The subscription economy is reshaping how businesses generate revenue. Instead of relying on one-off purchases, companies are building long-term relationships with customers through recurring payments. It’s a model that offers predictability and growth — but it also comes with unique challenges.

For merchants, the key to success lies in seamless payments and retaining customer loyalty. In this article, we’ll explore the subscription economy’s impact on businesses, its future, and how smart tools can support retention and growth.

What Is a Subscription Economy?

The subscription economy is a term derived from Zuora’s Subscription Economy Index. It describes the growing shift from traditional one-time purchases to subscription-based business models. Instead of focusing on selling individual products, this approach prioritises ongoing value for customers who subscribe to access a product or service.

Subscription business models generate recurring revenue, where customers pay regularly—weekly, monthly, or annually—for continuous access. Common examples include:

- Streaming platforms like Netflix, Audible and Spotify

- Software-as-a-Service (SaaS) tools like Microsoft Office or Adobe

- Physical subscriptions, such as monthly boxes for books, wine, coffee, or meal kits

Subscription businesses earn most of their revenue after customers subscribe, not from the initial sign-up. Over time, customer contributions become the foundation of their income.

This model changes the way revenue is generated, prioritising long-term relationships over one-time transactions. Instead of focusing solely on products, subscription businesses centre their efforts on creating a better experience for their customers.

State of Subscription Economy

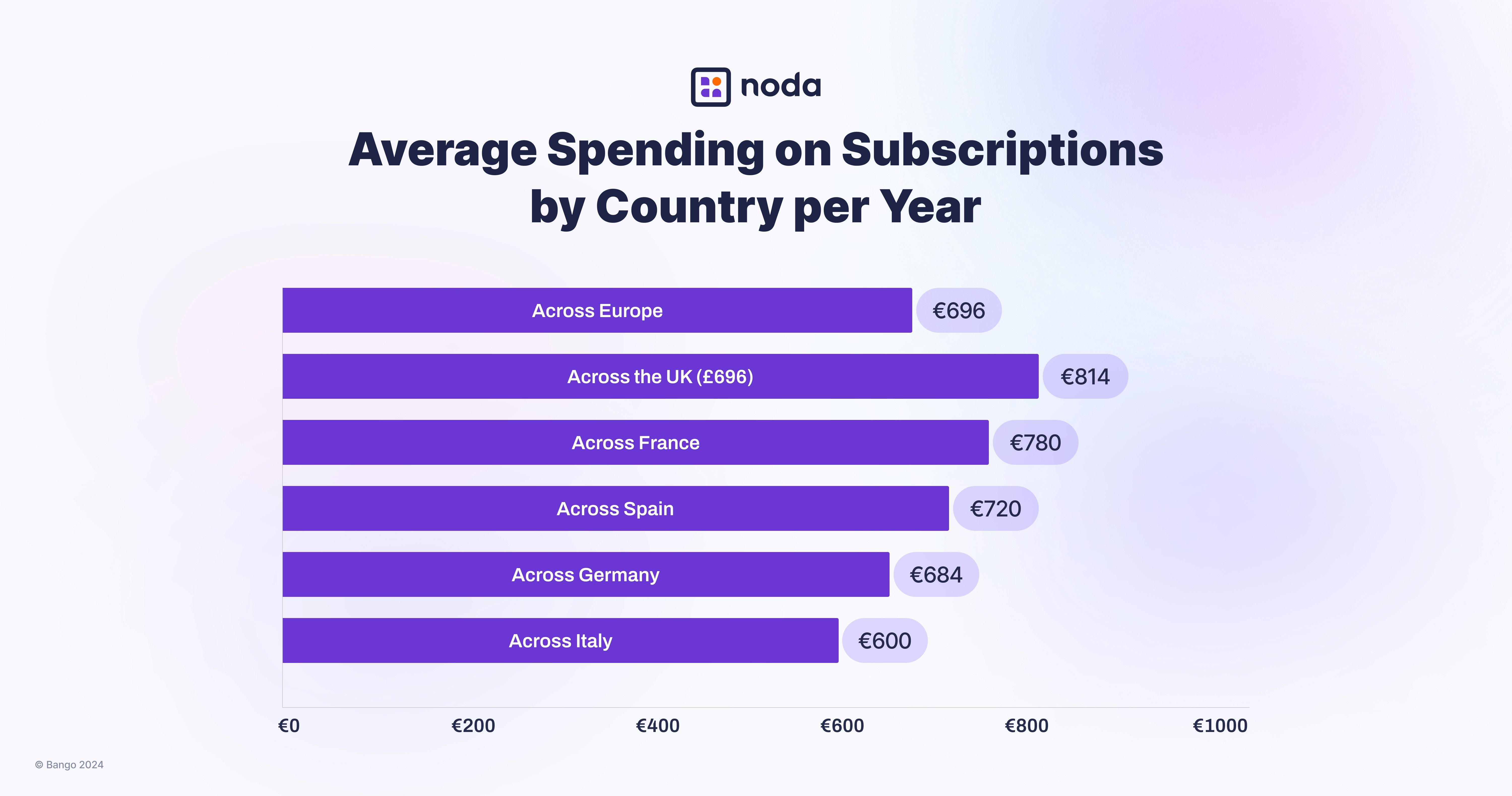

According to the Subscription Wars report from Bango, which surveyed over 5000 consumers in the UK, France, Spain, Italy and Germany, an average European spends €696 per year on subscription services. This number is the highest in the UK and the lowest in Italy.

