Open banking payment integration allows UK merchants to accept direct bank-to-bank payments without relying solely on cards. For e-commerce businesses, this means lower fees, faster settlement, and reduced fraud. This guide explains how open banking integration works, why it matters, and how to choose the right provider.

Key Takeaways

- Open banking payment integration lets UK businesses accept direct bank payments through secure APIs – cutting out card networks like Visa and Mastercard.

- Lower costs and faster payments: merchants save on card fees and get near-instant settlement, improving cash flow.

- Better checkout experience: customers pay straight from their bank app using Face ID or fingerprint – no card details, fewer drop-offs.

- Flexible integration options: from simple e-commerce plugins and QR codes to custom API setups for full control.

- Regulation and growth: open banking is backed by the FCA and CMA, used by over 15 million people in the UK, with open finance frameworks coming by 2027.

What Is An Open Banking Payment Integration?

An open banking payment integration allows businesses to accept pay-by-bank (also called direct bank payments) at checkout.

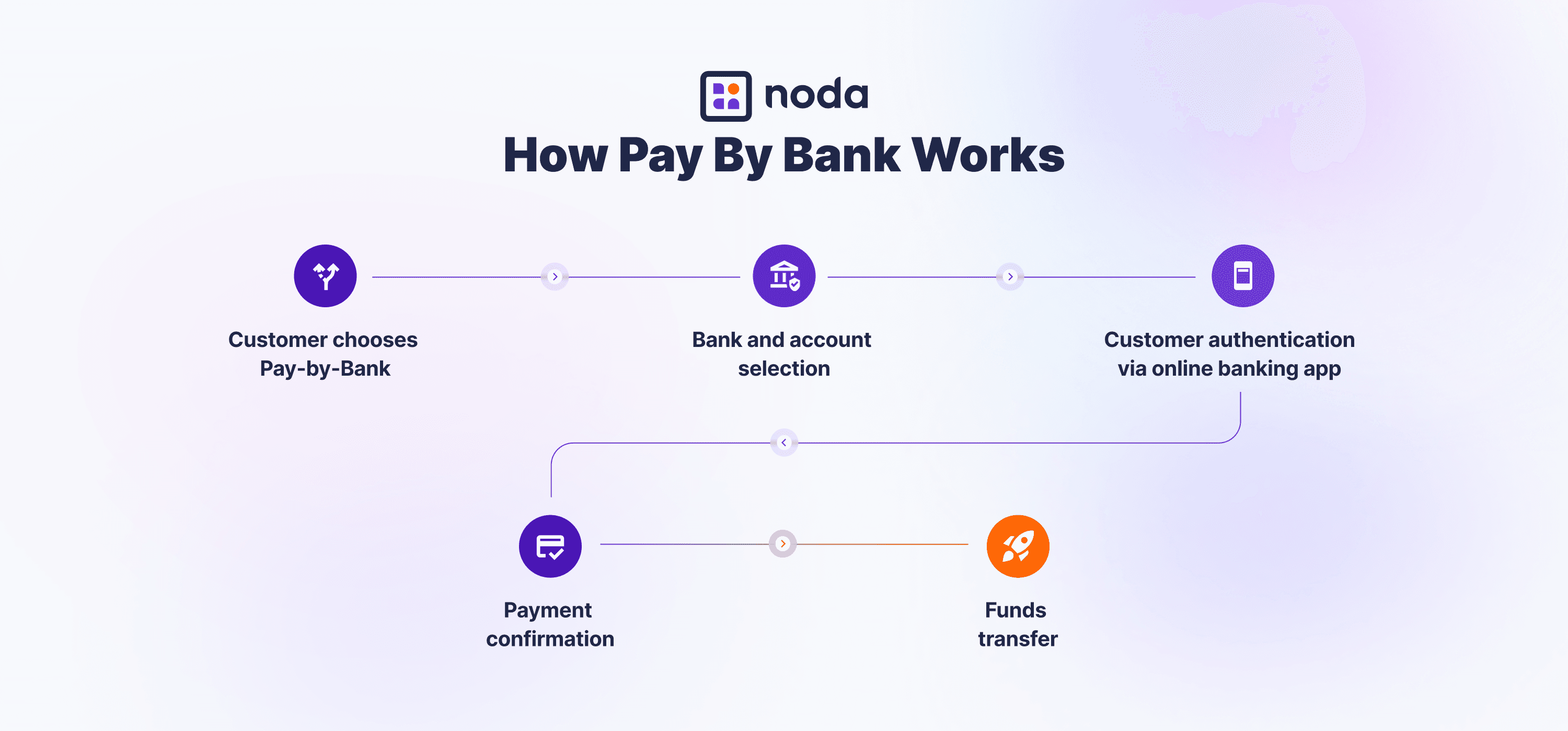

Open banking payments let customers pay straight from their bank account – no cards like Visa or Mastercard needed. At checkout, they pick their bank, confirm the payment in their banking app (usually with Face ID or fingerprint), and the money moves instantly to the merchant through a secure API connection.

Since open banking payments skip card networks, they’re faster, cheaper, and offer a smoother experience for customers. There are already 15 million active users in the UK – and that number is only expected to keep rising.

Open Banking Payment Flow

How to Integrate Open Banking Payments

General Guidance

The easiest way to enable open banking payments is by partnering with a licensed Payment Initiation Service Provider (PISP).

