Those who run an e-commerce business may not define exactly what a chargeback is. But they know exactly what it means in practice. Although reversed transactions were made to protect consumers from suspicious transactions, they represent a significant challenge for merchants.

With online shopping driving a large share of chargebacks, the problem is only growing. In 2022 alone, 2.8% of global online orders resulted in chargebacks—a figure projected to rise to 337 million annually by 2026.

Now, imagine a payment method that drastically reduces chargebacks. With Pay-By-Bank, this is possible. This comprehensive e-commerce chargeback guide will help merchants navigate the challenges of managing disputes while learning practical strategies to prevent them and protect their business.

What Are Chargebacks in E-commerce?

A chargeback occurs when a cardholder disputes a charge, and the amount is sent back to them, withdrawing the funds from the merchant’s account. In practice, several situations can lead to an e-commerce chargeback—for instance, when a customer notices an unfamiliar transaction on their card statement or experiences a delay in delivery.

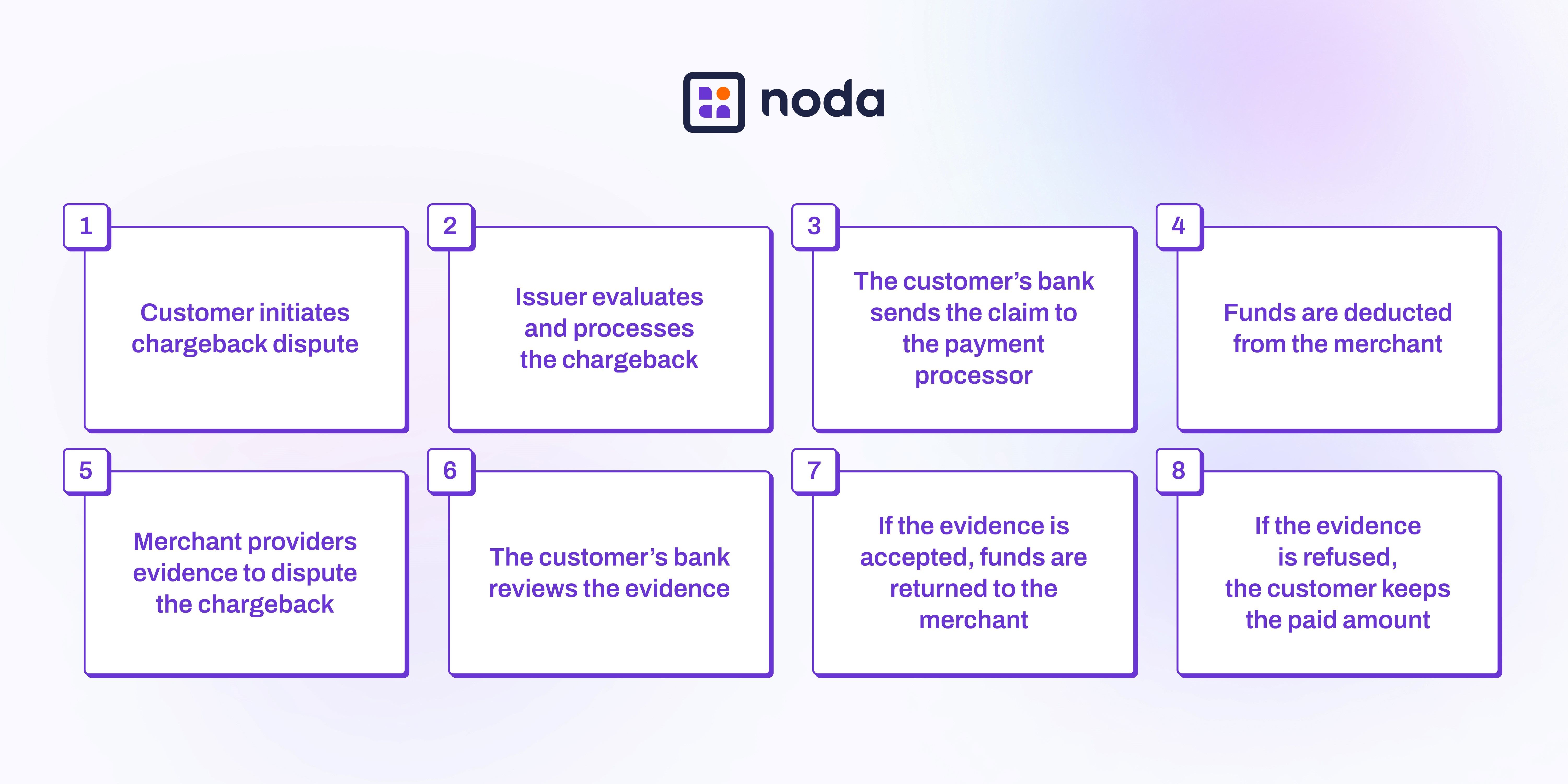

However, it is also important to understand the entire dispute process so you can effectively manage chargebacks while selling online. Here is a close look at how the chargeback process flow works:

Understanding Why Chargebacks Happen in E-commerce

Several reasons can trigger a chargeback request. In e-commerce, the most common cause is fraud—when someone other than the customer uses their payment details to make unauthorised purchases. In addition, card-not-present (CNP) payments increase the risk of fraud and disputes since merchants cannot verify the physical card or the cardholder’s identity.

