If you want to stay competitive, you need to get the basics right—starting with how you take payments.

Digital payments are growing fast. According to Statista, the global digital payments market is expected to reach a transaction value of $15.53 trillion by 2028. That’s a big jump, showing just how quickly the industry is expanding year by year.

That’s why having a smooth, reliable payment setup isn’t a nice-to-have—it’s essential. In this guide, we break down what merchant services actually are, what’s included, and why they matter for your business.

What Are Merchant Services?

Business merchant services cover everything a company needs to accept and process payments.

This includes hardware, software, and financial services for cards, mobile wallets, contactless payments, and other payment methods. Banks, payment processors, and financial institutions usually would provide these products.

How Do Merchant Services Work?

The merchant services industry provides a myriad of solutions for different payment strategies.

The services required would depend on the merchant, their industry and specific requirements. Let’s take a look at the most popular merchant services in more detail.

Payment Processing

The way businesses accept payments is vital for daily operations. Merchant processing services would typically offer both online and in-person payments. The flow would depend on the method used. Card processing, for example, involves complex communication between the payment gateway, processor, issuing and acquiring banks, and the credit network. Merchant service providers would streamline this communication.

Add Noda, we offer payment processing for card and open banking payments.

- Card payments: Set up credit and debit card payments with smart routing, smooth UX, and fast integration. Integration via Card API.

- Open banking: accept pay-by-bank transactions—cheaper, faster, and safer than cards. Noda connects you to 2,000+ banks in 28 countries and accepts payments in multiple currencies. We offer integration via APIs, plugins, or no-code payment links & branded checkout pages.

Payment Gateway

A payment gateway is a crucial technology that acts as a middleman between the customer and the payment processor. A merchant’s payment gateway encrypts and transmits card details between the customer, merchant, payment processor, and financial institutions. Think of it as a digital conductor.

Checkout Page

An optimised checkout page is essential for e-commerce success. Many customers – as many as 70% – will abandon their shopping carts if the checkout process is too complicated.

For checkout pages, simplicity is key. And this is something a merchant services provider could help with. Usually, they would offer a customisable checkout page to match your branding.

At Noda, you get flexible checkout options—no matter your setup.

- API: Embed a checkout form right into your website using our APIs—for both card payments and open banking.

- No dev team? Use our no-code branded checkout pages with payment links or QR codes to guide customers straight to payment.

- Open banking plugins for major e-commerce platforms—easy to install and ready to go.

All built with smooth UX in mind—so your customers stay, pay, and come back.

Open Banking Payments

Open banking is quickly becoming the go-to alternative to card payments and more and more providers offer it as part of their service—and for good reason.

Pay-by-bank is cheaper for merchants, with no card network or chargeback fees. Payments are settled instantly, improving cash flow and reducing admin time. It’s also more secure, using bank-grade authentication like Face ID or fingerprint login.

On mobile, it’s even better. Shoppers are redirected from your site to their bank app to approve the payment in seconds—no need to type in card numbers or billing info. That’s why Gen Z and Millennials are embracing pay-by-bank at a growing pace.

As mentioned above, at Noda we offer open banking via APIs, plugins or payment links & QR codes.

Analytics & Reports

Evidence-based decision-making is invaluable for sustainable business growth. This is where analytics and reports come into play. These tools collect data about your website's customers and their payments.

Some merchant providers offer these capabilities. An analytics platform with integrated reporting software can help you organise and interpret the data you gather, providing meaningful customer insights.

At Noda, for example, you can unlock customer insights with open banking data. Our data enrichment tools let you access transaction history to personalise marketing, boost engagement, and grow revenue.

Mobile Payments

A merchant service provider would help setting up payments made using mobile devices, such as tablets and smartphones.

Mobile wallets like Apple Pay and Google Pay are currently some of the most popular payment methods, so it’s beneficial that your provider offers them. Plus, in-app payments could be a valuable feature if most of your customers prefer to pay within a mobile application.

Another form of payment built for mobile is open banking. It uses app-to-app redirection, so customers are taken straight from your checkout to their trusted banking app to approve the payment. No need to enter card details or passwords—just a few taps using Face ID or fingerprint. It’s fast, secure, and designed for the mobile-first generation like Gen Z and Millennials.

Point-of-Sale (PoS)

The point-of-sale (PoS) system is where sales are made. It includes the software and hardware needed to manage transactions.

In physical stores, the main PoS hardware is the cash register, which typically includes an internet-connected terminal, cash drawer, and receipt printer. Some also have built-in card terminals. Meanwhile, online merchant services for e-commerce would offer PoS as a fully digital system.

Merchant Account

Merchant account service links a business to a merchant services provider, like a bank, allowing it to accept credit and debit cards. It acts as a middleman between the customer's bank and the business's bank. When a customer pays, the funds are deducted from their account and transferred to the merchant account.