When choosing a provider, make sure they’re authorised and listed in the Open Banking Directory, and consider practical factors such as:

- Bank coverage across the UK and EU. For example, at Noda we offer 2,000+ banks in the EU and UK.

- Access to data tools and analytics

- Quality of dashboard and customer support

- Transparent pricing

Open Banking Payment Integration Types

- Open Banking API: Offers full flexibility to build a custom checkout experience on your site, though it takes more time and technical setup.

- E-commerce Platform Plugins: The quickest route – just connect your checkout to your e-commerce platform. At Noda, we offer integration with WooCommerce, Magento, PrestaShop, and OpenCart.

- Payment Links: Accept open banking payments online via secure, shareable links – no coding required.

- QR Payments: Take instant, in-person payments through QR codes – like payment links, it is code-free.

Open Banking Integration Tips

Set up fallback options to card payments, so customers can still complete checkout if their bank isn’t supported or a transaction doesn’t go through.

Test payments with major UK banks to make sure the process runs smoothly and feels consistent for every user.

Finally, educate your customers – emphasise that open banking is safe, instant, and authorised directly within their own banking app to build trust and encourage adoption.

How Noda Simplifies Open Banking Integration

Noda makes it easy for businesses to start accepting open banking payments – without the usual tech friction. You get everything in one place: open banking payments, cards, Apple Pay, and Google Pay, instant payouts – all under one seamless platform.

Integration is fully flexible: plug it into your e-commerce site with ready-made plugins, build a custom API, or go live fast with no-code options like payment links and QR codes.

Beyond payments, Noda also unlocks data enrichment tools, giving you deeper customer insights. And you’re never left on your own – a dedicated onboarding and integration manager guides you through every step.

Open Banking Integration: UK Regulatory Snapshot

In the UK, open banking is governed by a mix of laws, regulators, and technical standards. Oversight mainly comes from the Financial Conduct Authority (FCA) and the Competition and Markets Authority (CMA). At its core, the framework rests on three key pillars:

- Payment Services Regulations 2017 (PSRs): This legislation brought the EU’s PSD2 directive into UK law, requiring banks to share API with licensed fintechs.

- CMA Order: The CMA directed the UK’s nine largest banks (the CMA9) to develop open banking systems meeting high security and interoperability standards.

- FCA Oversight: The FCA supervises both banks and third-party providers (TPPs). Only FCA-authorised firms can connect to open banking APIs and offer services like AISP or PISP.

The Open Banking Implementation Entity (OBIE) was established to define how data is shared – setting standards for APIs, customer experience, and authorisation.

Today, the UK is shifting toward a new independent standards body known as the Future Entity, which will take over governance and guide new features such as Variable Recurring Payments (VRPs) – recurring open banking payments. The full rollout is expected in 2025.

Comparing UK Open Banking Providers

| Provider | Strengths | Limitations | Ideal for |

| Noda | Combines open banking with cards, wallets, and no-code tools, flexible integration | Does not support recurring subscriptions | SMEs & e-commerce |

| TrueLayer | Strong UK/EU coverage and fintech adoption | Developer-heavy, hidden fees | Larger fintechs |

| GoCardless | Great for recurring payments and VRP | Subscription-centric; no fall-back options such as cards | Subscription-based businesses |

| Tink | Broad EU coverage | Enterprise focus, slower onboarding | Pan-EU merchants |

Future of Open Banking Payments in the UK

Open banking in the UK is growing fast – already used by over 15 million people, with more than 2 billion secure API calls made every month. To compare – in 2018, there were just 320,000 pay-by-bank payments in the UK

“From paying taxes to ordering dinner, millions of UK consumers and businesses are embracing open banking to manage their money with greater control, speed and confidence.” – OBL

That growth is being driven by new features like VRPs – which now make up 13% of all open banking payments – and steady improvements in API technology. As a result, more consumers and businesses are moving away from traditional card networks, especially digitally-native generations. According to Mastercard’s Rise of Open Banking report, GenZ are the most eager to embrace new fintech solutions.

On the regulation side, the FCA is working on a five-year plan to expand open banking into open finance, covering areas such as investments, savings, and insurance. The first version of this framework is expected by 2027.

Alongside this, the new Data (Use and Access) Act 2025 will help create a broader smart data economy, gradually rolling out by mid-2026.

FAQs

Does Open Banking replace card payments?

No, it works alongside them. Most businesses keep cards as a backup payment option.

How long does integration take?

It depends on the setup. With plug-ins, you can be live in a few hours; custom API integrations may take a few days. At Noda, we offer an onboarding and integration manager supporting you through all the steps.

Are open banking payments safe?

Yes. They’re protected by bank-grade encryption and Strong Customer Authentication (SCA), often using Face ID or fingerprint.

What banks support open banking in the UK?

All major UK banks are required by law (PSD2) to provide secure APIs for open banking.

Do merchants still pay fees?

Yes, but they’re much lower – typically a fraction of card transaction costs.

Can open banking handle recurring payments?

Yes, through Variable Recurring Payments (VRPs), though widespread adoption is still developing.

What if a bank API fails during checkout?

Customers are automatically redirected to other payment options such as cards, Apple Pay, Google Pay, or QR code payments.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each