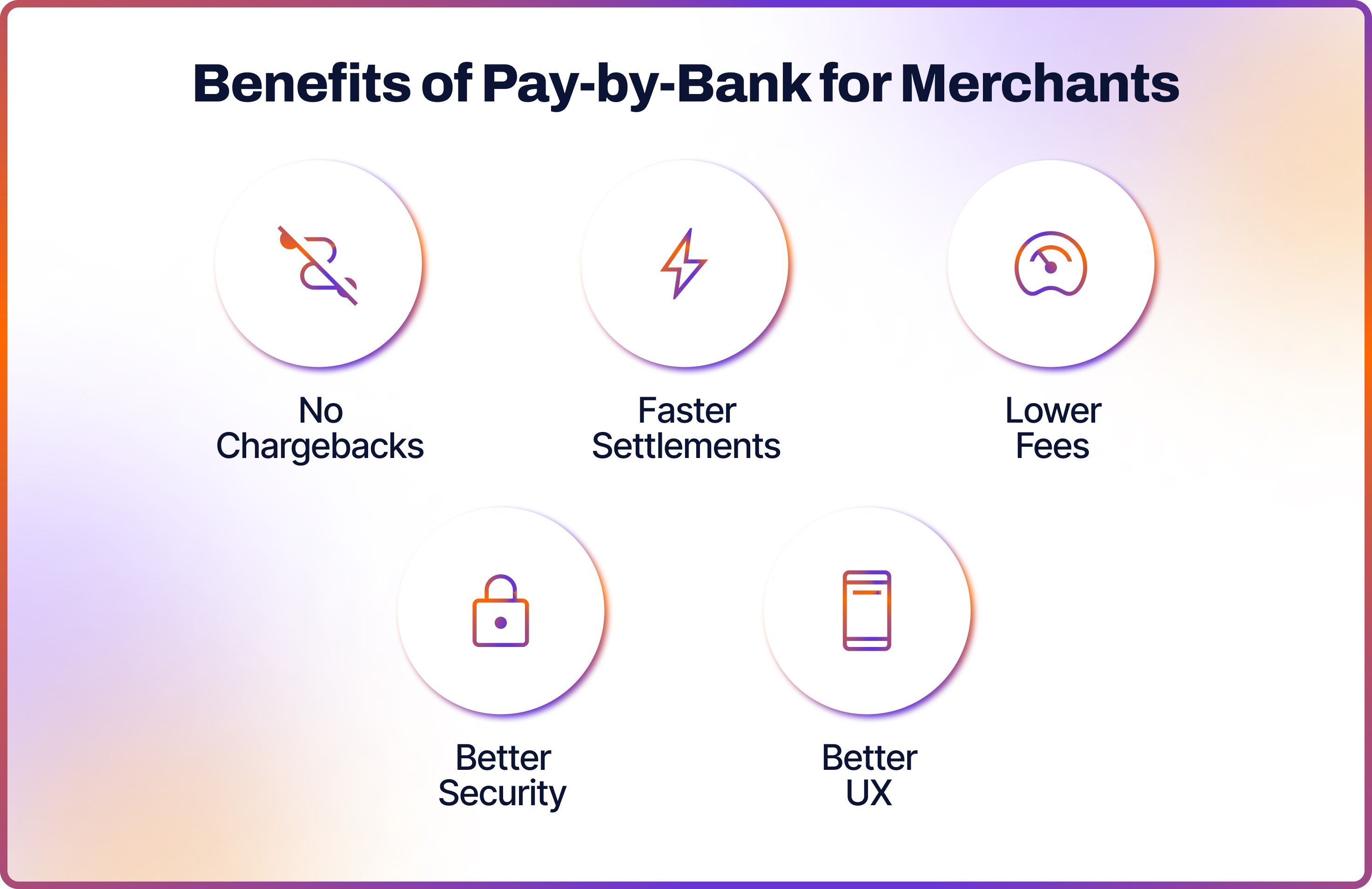

It offers superior user experience (UX) as customers don’t have to enter card details manually, and transactions happen from account to account (A2A), avoiding card networks. This also means cost savings for merchants and faster payments.

The flow of pay-by-bank typically looks like this:

- Customer selects their bank & reviews the payment information

- Customer is connected to their trusted bank’s interface (mobile or online), which is already familiar to them, and logs in

- The payment is complete within the bank’s interface, using Strong Customer Authentication (SCA)

After the transaction is complete within the banking app, the customer returns back to the merchant’s website or app to get the order confirmation.

