Getting your Ecwid store ready to accept payments is a key step. You’ve got your products set up, now it's time to make buying them easy for your customers. A smooth, secure Ecwid payments can be the difference between a sale and an abandoned cart.

Ecwid gives you plenty of options, from credit cards to digital wallets and open banking. In this guide, we’ll show you how to set up payments quickly and easily, so you can keep your customers happy and your sales steady.

What Is Ecwid?

Ecwid is an e-commerce platform that helps small and medium-sized businesses to sell goods or services online. Merchants can add a store to an existing website, social media and popular marketplaces. The platform has a free plan, with no design or coding skills necessary.

The platform also offers help with inventory, orders, payments, tax management, shipping and delivery, advertising and much more.

How to Accept Payments with Ecwid

Ecwid does not handle payments directly. To accept payments online, Ecqid merchants should first open a merchant account with an Ecwid payment processor from their supported list of 81 options. The provider recommends using at least three payment systems to offer a wider range of popular payment methods.

What Is a Payment Processor & Merchant Account?

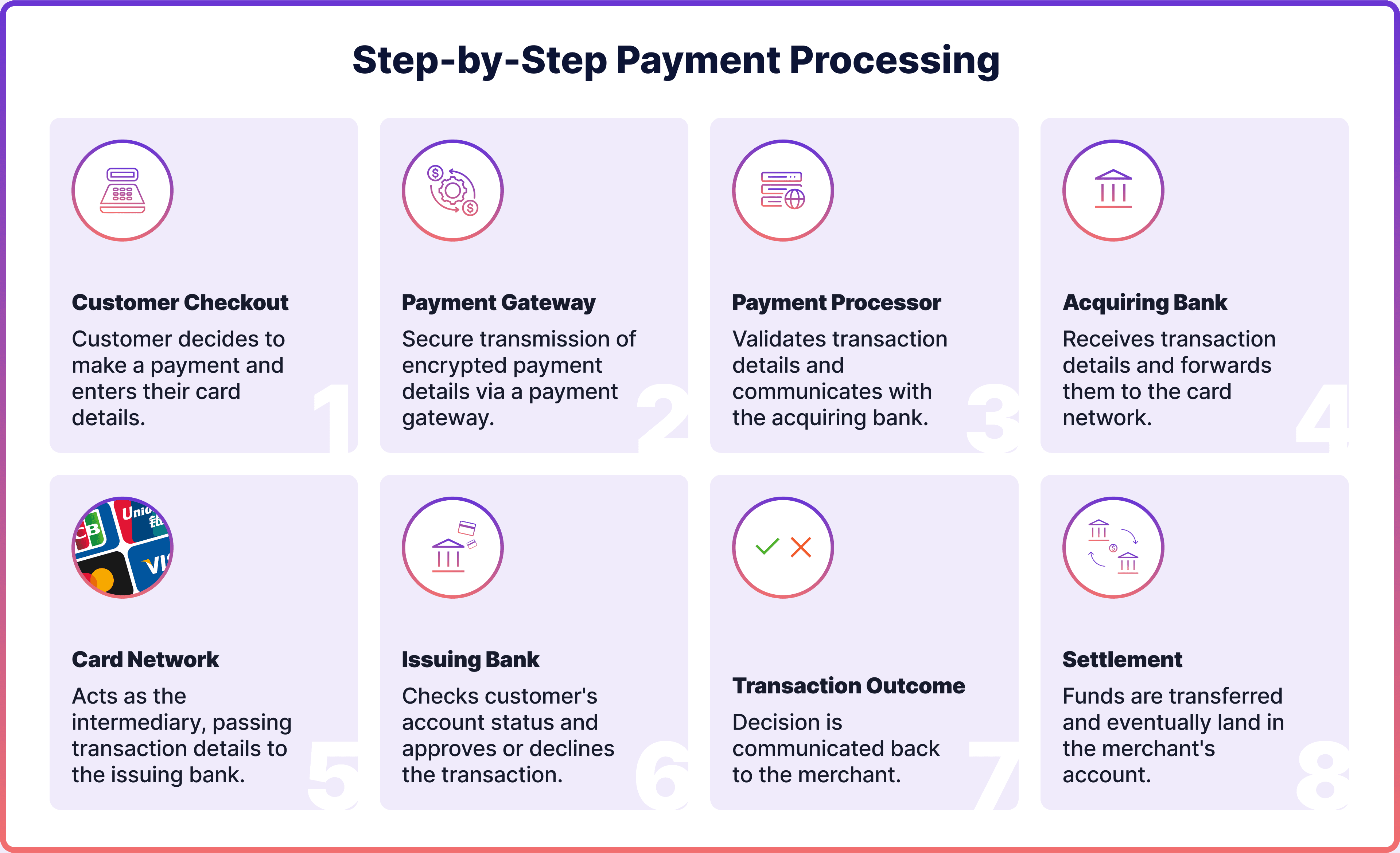

Merchant account links a business to a merchant services provider, like a bank, allowing it to accept credit and debit cards. It acts as a middleman between the customer's bank and the business's bank.

