How you let customers pay has a big impact on whether they actually complete their order.

If you’re running your store on WooCommerce or Magento, you’ve probably run into the same issue—trying to find a payment setup that’s safe, low-cost, and smooth for your shoppers.

This article breaks down your main options when it comes to WooCommerce vs Magento payments, and explains why open banking might be the better fit for your business.

Magento vs WooCommerce Comparison: Quick Overview

Before diving into the payment methods they offer, let’s first compare WooCommerce and Magento platforms on their own.

| Magento (now Adobe Commerce) | WooCommerce | |

| Platform type | Standalone platform, part of Adobe ecosystem | WordPress plugin |

| Open source | Yes | Yes |

| Regions | All countries, particularly popular in the US | 160+ countries, particularly popular in the US, the UK, India |

| Market share | 8% | 29% |

| Total websites | 659,604 | 15,335,839 |

| Templates or themes | Two default themes, many more third-party themes | 28+ |

| Modules or add-ons | 6,300+ | 638+ |

| Languages | Multi-language support | Extensions required |

| Default payment options |

|

|

What Is Magento (Adobe Commerce)?

Magento is an e-commerce platform that lets merchants build their online stores. In 2018, Magento was acquired by Adobe. Its enterprise version was renamed Adobe Commerce, while the free open-source version is still available and supported.

Magento works well for businesses with developers on hand, since setup and management can be complex. Plus, it usually needs stronger hosting. Many businesses use dedicated servers or cloud hosting to keep their store running smoothly.

Magento is also good for selling internationally, as according to the platform’s website, it can be configured to work with all countries. It can calculate taxes, switch currencies based on where a customer is, and handle local tax rules. Merchants can choose which countries to ship to, manage big product ranges, and use built-in tools for marketing and reporting.

While it serves global audience, the platform is particularly popular in the US:

- The US has over 34,000 Magento e-commerce stores, which is by far the highest number compared to other countries.

- The UK has around 8,100 Magento stores, which is over three times less than in the US.

- The Netherlands holds 7,500 stores.

- Germany has around 6,700.