What Are the Types of Payment Initiation?

Payment initiation can take place via two types of SEPA credit transfers: the standard credit transfer and the instant credit transfer.

SEPA Credit Transfers are one-time bank transfers using IBAN codes, conducted in euros, commonly used for consumer transactions within SEPA countries. If your business operates outside SEPA, PIS won't use this transfer type, as both banks must be within the SEPA region.

SEPA Instant Credit Transfers are real-time euro transactions up to €100,000 for any two account holders in the SEPA region, available at all hours. Most of these payments are completed in less than five seconds and can be carried out on smartphones.

The PISP routes the transfer through the optimal choice for your bank. Some PISPs only offer instant transfers, excluding banks that don’t offer this option for free.

How Secure Are Payment Initiation Transactions?

While PSD2 laid the foundation for the current PIS landscape, it also ensures that the data is protected. Let’s remember that open banking is fully regulated in Europe and the UK, meaning the APIs are standardised and there are mandatory security measures.

For example, PSD2 enforced strong customer authentication (SCA), which applies to all online payments. It’s a type of multi-factor authentication where users need to confirm their identity using two out of three options: something they have (for example, a device), something they know (for example, a password), or something they are (for example, fingerprints or biometrics).

Secondly, API sharing is safer by default, compared, for example, to the practise of screen scrapping. It’s an outdated method where third parties collect data by logging into users’ bank accounts on their behalf and extracting the information displayed on the screen. This approach can be vulnerable to data leaks and cyberattacks, whereas APIs provide secure regulated channels.

Transform Your Payments with Noda’s Open Banking API

Noda is a licensed PIS provider that is redefining how merchants process payments. With Noda’s Open Banking APIs, your customers can pay directly from their bank accounts, skipping the need to enter card details. This makes checkout faster, eliminates chargebacks and reduces cart abandonment.

Partnering with Noda means avoiding expensive card processing fees, so you keep more of your business revenue. Our Open Banking API integrates easily, offering your customers a secure, fast, and simple payment experience.

Ready to simplify payments and boost profits? Learn how Noda can transform your business today.

PSD2 Compliance for PIS Payments

As a merchant, you must ensure that your payment initiation service provider is compliant with PSD2 and licensed as PISP. It’s an EU regulation that aims to harmonise the operations of payment services in EEA. PSD2 was initially enforced in 2018 and will be soon updated to PSD3.

As mentioned earlier, under PSD2 all online payments require SCA. Before implementation, online customers typically used a username and password to identify themselves, but this process is often inconvenient, as users frequently forget their login details.

Payment providers need to confirm customer identity with at least two independent factors of information (as previously explained). There are strict requirements that third-party providers must follow when authorising transactions.

Benefits of PIS Payments

- Superior User Experience (UX): PIS payments allow customers to pay directly from their bank accounts, reducing friction and cart abandonment.

- Lower Costs for Merchants: By avoiding traditional card networks, PIS payments help merchants save on transaction fees, increasing their profit margins.

- No Chargebacks: With no involvement of card networks, PIS payments eliminate the risk of chargebacks, protecting merchants from costly disputes.

- Superior Security: These payments use regulated APIs and strong customer authentication.

- Faster Payments: They are processed in real-time, ensuring that funds reach the merchant’s account almost instantly.

FAQs

What is the difference between AIS and PIS?

PISPs and AISPs are two different types of licensed TPPs. The key difference lies in their functionality. While PISPs initiate payments on clients’ behalf, AISPs gather and process financial data from multiple banks. The usage of PISPs means more secure and efficient online payments, while AISPs enhance financial transparency and management.

What is the role of PIS?

PIS enable secure and direct payments from a customer's bank account to a merchant. They streamline the payment process, making transactions quicker and more efficient without the need for card details.

What is PIS used for?

PIS is used to simplify online payments by allowing customers to pay directly from their bank accounts. It’s commonly used in e-commerce, bill payments, and money transfers, providing a secure alternative to card payments.

What are the three stages of initiation?

The three stages of payment initiation include the customer selecting their bank, authenticating the payment via their banking app or online portal, and the immediate transfer of funds directly from the customer’s account to the merchant.

Are payment initiation services necessary?

While not mandatory, PIS offer significant advantages. They improve the UX, reduce transaction costs, and increase payment security, making it a valuable service for merchants and consumers.

Will payment initiation services take time?

No, PIS is designed to be quick and efficient. With SEPA instant credit transfers, for example, payments are processed in real time, allowing merchants to receive funds almost instantly.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know