Tired of clunky card readers, high fees, and checkout delays? You’re not alone. Customers expect fast, flexible ways to pay, especially digitally native Millennials and GenZs—and if you don’t offer them, they might not come back.

QR codes are an innovative way to get paid. With just a few clicks, you can generate a unique QR code linked to a payment link or a checkout page. No extra hardware and no setup headaches. Your customers simply scan, confirm, and pay directly from their phone. It’s fast and secure, as these QR codes use features like encryption.

In this article, we’ll walk you through exactly how QR code payments work and how you can start using QR codes for payments.

Why QR Payments Are on the Rise

QR codes as a payment method are becoming popular with customers who want to go cardless. As more people use smartphones, more shops are using QR payments. Instead of tapping a card, customers scan a code with their phone, approve the payment, and they’re done. No card machines, no PINs needed.

By 2025, 42% of in-store mobile transactions will use QR codes, with China leading at 85% adoption. The global QR payments market is set to reach $45.9 billion by 2032, growing at 16.27% annually.

The reason? With 4.69 billion smartphone users today, mobile payments are the future. They are beloved by digitally-native shoppers who already expect mobile-friendly payment options like QR codes for offline shopping.

Plus, card use is on the decline, while newer methods like pay-by-bank are gaining traction. Many shoppers don’t want to use cards—even through digital wallets–as they are more expensive and less secure.

What Is a QR Payment?

QR, an abbreviation for Quick Response, was developed in 1994 for the Japanese automotive industry. It is a type of matrix barcode that has since gained popularity and found diverse use cases. They are used for marketing, information sharing, and notably, for mobile payments.

Unlike the linear barcodes seen on product labels, QR codes offer four key advantages:

- They can store a large amount of data.

- They can be scanned from a screen, not just paper.

- They can be read even if part of the code is damaged.

- They offer enhanced security as information can be encrypted.

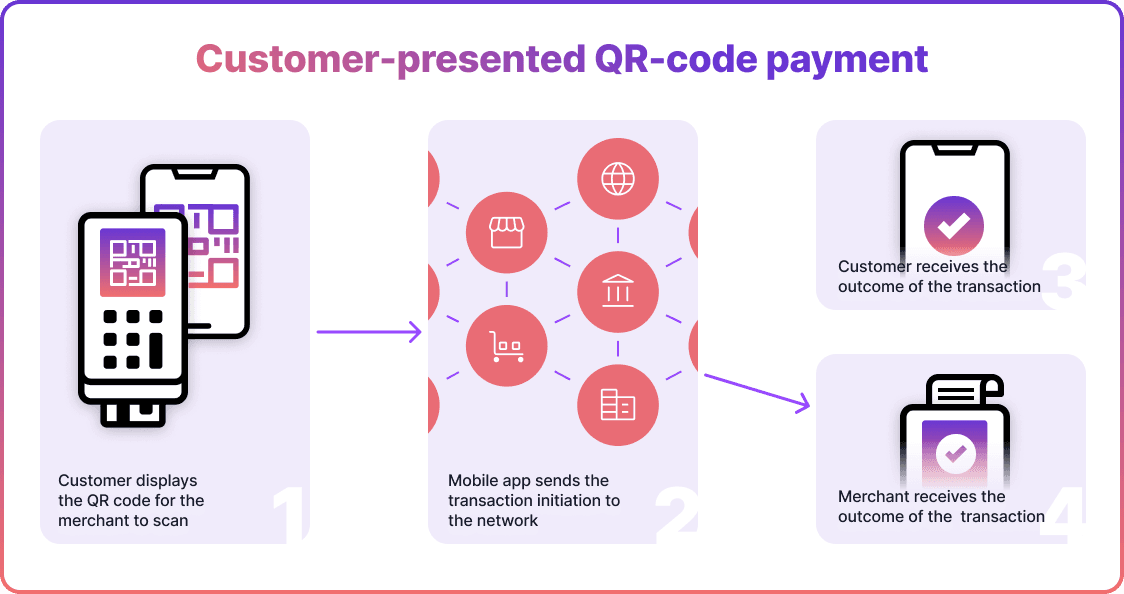

How Does a QR Code Payment Work?

