Open banking payments – often referred to as pay-by-bank – let UK customers pay you straight from their banking app, skipping card networks and manual transfers.

Pay-by-bank cuts processing costs, enables instant settlement, and reduces fraud risks. Adoption is accelerating, with over 15 million of active users in the UK, and regulators are expanding recurring use cases in 2025s, so it’s worth every SME’s attention.

What Is Open Banking Payment?

As mentioned earlier, open banking payments are made directly through the customer’s banking app. There’s no need to enter long card details, making the process fast and seamless. Here’s what the customer flow looks like:

- Customer selects Pay-by-Bank at checkout

- Customer chooses their bank – at Noda, we cover 2,000+ banks in the UK and EU; full UK bank coverage.

- Multi-factor authentication via their online banking app, typically with biometric authentication

- Customer reviews details and confirms payment

- Funds are debited instantly – using UK’s Faster Payments

This process cuts out card networks and middlemen, making payments faster and cheaper. Behind the scenes, pay-by-bank runs on data sharing via APIs provided by banks. These are regulated by UK PSR legislation, and only licensed providers can get access, plus consumer consent is mandatory. Consumers can withdraw consent anytime.

Why Use Open Banking? Benefits for E-Commerce SMEs

- Lower costs: No interchange or scheme fees – payments go directly between accounts. Card fees stack up from multiple layers (1.5–3%+), while pay-by-bank usually costs 0.1–1% or £0.20–£0.50 per transaction.

- No chargebacks: Payments are bank-authorised, removing chargeback fraud and related admin costs.

- Faster settlements: Funds arrive instantly via Faster Payments, improving cash flow and reconciliation.

- Better checkout experience: Customers approve payments in their banking app – no card details, fewer drop-offs, higher conversions. Open banking reduces shopping card abandonment.

- Stronger security: Protected by bank-grade encryption and SCA using biometrics or 2FA, reducing fraud risk.

Open Banking Payments: UK Regulations

Open banking in the UK is governed by the FCA and CMA, ensuring financial data is shared securely and only with customer consent.

Its framework rests on three main pillars:

- Payment Services Regulations 2017 (PSRs): Implements European PSD2 into UK law, obliging banks to provide API access to licensed fintechs.

- CMA Order: Required the UK’s nine largest banks (CMA9) to build standardised, secure open banking systems.

- FCA Oversight: Only FCA-authorised firms can operate as Account Information (AISP) or Payment Initiation (PISP) providers.

The Open Banking Implementation Entity (OBIE) currently manages technical standards, soon to be joined by the Future Entity, which will oversee next-generation features like Variable Recurring Payments (VRPs) – full commercial rollout expected by the end of 2025.

Looking ahead, the Data (Use and Access) Act 2025 will extend these principles toward open finance and a broader smart data economy. FCA also is soon to publish its open finance roadmap.

Open Banking vs Card Payments

Open Banking Payments’ Buyer Protection

No Chargeback Protection

When it comes to buyer protection, open banking payments work differently from traditional card payments – and merchants need to make this clear.

With credit cards, customers are covered by Section 75 of the Consumer Credit Act, which protects purchases between £100 and £30,000 if something goes wrong. Debit and credit cards also offer chargebacks, allowing banks to reverse disputed transactions in certain cases.

In contrast, open banking payments don’t include these mechanisms. There’s no Section 75 protection or chargeback option – refunds must be handled directly between you and your customer.

What to do: be transparent. Publish a clear refund policy or service-level agreement, provide an easy way for customers to reach you, and display trust signals such as reviews or security badges to build confidence in your process.

APP Fraud Reimbursement

While pay-by-bank doesn’t include chargebacks like card payments do, there is now a fraud reimbursement mechanism in place to protect consumers and small businesses.

Since October 2024, the PSR has required banks and other payment service providers to reimburse victims of authorised push payment (APP) scams made via Faster Payments or CHAPS, up to a maximum of £85,000 per claim.

These rules apply to cases where a customer is tricked into sending money to a fraudster – not to unauthorised fraud or civil disputes such as undelivered goods.

Responsibility is shared equally between the sending and receiving PSPs. Reimbursement is not due if the customer acted with gross negligence or complicity, or if the case involves large corporations, crypto, or international transfers.