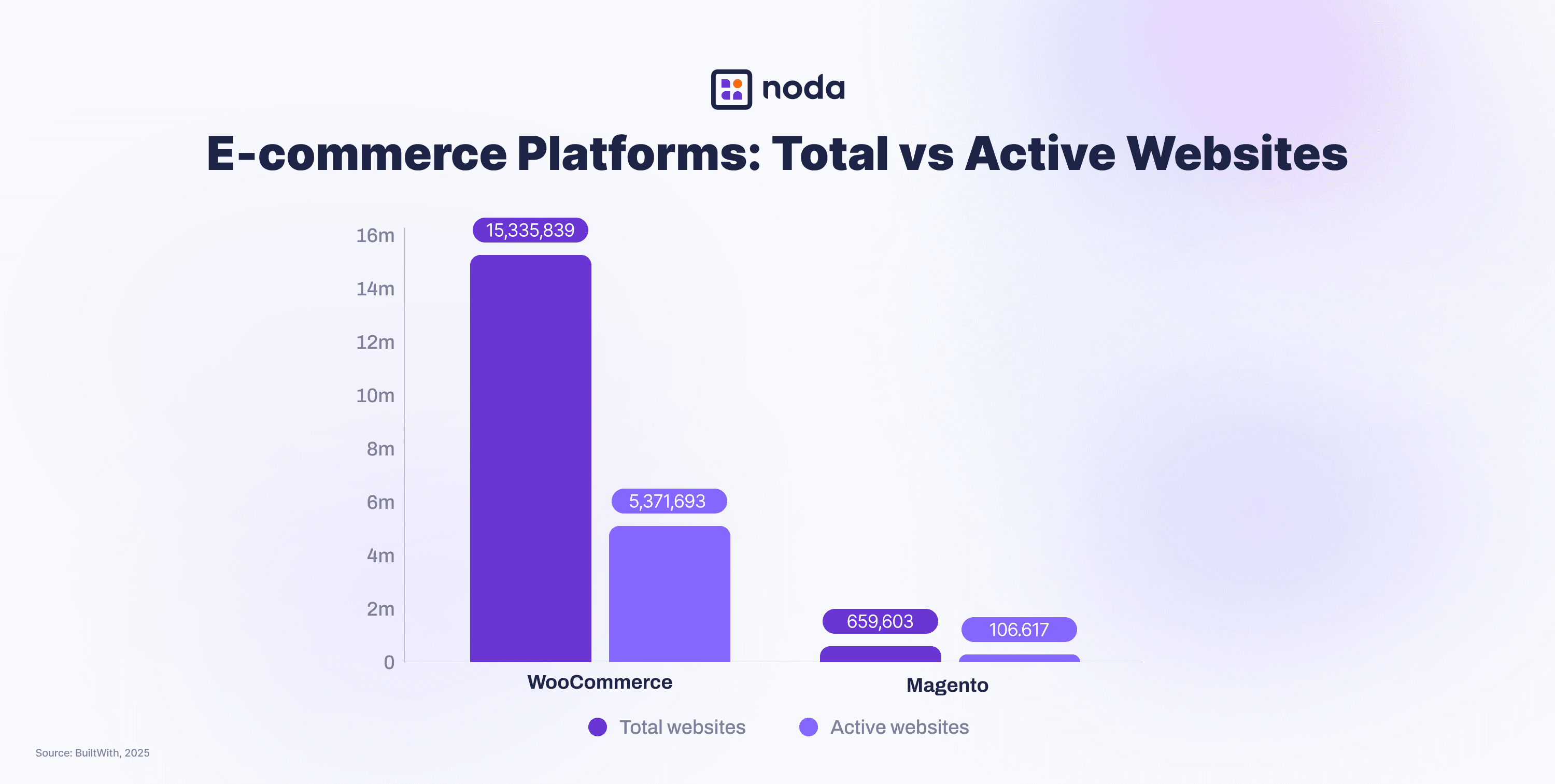

It has to be noted that Magento is a relatively small platform compared to the e-commerce software giant WooCommerce. Magento only has 659,603 websites using it, 106,617 of which are active. In comparison, WooCommerce is used by 15,335,839 websites, 5,371,693 of which are active.

What Is WooCommerce?

WooCommerce is an open-source plugin that lets you add a full online shop to any WordPress site. It’s one of the biggest players in e-commerce, powering over 5.3 million online stores and holding nearly 30% of the global market.

The plugin is flexible, though you might need extra plugins to unlock more advanced features. It’s specifically designed for businesses that are using (or looking to use) WordPress as their main site.

You can sell globally or limit sales to certain countries. WooCommerce also lets you customise shipping, tax, and payment settings, and with the right plugins, it can support over 160 countries.

While WooCommerce is used globally, it’s especially popular in a few key countries:

- The US leads by a large margin, with over 2.1 million stores running on WooCommerce.

- The UK follows, with about 200,000 stores.

- India is another major user, with close to 160,000 active shops.

- Germany and France also show strong adoption, with around 156,000 and 151,000 stores respectively.

WooCommerce is also widely used in Brazil, Italy, the Netherlands, Spain, Australia, and several other regions.

Magento vs WooCommerce for Payments

| Magento | WooCommerce | |

| Cards | Via plugin | Default |

| Open banking | Via Noda’s Open Banking plugin | Via Noda’s Open Banking plugin |

| Digital wallets | Via plugin | Via plugin |

| Bank transfer | Default | Default |

| Cash-on-delivery | Default | Default |

| Cheques | Default | Default |

| Buy-Now-Pay-Later | Via plugin | Default |

Magento’s default payment options include bank transfers (not open banking), checks or money orders, payment on account (for approved B2B buyers), and cash on delivery. For cards, digital wallets, and other methods, merchants need to configure them separately.

When you add WooCommerce to your WordPress site, it includes a few basic payment options out of the box—like bank transfer, cheque, and cash on delivery. It also comes with WooPayments, which supports card payments, digital wallets, Buy Now Pay Later, and local payment methods.

The key difference between Magento and WooCommerce payment options, therefore, is that Magento offers less features by default. For example, it doesn’t offer digital wallets, cards or BNPL – only via plugin.

Does Magento and WooCommerce Support Open Banking?

Magento and WooCommerce do not offer open banking (pay-by-bank) as a default payment option.

To accept open banking payments on Magento or WooCommerce, you’ll need to add a separate plugin—such as Noda’s open banking integration. It’s not included by default, so you’ll need to onboard with Noda and set it up, which takes minutes.

Magento vs WooCommerce: Payment Drawbacks

Magento and WooCommerce give you plenty of payment options through add-ons and settings—but it’s up to you to choose and configure them. That’s often where things get tricky for merchants.

- Limited default options

WooCommerce comes with built-in support for cards and digital wallets, while Magento’s default options are more limited—mainly bank transfers, checks, and account credit. These methods may feel outdated for digital-first customers like Millennials and Gen Z. None of the providers offer open banking payments by default.

It should be noted that WooCommerce and Magento aren’t payment services—they’re platforms for building and running online stores. For payments, they rely on third-party providers, which they promote as built-in solutions.