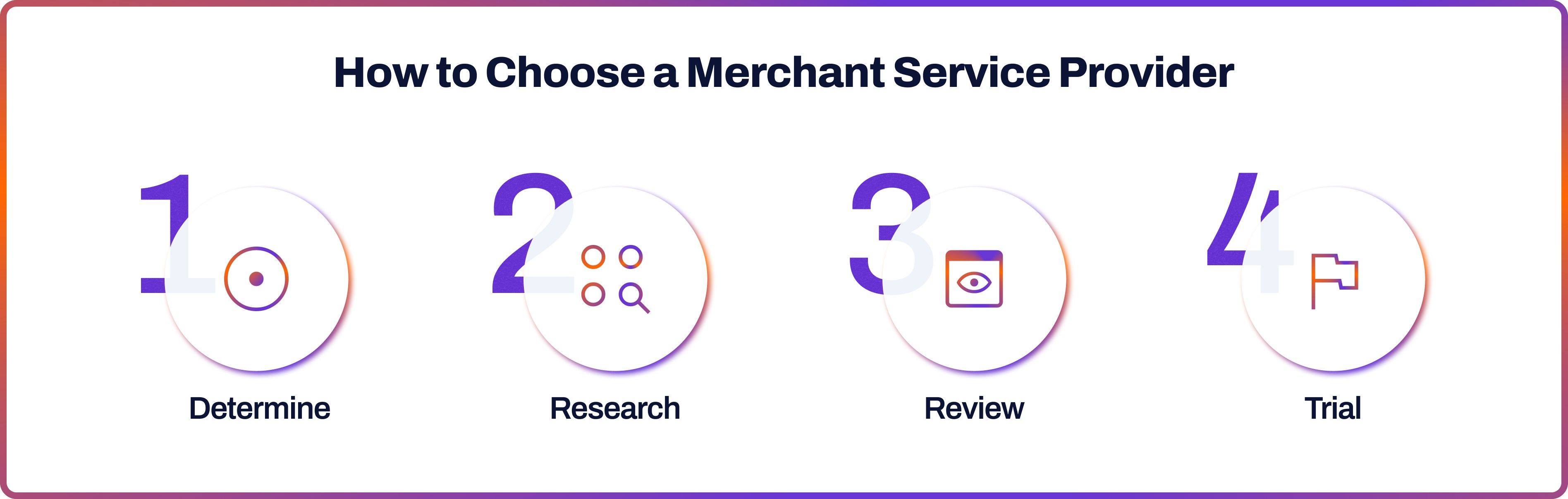

How to Choose a Merchant Service Provider

Determine Your Needs

First, understand your payment processing needs. Consider your sales volume, average transaction value, and the payment methods you want to accept (in-person, online, or mobile). Prioritise these requirements to find a provider that supports them.

Research

Start by seeking recommendations and reading online reviews. Consider the experiences of other business owners. Evaluate each provider's reputation and track record, especially within your industry.

Review Providers

When comparing providers, pay attention to the following categories:

- Merchant Services Fees: Compare fees, including transaction, monthly, setup, and equipment rental. Watch for hidden charges and ensure the pricing structure fits your budget and expected transaction volume.

- Customer Support: Look for providers with a reputation for excellent service and 24/7 availability. Check their communication channels, such as phone, email, and live chat.

- Security & Compliance: Ensure they adhere to the Payment Card Industry Data Security Standard (PCI DSS) and use advanced fraud protection measures like tokenisation and encryption.

- Merchant Integration: Consider whether the provider's solutions integrate smoothly with your existing systems, such as CRM, accounting software, and hardware. Good integration automates sales data import, reducing manual entry and improving accuracy.

- Scalability: Select a provider that can support your business's growth. Ensure they can work with various payment technologies and types, including point-of-sale systems, online gateways, and mobile processing.

Trial the Service

Test the provider’s services through a demo or trial period. Assess the platform’s functionality, ease of use, and reliability. Consider factors such as transaction processing speed, UX, and any potential issues during the trial phase.

Why Choose Noda as Merchant Services Provider

Noda gives you everything you need to take payments smoothly—whether online, in-store, or on mobile. We combine the reliability of card processing with the power of open banking, so your business can offer flexible, secure, and fast payment options that match how your customers shop today.

Need a fast checkout with low fees? Our Open Banking API connects you to 2,000+ banks across 28 countries for real-time, account-to-account payments—no card networks, no chargebacks.

Prefer card payments? Use our Card API with smart routing and seamless UX to keep conversions high.

No dev team? No problem. Noda offers easy integration with plugins, no-code payment links, branded checkout pages, and QR codes—so you can start taking payments fast.

Plus, with our advanced data tools, you’ll unlock valuable insights to personalise marketing and grow revenue.

Noda makes payments simple, scalable, and built for how your customers pay today. Ready to grow?

FAQs

What do merchant services include?

Merchant payment services cover everything a business needs to accept and process payments. This includes hardware, software, and financial services for cards, mobile wallets, and other payment methods. Providers typically offer payment gateways, PoS systems, and merchant accounts for businesses.

What are the benefits of using merchant services?

Merchant services streamline the payment process, making transactions efficient and secure. Quality providers would enhance customer experience by supporting various payment methods and ensuring quick fund transfers. Additionally, they may offer valuable tools like analytics and reporting for better business insights and open banking payments.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each