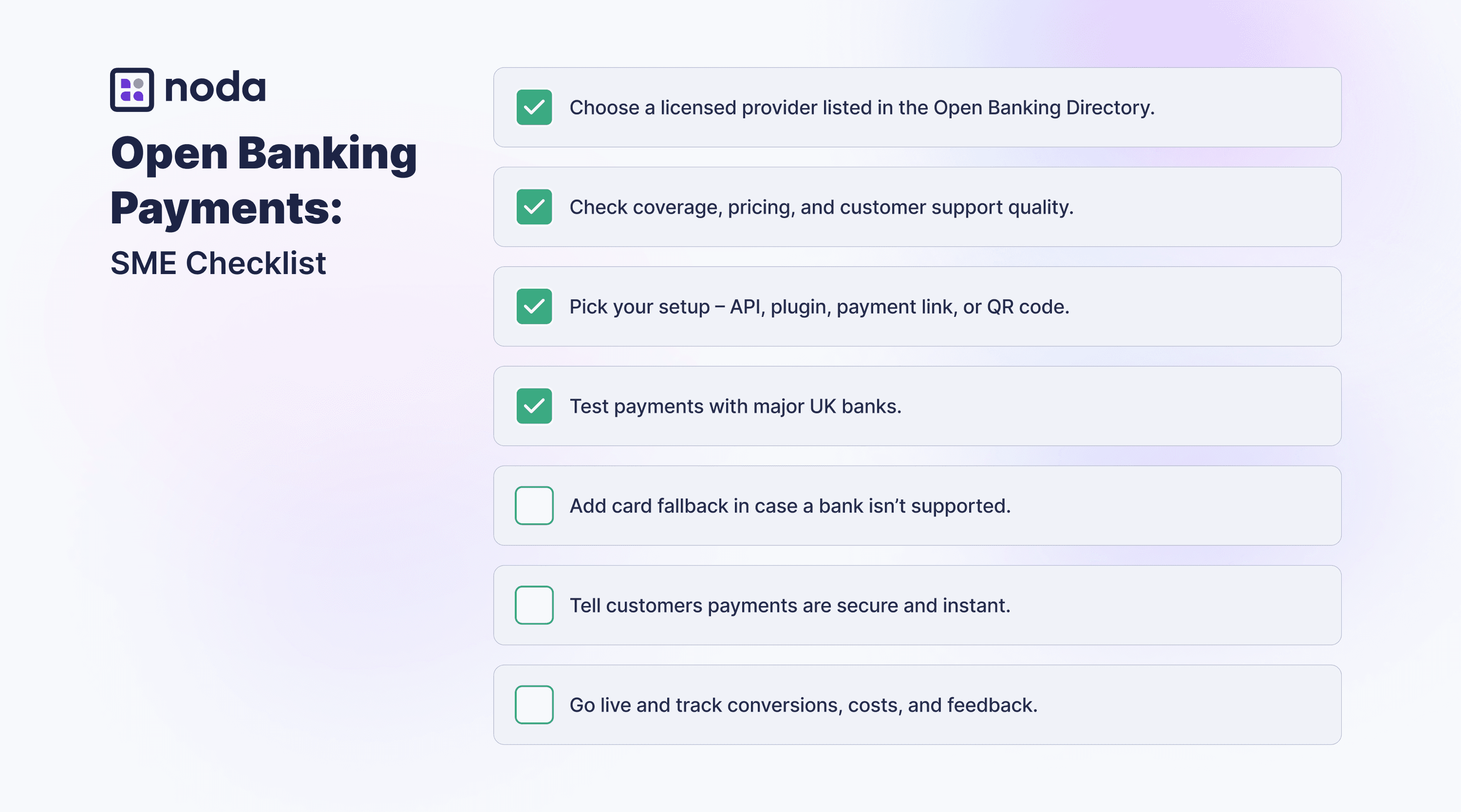

How to Integrate Open Banking Payments: SME Checklist

The simplest way to start accepting open banking payments is by partnering with a licensed PISP. Choose a provider that’s FCA-authorised and listed in the Open Banking Directory, and assess practical factors such as:

- Coverage across UK and EU banks (e.g. Noda supports 2,000+ banks).

- Access to data and analytics tools.

- Dashboard usability and support quality.

- Transparent, predictable pricing. Read: Open Banking Costs.

Integration Options

- Open Banking API: Full control over your checkout design and payment journey; requires more technical setup.

- E-commerce Plugins: The fastest option for SMEs that use e-commerce platforms. For example, at Noda we offer plugins for WooCommerce, Magento, PrestaShop, and OpenCart.

- Payment Links: Shareable links for instant, no-code online payments.

- QR Payments: Ideal for in-person sales – customers scan and pay directly via their banking app.

Integration Best Practices

- Enable card fallback so customers can still complete checkout if their bank isn’t supported. Test across major UK banks to ensure smooth performance.

- Educate customers – highlight that open banking is secure, instant and authorised in their own banking app, yet there are no chargebacks. Outline your refund policy.

FAQs

Is pay-by-bank cheaper than cards?

Usually it is cheaper. Card fees stack up from multiple layers (1.5–3%+), while pay-by-bank usually costs 0.1–1% or £0.20–£0.50 per transaction.

Do customers get the same protection as credit cards?

Not exactly – there’s no chargeback or Section 75, so publish a clear refund policy to maintain customer trust. There is APP fraud protection for up to a maximum of £85,000 per claim.

How fast is settlement?

Almost instant, compared to up to three days for card payments. Open banking runs on UK Faster Payments.

Can I use it for subscriptions?

Yes – the first uses of commercial Variable Recurring Payments (VRPs) are expected to roll out in 2026.

Is pay-by-bank safe?

Yes – it uses bank-app authentication, Strong Customer Authentication (SCA) is mandated, and new APP fraud reimbursement protects customers for up to a maximum of £85,000 per claim.

Will it hurt conversions?

Unlikely – with clear messaging, many merchants see higher completion rates than with manual transfers. Yet it’s important to enable card fallback so customers can still complete checkout if their bank isn’t supported.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each