- High fees and slow payouts

Out of the box, WooCommerce focuses on card payments and digital wallets. But because they rely predominantly on card networks, the card processing fees, such as interchange and scheme charges, can quickly add up—especially for stores with low margins or lots of orders.

Both WooCommerce and Magento also offer manual bank transfers, but these go through slower, old-school payment systems, not instant rails such as open banking. They are also very inconvenient for customers and merchants.

- Complex or time-consuming integration

Merchants often run into issues dealing with multiple API versions. Adding new payment methods can take time and usually needs someone with technical skills. Managing and updating payment plugins can get complicated—especially with Magento, which often requires heavy development work to integrate properly.

Better Way to Get Paid: Open Banking

Most online payments—like cards and digital wallets—still rely on card networks. That means extra fees, slower payouts, and the risk of chargebacks for merchants. Bank transfers are another option, but they’re often delayed. Buy Now, Pay Later can be expensive too.

Open banking, or pay-by-bank, offers a smarter alternative. It skips card networks entirely, so payments are faster, cheaper, and go straight from the customer’s bank to yours—no middlemen involved.

Here’s how it works:

- The customer chooses pay-by-bank at checkout

- They pick their bank from a list (Noda supports 2,000+ banks in 28 European countries)

They’re sent to their bank’s app or website to approve the payment—usually with Face ID or fingerprint

The payment arrives instantly in your account

These payments follow strict PSD2 rules in Europe and use secure, bank-issued APIs. Only approved, licensed providers like Noda are allowed to connect and process them.

Open Banking for Magento & WooCommerce

Upgrade your checkout with Noda’s open banking plugins—built for Magento, WooCommerce, and other major e-commerce platforms.

Connect to 2,000+ banks across 28 European countries, accept multiple currencies, cut out card fees, and get paid instantly.

How Open Banking Plugins Work

Adding Noda to your store is quick and code-free:

Step 1: Upload the plugin file to your platform’s admin panel.

Step 2: Enter your API keys from Noda Hub after onboarding.

Step 3: You’re live—Noda’s pay-by-bank button is now a payment option in your store.

No coding required. Set it up in minutes and start taking fast, low-cost bank payments right away.

Why Add Pay-by-Bank to Your Checkout?

- Save on fees: With no card networks involved, you skip interchange and scheme charges—keeping more of your revenue, especially if you handle lots of orders or work with slim margins.

- Get paid instantly: No more waiting days for payouts. Payments land in your account right away, helping you manage cash flow and reinvest faster.

- Less chargebacks: Customers confirm payments directly through their bank, so there’s no way to reverse them like with cards. That means fewer disputes and less hassle for your team.

- Better UX: Open banking is smooth and quick. Customers choose their bank, approve the payment in their app, and it’s done—no card details, logins, or extra steps to slow them down.

- Works everywhere: Pay-by-bank is compatible with any device that has online banking—mobile, desktop, or tablet—so all your customers can use it, no matter how they shop.

Best Payment Options for Magento & WooCommerce

Don’t rely on just one payment method—offering a few key options is the best way to boost conversions and lower costs.

Start with your customers: where they live, how old they are, and how they like to pay. Some go for wallets, others prefer pay-by-bank or even crypto.

Look at what’s common in your market and what your competitors offer—that’s often a good sign of what your shoppers expect at checkout.

FAQs

Is Magento better than WooCommerce?

It depends on your business size and needs. Magento may be more useful for larger stores with developer support, while WooCommerce is easier to set up, especially if you’re looking to use WordPress. WooCommerce is also a much bigger provider.

Is Magento similar to WordPress?

Not really. Magento is a standalone e-commerce platform, while WooCommerce is a plugin built to work with WordPress.

How long do Magento payments take?

Default payment methods like bank transfers or cheques can be slow. Instant payouts are only possible if you use open banking with a plugin like Noda.

Are Magento payments secure?

Yes, Magento can be secure if properly configured. Security depends on how payment methods are integrated and maintained.

Is WooCommerce good for e-commerce?

Yes, WooCommerce powers millions of online stores and is great for small to medium-sized businesses, especially if they already use or are looking to use WordPress. However, there are limited payment options, and they predominantly rely on card networks. For a more optimised checkout, you can use third-party plugins, such as Noda’s pay-by-bank.

Is Magento good for B2B?

Yes, especially the Adobe Commerce version, which includes B2B features like payment on account and support for large catalogues and complex operations.

Is WordPress better than Magento?

WordPress is easier for content-driven sites, while Magento is better for complex, large-scale e-commerce. They serve different needs.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each