Meanwhile, a payment processor is the party that collects customer payment data from a payment gateway, and then communicates with issuing and acquiring banks and card networks to authorise and complete the transaction.

The payment flow would depend on the payment method used. For example, card processing involves more complex communication than account-to-account payments.

How Do Ecwid Payments Work?

As mentioned earlier, merchants can choose a payment processing system from the Ecwid list depending on their location, and integrate it into their e-commerce store. The platform does not charge any Ecwid payment processing fees, but third-party payment processors do.

In terms of integration, the platform offers Payment API to integrate with an Ecwid payment gateway. API-hosted payment gateways use application programming interfaces (APIs) to allow secure communication between different software. Merchants can develop a custom integration or hire a third-party to do that.

Once a customer pays, a payment provider has to process the transaction. Once the transaction was successfully processed, merchants can withdraw the money from their merchant account to their bank account.

Merchants can also disable a payment provider if they no longer want to use it. For that, they should go to Ecwid admin, click Actions and then remove the relevant payment provider to disconnect them.

Ecwid Payment Methods

Your Ecwid payment options would depend on your payment processors and what payment methods they offer. As mentioned earlier, you can choose several payment systems to increase conversions and reduce shopping cart abandonment.

By default, all payment methods display on your checkout page in the order of time merchants set them up, but you can change the payment methods order if required. Merchants can sort and enable payment methods in the Admin page.

Some of the popular payment methods merchants should consider include:

- Card Payments: A widely trusted method for e-commerce, credit and debit cards have been in use since the 20th century. To accept card payments, set up a payment gateway with your chosen provider.

- Digital Wallets: Digital wallets like PayPal, Apple Pay, and Google Pay store payment information securely. They’ve become more popular than cards since 2022, offering quick, one-click payments.

- Buy Now, Pay Later (BNPL): BNPL lets customers purchase items immediately and pay later, often with no interest. Popular with Millennials and Gen Z, BNPL services include Klarna, Afterpay, and Affirm.

Open Banking Payments for Ecwid

Open banking, or pay-by-bank payments is an innovative payment method that lets customers pay directly from their bank accounts in real-time using their trusted bank’s interface. No cards, no extra steps—just a smooth, straightforward payment process.

Benefits of Open Banking Payments for Ecwid

For e-commerce businesses, open banking offers several benefits. It cuts down on chargebacks, reduces card processing fees (as no card networks are involved), and lowers overall costs. Customers are redirected to their bank’s secure interface to authorise payments, increasing trust and making checkout faster. Funds are transferred directly between accounts, keeping things simple.

Open banking is also secure. Payments use regulated APIs, and data is only shared with the customer’s permission. Additionally, payment providers offer useful tools to help you better understand your customers, identify valuable ones, and create more effective marketing campaigns.

If you’re looking for a more efficient way to handle payments, open banking is an easy, cost-effective solution.

Leverage Open Banking with Noda’s Ecwid Payment Plugin

Noda makes accepting open banking payments on your Ecwid store simple. As a global provider, Noda partners with over 2,000 banks across 28 countries, giving you access to a wide network for smooth payment processing, customer verification, and more.

Getting started is quick and easy—no technical expertise needed. Just follow these steps:

- Onboard with Noda.

- Upload the Noda plugin file in your Ecwid admin panel.

- Enter the API keys provided by Noda Hub during onboarding.

- Your Ecwid store is now connected to Noda’s open banking solution.

With Noda, you also benefit from seamless global payment processing, supporting multiple currencies to serve your customers wherever they are. Plus, our Know Your Whales (KYW) tool helps you forecast customer lifetime value and offers valuable insights to optimise your payment flow and user experience.

Whether you're looking to simplify payments, enhance customer verification, or optimise your checkout experience, Noda’s Ecwid plugin is the perfect solution for scaling your business.

FAQs

What payment methods are available on Ecwid?

Ecwid supports a wide range of payment methods, including credit and debit cards, digital wallets like PayPal and Apple Pay, and open banking solutions.

How do I set up payments on my Ecwid store?

To set up payments, choose a payment provider from Ecwid's list, create a merchant account, and integrate it with your store using the provided API or plugin.

Does Ecwid charge transaction fees for payments?

There aren’t any Ecwid transaction fees, but your payment processor may apply their own fees depending on the method you choose.

What is open banking, and how does it work with Ecwid?

Open banking allows customers to pay directly from their bank accounts in real-time. With Ecwid, you can integrate open banking payments through providers like Noda for a seamless, secure checkout experience.

What are the benefits of using open banking with Ecwid?

Using open banking with Ecwid offers lower transaction costs, faster payments, and reduced chargebacks. It provides a smooth checkout experience by allowing customers to pay directly from their bank accounts in real-time.

How do I integrate Noda’s open banking plugin with Ecwid?

To integrate Noda with Ecwid, simply upload the Noda plugin in your admin panel, enter the API keys provided during onboarding, and your store will be ready to accept open banking payments.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each