Payment by a QR code is extremely simple. Instead of tapping a card, customers simply scan a QR code, confirm, and pay on their mobile. When they scan a code, the software on their smartphone decodes the matrix patterns and converts them into a string of characters, which directs them to a checkout page.

How to Create a QR Code for Payment

Merchants can generate a QR code in seconds from their provider’s dashboard, linking straight to checkout.

At Noda, QR code-based payments are built into our instant payment links. They support pay-by-bank, so there are no cards, no extra fees—just fast, secure payments using a QR code.

If you’re a UK-based merchant, we also offer a dedicated QR code dashboard designed specifically for in-store payments. It gives you flexible options to suit your setup, including:

- Dynamic QR codes, where the customer enters the amount

- Fixed QR codes, with pre-set amounts like £10, £20, £50

- Merchant-controlled codes, where you set the amount yourself

Download them in any format or size. Every transaction shows up in real time, so it’s easy to track, reconcile, and move on.

Integrate QR Code Payments with Noda

With Noda’s QR code solution, accepting payments has never been easier. Whether you're selling online, in-store, or through social media, Noda’s secure payment processing offers the flexibility to take it anywhere – instantly.

Generate scannable QR codes & payment links on the fly – no complex setup needed.

Let customers pay across different channels, whether in person, through email, or on social media. Use Noda’s no-code branded payment pages for a seamless, customised checkout experience – no technical expertise required.

How Your Customers Pay with a QR Code

Paying with a QR code is fast and easy. Customers just scan the code with their phone camera, tap the link, and approve the payment.

At Noda, our QR code payment system enables open banking transactions so customers can approve the payment within their banking app, which takes just a few taps to pay. Note: Noda’s in-store QR codes are only available for UK merchants.

Here is a step-by-step flow of how your customers pay with Noda’s QR code:

1. Customers scan the QR code

Your customer opens their phone’s camera and points it at the QR code you display at the checkout, on the bill, or at their table. They tap the link that appears on their screen.

2. Customers choose their bank and log in

The link takes them to a secure page where they select their bank and log in using their usual online banking details.

3. Customers review and approve the payment

They check the payment details in their banking app and verify the payment using biometric authentication. That’s it—the payment is complete, with no cards or typing needed.

Why Noda Chose Open Banking for QR Code Payments

At Noda, we believe getting paid should be simple, secure, and fast—for both you and your customers. That’s why we built our QR code and payment link system around open banking.

QR codes are the easiest way to start a payment. But the real magic happens behind the scenes: instead of routing through costly card networks, the payment goes straight from your customer’s bank to yours. Paired with open banking, QR code payments offer the perfect UX flow.

With open banking, there are no card numbers shared, no risk of chargebacks, and no expensive processing fees. Customers simply use their trusted banking app to approve the payment—biometrically, securely, instantly. For merchants, that means lower costs, no hardware, faster settlement, and smoother checkouts.

Read: Why We Choose Open Banking

How to Use QR Codes for Businesses

QR scan to pay codes are a flexible and modern way to get paid—and there’s plenty of room to get creative with how to use QR code for payment. Here are a few examples.

Retail Shops

Retailers can place QR codes at checkout counters or on product tags. Shoppers scan the code with their phone to pay instantly. For example, a clothing store can let customers scan a QR code on the counter to pay for their purchase, speeding up the checkout process and reducing queues.

Restaurants and Cafes

Restaurants and cafes can print QR codes on receipts or table tents. Diners scan the code to view their bill and pay right from their phone. For instance, a café could have a QR code on each table, so customers can order, split the bill, and pay without waiting for staff.

Barber Shops and Hairdressers

Barbers and stylists can display QR codes at their stations or reception desk. After a haircut, clients simply scan the code to pay, tip, and even book their next appointment. For example, a barber could show a QR code on their mirror, making checkout quick and contactless.

Event Tracking

Event organisers can use QR codes on tickets or wristbands for entry and purchases. Attendees scan the code to pay for food, drinks, or merchandise at the venue. For example, at a music festival, food stalls can display QR codes so fans can buy snacks without carrying cash.