The rise of the subscription-based economy is largely driven by consumer preferences. Both individuals and businesses are increasingly opting for subscriptions instead of traditional one-time purchases.

While physical products are still part of the subscription economy, its growth is heavily influenced by digital technology. Items that once required physical purchases, like books, music, or movies, can now be streamed or downloaded, making subscriptions more appealing.

Recurring Payment Methods in Subscription Economy

Subscriptions rely on recurring payments, where customers authorise ongoing charges, like direct debits or card payments. Revenue often comes from contracts for a set period or through auto-renewals. Customers can cancel or renew as needed, meaning success hinges on the relationship your business builds with them.

Recurring Card Payments

The most common method for subscriptions, card payments allow businesses to charge customers the same amount automatically at regular intervals. Recurring card payments are available via Noda’s card payment gateway.

Direct Debit

A UK-specific option where customers authorise their bank to send payments to a merchant. The payments can be of variable amounts. Managed through BACS, these payments typically settle in three days.

Variable Recurring Payments (VRPs)

VRPs are a modern payment solution powered by open banking. They allow customers to authorise third-party providers (TPPs) to make payments at varying amounts and intervals.

- Sweeping VRPs

Sweeping refers to transferring funds between a customer's own accounts. For instance, it can be used to automate monthly contributions to investment accounts, move extra funds into high-interest savings accounts, or ensure timely payments to avoid overdraft fees.

- Non-Sweeping (Commercial) VRPs

Non-sweeping VRPs allow flexible recurring payments between a customer’s account and a merchant. While not mandated by the CMA in the UK, these payments are gaining traction. In 2022, NatWest partnered with some open banking providers to offer non-sweeping VRPs as a new payment option.

These payments simplify regular bills, subscriptions, and tax management by automating processes like VAT allocation. They also avoid the challenges of indemnity claims linked to Direct Debit, offering businesses and consumers a more efficient solution.

Future of Subscription Economy

The subscription economy growth is projected to reach nearly $1 trillion globally by 2028, according to Juniper Research, driven by its expansion into new industries. However, after rapid growth during the COVID-19 pandemic, the sector now faces emerging challenges.

According to the latest report by Minna Technologies and FT Strategies, factors like the cost-of-living crisis are slowing this expansion. As a result, subscription businesses are shifting their focus to retention, with 68% of surveyed leaders naming it their top strategic priority.

To thrive in the future, fintech and banking brands must keep pace with rising consumer expectations for seamless user experiences, driven by Gen Z and millennials. A smooth customer journey—transparent, personalised, and intuitive—is increasingly a key differentiator.

Payments play a critical role in this, as subscription businesses urgently need to address issues like failed transactions, outdated payment details, and disputes. These pain points significantly impact customer satisfaction, brand perception, and churn rates. In fact, 58% of executives cite payment improvement as a priority just behind retention.

Looking ahead, real-time customer insights will be essential for hyper-personalised offers and building loyalty. By leveraging tools like user insights, subscription businesses can analyse behaviour and deliver timely, relevant offers that strengthen retention.

Recurring Payments with Noda

For businesses seeking a simple, reliable recurring card payment solution, Noda is designed to keep your payment processes smooth and your customers satisfied. With an intuitive user experience, our platform helps you build stronger customer relationships and increase retention.

Turn User Insights into Growth

Noda doesn’t just process payments – it provides the insights you need to grow. From customer verification to in-depth behavioural analytics via Know Your Whales (KYW), our tools let you optimise your subscription services, deliver personalised experiences, and boost loyalty. With Noda, you can forecast long-term value while maintaining high retention rates.

Open Banking VRPs

Noda is also pioneering recurring payments through open banking VRPs. Already live in the Baltic states, we’re actively working to expand this service to more regions. Open banking offers businesses and customers an alternative payment method with lower fees, no chargebacks, and a faster, more seamless experience.

Extra Features for Flexible Integration

Our platform offers Open Banking API for pay-by-bank payments and e-commerce plugins like OpenCart, WooCommerce, Magento, and PrestaShop. With no-code payment options, Noda is quick to integrate, even for businesses without technical resources. Whether you’re starting out or scaling up, our flexible plans fit your unique needs.

Reach More Customers

Noda partners with over 16,500 banks in 27 countries, supporting multiple currencies and instant bank payments. Pay-by-bank technology helps your business cut middlemen fees and eliminates chargebacks while offering customers the convenience of trusted local banks.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each