Payment disputes are not always about fraud. They can also occur from more routine issues, such as merchants charging the card in the wrong currency, failing to comply with card network rules, delivering incorrect orders, or even customers simply regretting their purchase. While these might seem like minor problems, they can quickly escalate into costly disputes for merchants.

In addition to these challenges, retailers must also contend with friendly fraud, also known as chargeback fraud. This happens when a customer, either intentionally or unintentionally, requests a refund for a legitimate purchase without a valid reason. In fact, 45% of merchants worldwide were affected by friendly fraud in 2024.

How E-commerce Chargebacks Affect Your Business and Revenue

For retailers, the most immediate and significant impact is chargeback fees. When a fraudulent transaction is processed after a product has been shipped—or in the case of the travel business, when customers cancel at last minute for various reasons—merchants not only lose the product or service but also the payment received. This double loss can quickly add up, which can be a substantial challenge, especially for smaller e-commerce merchants.

Additionally, major credit card companies penalise businesses with high chargeback rates. For instance, under Visa and Mastercard monitoring programmes, companies with over 100 disputes per month or disputes exceeding 1% of their total transactions are subject to analysis.

On top of this, payment processors often charge merchants for these disputes, adding to the financial burden. For example, Stripe charges £20 per dispute, while PayPal fees are £14 per chargeback (accurate as of 6 Dec 2024). These costs can quickly add up, making chargebacks an expensive challenge for e-commerce businesses.

Consistently going over these thresholds can result in penalties, like higher fees or limits on processing payments.

There is also the matter of consumer experience, which is equally critical. Payment disputes are often time-consuming and bureaucratic, leaving customers frustrated. This negative experience can damage a business reputation, even if the retailer is not directly at fault for the fraud. Customers may associate the issue with the company, leaving a lasting bad impression.

Effective Strategies for E-commerce Chargeback Prevention

Now you are wondering: How do I stop chargebacks? While you cannot avoid them from happening, you can invest in e-commerce chargeback protection by addressing common customer pain points. Here are some best practices to safeguard your e-commerce store:

Clear Communication

Be transparent about your products, services and policies. Misunderstandings often lead to disputes, so make sure your customers have all the information they need before making a purchase. If you are selling a travel package, for example, inform clearly what is included, such as accommodation, meals, or activities.

Accurate Delivery Information

Provide clear and detailed shipping updates, including tracking numbers, estimated delivery dates, and any delays.

Fraud Prevention Measures

Since fraudulent purchases are one of the leading causes of payment disputes in e-commerce, investing in a robust security system must be a priority. Real-time payment authentication and data encryption, for example, can help online stores prevent unauthorised transactions. Some businesses also consider chargeback insurance to manage disputes and protect revenue.

Responsive Customer Support

Effective and direct communication with a customer can significantly reduce the number of disputes since clients can rapidly get their questions answered. For instance, a helpful and accessible support team, can often resolve misunderstandings before they become chargebacks.

What Is the Best Solution for Chargebacks?

Credit card transactions are the leading cause of payment disputes. To illustrate this, in the U.S., consumers dispute around 105 million charges annually. Industries that rely on card-not-present transactions often experience higher chargeback rates due to the increased risk of fraud and disputes.

To tackle this issue, businesses often consider alternative payment methods that eliminate chargeback risks. Open Banking payments—also known as account-to-account (A2A) or Pay-by-Bank—offer a reliable and cost-effective e-commerce chargeback solution. Since they do not rely on traditional card networks, these payment options can reduce chargeback risks while providing added benefits like lower fees, faster settlements and enhanced security.

By leveraging Open Banking technology, this payment method ensures the transfer occurs directly between the shopper's and merchant's bank accounts, eliminating the need for cards or intermediaries and reducing risks of fraud. This simple, secure process not only eliminates the risk of chargebacks but also provides a seamless customer experience.

Click here to learn more about Open Banking

Revolutionising E-commerce Chargeback Management with Noda

Noda's Open Banking Platform connects with over 2,000 banks across 28 countries, including the UK, Europe, Brazil and Canada offering direct, secure bank payments that eliminate dispute risks while reducing fees. By revolutionising the way e-commerce businesses handle transactions, Nosa provides seamless integration through plugins and advanced tools for payment optimisation and customer verification, Noda empowers your e-commerce business to grow with confidence.

Do not let chargebacks drain your profits. Upgrade your payment process with Noda Open Banking platform to reduce disputes, secure your revenue, and provide your customers with a seamless payment experience today.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each