Read: QR Code Payments for Business

Key Benefits of QR Payments for Merchants

- Lower Costs, Easy Setup: No need for pricey card readers or checkout systems. Just generate a QR code and display it. It’s perfect for small businesses, market stalls, or pop-ups that want to keep costs low.

- Faster Checkouts: QR code payments speed things up. Customers scan and pay in seconds. That means shorter lines and more sales—great for busy places like cafés or salons.

- Smarter Customer Insights: Track payments in real time and learn what sells best, when, and to whom. This helps you plan stock, run smarter promos, and better understand your customers.

Key Benefits of QR Codes for Customers

- Fast and Easy: Customers just scan and pay—no cards, no cash, no waiting. It’s quick, smooth, and works from any phone. Perfect for frictionless shopping or grabbing a coffee on the go.

- Safe and Private: With Noda’s pay-by-bank QR codes, payment happens right in the customer's banking app. No need to enter card details or touch shared machines. Your customers’ data stays protected with encryption and biometric authentication, and there’s less risk of fraud.

- Contact-Free and Hygienic: Everything happens in your customer’s own device. No need to hand over anything or tap a terminal—great for staying safe in busy shops or cafes.

QR Code Payments: Best Practises for Merchants

QR code payments can be a simple, powerful way to get paid—but only if they’re used right. Here’s how to make sure your setup runs smoothly and customers actually use it.

Put Your QR Codes Where People See Them

Placement matters. In-store? Stick them at the till, on tables, or near product displays. Online? Add them to your website’s checkout, invoices, or email receipts. The easier they are to spot, the more likely people are to use them.

Make Sure Your Staff Knows the Drill

Your team should be confident explaining how QR payments work and ready to help if something goes wrong. A quick training session can go a long way in smoothing out the customer experience.

Show Customers How It Works

Not everyone knows how to scan and pay. A small sign or message with quick instructions—right next to the QR code—can make it easier for anyone to give it a try.

Give People a Reason to Use It

Want more customers to try QR payments? Offer an incentive—maybe a small discount, loyalty points, or a freebie. You can also talk up the benefits in your marketing: faster checkout, no cards needed, and better UX.

Test, Learn, Improve

Check that everything works as it should. Try it out yourself. Fix what’s clunky, update what’s outdated, and keep improving. A smooth system means more successful payments.

FAQs

Where can I pay with a QR code?

You can pay with a QR code at any merchant that supports QR code payments, which can include physical stores, online websites, and even individual products.

What is a QR code transaction?

A QR code transaction is when customers use their smartphones to scan a QR code, which directs them to a secure checkout page, where they can pay via their preferred payment method.

Are QR code payments safe?

Yes, QR code payments are secure and safe. They use encryption techniques to safeguard sensitive information, protecting against potential fraud or data breaches.

How do I Pay with a QR Code?

Paying with a QR code is fast and easy. Customers just scan the code with their phone camera, tap the link, and approve the payment. At Noda, our QR codes enable open banking payments so customers can approve the payment within their trusted banking app. No cards, no typing—just a few taps to pay.

How do I set up a QR code for payment?

Merchants can generate a QR code in seconds from their provider’s dashboard, linking straight to a branded checkout page.

At Noda, for example, UK merchants have three options: dynamic (customer enter the amount); fixed (pre-set amount) or merchant-controlled (merchants set the amount) QR codes. Merchants can download them in any format or size. Every transaction shows up in real time, so it’s easy to track, reconcile, and move on.

Where can I pay with a QR code?

You can pay anywhere that supports QR payments—shops, cafés, websites, invoices, or social media links.

What is a QR code transaction?

It's when a customer scans a QR code to open a secure checkout page and pays, usually via bank.

Are QR code payments secure?

Yes. They use encryption and bank-grade security—no card details are shared.

What is scan to pay?

It’s a quick way to pay by scanning a QR code with your phone. You’re taken to a secure checkout page to confirm the payment—fast, simple, no physical card is needed.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know