With open banking, paying directly from bank accounts is becoming as common as using debit or credit cards. This is already happening in Europe and many other countries.

Yet many customers are still paying by traditional card payments. How do the two payment methods compare? Here, we explore all aspects of pay-by-bank versus card payments, including processing and the key differences.

Pay-by-Bank vs Cards: Processing

Pay-by-bank, also known as account-to-account (A2A) or an open banking transaction, allows customers to make online payments directly from their bank accounts. This approach avoids using card intermediaries. Customers authorise payments by using their online banking credentials, transferring funds directly to the merchant's account.

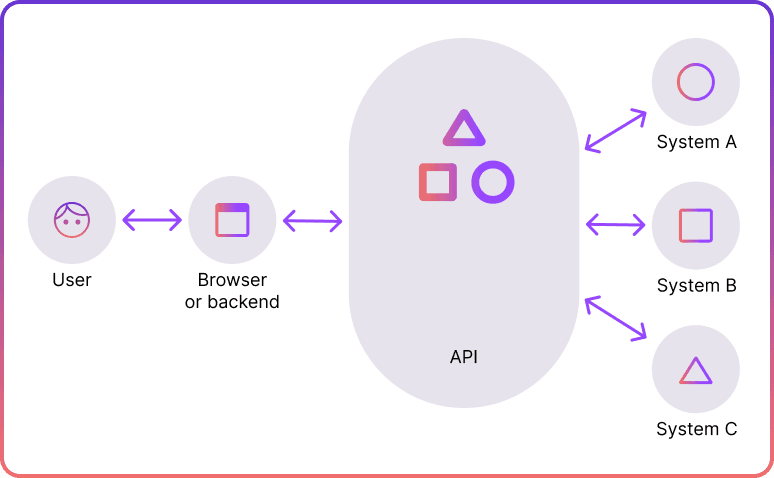

In 2018, the EU's PSD2 regulation came into effect, mandating that banks share customer data with authorised fintech companies through application programming interfaces (APIs). APIs act as connectors, facilitating secure communication between different systems. This framework has enhanced the speed, cost-efficiency, and security of A2A payments.

Card payments, on the other hand, refer to a cashless payment that uses a bank card, credit or debit. The amount is either debited directly from their bank account or, in the case of a credit card, charged at a later date. Card payments started gaining popularity in the 1970s and are widely used worldwide. Today, major card networks like Visa and Mastercard have hundreds of millions of cards in circulation issued by numerous banks.

Pay-by-Bank Processing

When choosing pay-by-bank, users are redirected to their trusted bank’s interface to complete the transaction. The payment processing flow is as follows:

- User selects the 'Pay by Bank app' option at checkout

- User selects their bank from the options provided and is re-directed to their banking app or web interface

- User logs in to their banking interface, using the required verification method such as Face ID, Touch ID, Mobile Banking PIN, or others

- User selects the account from which they would like to send money

- User reviews the on-screen details, including payee, amount, their chosen account and delivery address if displayed

- User clicks send and confirms the transaction

- The issuing bank reviews the transaction and decides whether to approve or decline it

- If the transaction is approved, the funds are transferred to the merchant’s account and the user is redirected back to their merchant’s platform

Card Payment Processing

Card payments, on the other hand, involve card networks, so, consequently, they include a few more steps. A typical card payment flow would look like this:

- User chooses card payment at the checkout & enters their payment information

- The payment details are sent to the payment gateway

- The gateway encrypts and transmits the transaction data, including card numbers

- The payment processor receives the encrypted data from the gateway

- The processor checks and confirms the transaction details

- The processor sends the transaction details to the acquiring bank linked to the merchant's account

- The acquiring bank forwards the transaction to a card network, such as Visa or Mastercard

- The card network contacts the issuing bank to verify the user's account status and balance

- The issuing bank reviews the transaction and decides whether to approve or decline it

- Approved transactions are collected by the merchant and sent to the payment processor for settlement at the end of the day

Pay-by-Bank vs Cards: Key Differences

| Pay-by-Bank | Card Payments | |

| User Experience (UX) | Smoother, as it doesn’t require users to enter card details | Requires users to enter card details |

| Transaction Fees | Fixed cost per transaction | A percentage of the transaction amount on top of interchange, scheme, gateway, and processing fees |

| Settlement Speed | Open banking payments offer instant processing and settlement | Card payments require extensive communication between the merchant's gateway, payment network, the customer's bank, and the merchant's bank, which delays processing and settlement. |

| Fraud Prevention | Require Strong Customer Authentication (SCA); rely on regulated APIs | Generally, require Strong Customer Authentication (SCA) |

| Integration | Would require open open-banking payments provider | Would require payment service provider |

User Experience

One major benefit of pay-by-bank for UX is app-to-app redirection. This method avoids using the mobile device's default browser and instead connects users directly to their banking app to give consent. If the banking app isn't installed, users are automatically sent to a mobile-optimised banking website. In contrast, card payments require users to manually enter their card details.

Transaction Fees

Pay-by-bank is more cost-effective than traditional card transactions because no card network is involved. Therefore a pay-by-bank payment has no interchange fees, offering a fixed cost per transaction. Money is transferred directly between bank accounts, which results in lower fees.

Transaction Speed

Slow settlements are a frequent issue for merchants using traditional payment methods like cards, which can take up to three days to process and may impact cash flow. Conversely, pay-by-bank payments are credited to merchants' accounts almost immediately, enabling businesses to monitor their cash flow accurately in real time.

Fraud Prevention

Pay-by-bank offers increased security because customers do not need to share their credit or debit card details to make a payment. Instead, data is transmitted through regulated APIs, reducing the risk of fraud and safeguarding customer information. This method is significantly more secure than screen scraping. Additionally, both pay-by-bank and most card payments use strong customer authentication (SCA).

Integration

Both card payments and open banking payments would require a payment service provider. For open banking payments, there are several types of integration options available: Direct Open Banking API, hosted payment pages (HPPs), software development kits (SDKs) and e-commerce plugins.

Future of Payments

The rapid adoption of pay-by-bank for online payments is expected to continue growing. Statista predicts that A2A payments will make up 10% of all e-commerce transactions by 2026. Currently, A2A payments are the fourth most popular payment method globally, following digital wallets, credit cards, and debit cards.

Statista's March 2023 report indicates that Europe is currently leading in the adoption of pay-by-bank payments. However, this trend is expected to spread globally. According to McKinsey, by 2026, pay-by-bank payments in North America could facilitate about $200 billion in consumer-to-business transactions, with the potential for even higher volumes in other payment categories.

Integrate Pay-by-Bank with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

FAQs

What are the key differences between pay-by-bank and card payments?

Pay-by-bank allows customers to pay directly from their bank accounts, bypassing card networks, while card payments involve using debit or credit cards. Pay-by-bank has fixed transaction costs and instant settlement, whereas card payments include multiple fees and slower processing.

What are the benefits of pay-by-bank for merchants?

Pay-by-bank offers lower transaction fees since there are no interchange fees, and it provides instant settlement, improving cash flow for merchants. It also enhances UX, leading to lower cart abandonments, and improves security by using regulated APIs and strong customer authentication.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each