Note that the information about Trustly and Sofort found in this article was taken from their respective websites on 17 May 2024. This information is subject to change.

Partnering with an open banking provider is becoming as common for merchants as accepting debit or credit cards. This trend is already widespread in Europe and many other countries.

Merchants can lower fees and improve user experience by adopting this payment method. Here, we take a look at the two open banking payment providers: Trustly and Klarna’s Sofort.

What is Trustly?

Trustly is a payments provider that offers open banking payments and data solutions. The Trustly Americas team is a fusion of PayWithMyBank, a Silicon Valley startup established in 2012, and Trustly AB from Sweden. These two entities merged in 2019 to create Trustly.

Currently, their team supports 8,300 merchants and processes more than $42 billion in annual transaction volume across their global network.

What is Sofort?

Sofort is part of Klarna, which is known for its Buy Now, Pay Later (BNPL) services. This means consumers can purchase items instantly and pay for them later. Unlike typical BNLP Klarna payment methods, Sofort is Klarna’s product which specifically uses open banking technology to let customers pay directly from their bank accounts.

In 2014, Klarna acquired Sofort, forming the Klarna Group. A significant rebranding in August 2017 integrated the Sofort payment method visually into Klarna's product lineup.

Originally named Payment Network, Sofort GmbH was established in Munich, Germany, in 2005. The company provides secure solutions for buying both physical and digital goods online. This includes the payment method known as Sofort.

Klarna was founded in Sweden in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson, initially named as Kreditor. Today, the company has expanded to other countries and become the leading alternative payments method.

What are Open Banking Payments?

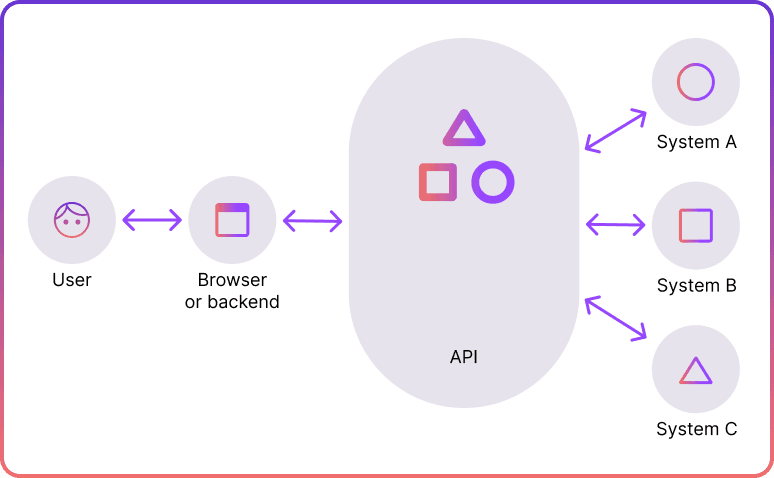

Since 2018, the EU's PSD2 regulation has mandated that banks provide licensed fintech firms with customer data through secure application programming interfaces (APIs). APIs act as a software bridge, enabling different systems to communicate.

Open banking has spurred the development of direct account-to-account (A2A) payments, commonly known as "Pay-by-Bank" or open banking payments, now very popular with both consumers and merchants.

A2A payments offer several benefits to e-commerce businesses, such as fast fund transfers and a seamless UX. Customers don't need to enter their payment details manually. Instead, they are directed from the payment site to their banking app and back via app-to-app redirection.

This improves the UX, reduces cart abandonment, and lets merchants access funds quickly. In 2022, A2A payments made up 9% of global e-commerce transactions, according to Statista.

Trustly vs Sofort: Open Banking Payments

It’s important to note that Sofort is not actually a payment service provider. It’s a product in Klarna’s wider payments suite, an A2A payment method that lets customers use their own bank details to pay online without needing to register or create an account.

To pay with Sofort, customers choose the "Pay now with online banking" option at checkout. This action transfers the order details to a secure Klarna payment form. The payment flow is a typical open banking payment, with convenient app-to-app redirection.

Meanwhile, Trustly is a complete open banking payments platform. Trustly Pay enables merchants to smoothly accept A2A payments. The provider offers intuitive User Interfaces (UIs), smart routing and optimised settlement time. Their network is connected to 12,000 banks and 8,300 merchants.

Apart from Trustly payments, the provider offers Trustly Bank Payouts, which allows merchants to accept open banking payouts to bank accounts.

Open Banking Data

Apart from Trustly bank transfers, the provider also offers a range of open banking data products. For example, Trustly Connect allows merchants to retrieve bank-grade data for immediate account authentication and ownership verification.

Meanwhile, Trustly ID enabled banks-sources know your customer (KYC) data to instantly verify identity information, and simplify onboarding and KYC processes.

Additionally, Trustly Cashflow offers merchants a solution to access a consumer’s financial health in real time. This can be used for risk assessment in loan applications, wealth and income verification, and more.

Trustly vs Sofort: Pricing

In terms of Sofort vs Trustly fees, the providers use a similar approach of not revealing their pricing on the websites.

To learn precise Trustly pricing plans and fees, merchants would have to contact the provider directly. Similarly, merchants need to enquire about this with Sofort.

Sofort vs Trustly: Integration & Coverage

According to the provider, the Trustly open banking network connects to 12,000 banks in over 33 Trustly countries, with 8,300 merchants, $56bn of total payments value, and 650m consumer reach. Trustly APIs are available for open banking integration.

Klarna’s Sofort, meanwhile, is trusted by more than 30 million users and available in nine countries, including Austria, Belgium, Germany, Italy, Netherlands, Poland, Spain, Switzerland and the UK.

Alternatives to Trustly and Sofort

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine user experience, Noda is your partner in growth.

FAQs

Is Sofort or Trustly better?

Sofort and Trustly are both effective for open banking payments, but they serve different needs. Sofort is part of Klarna and is available in nine European countries. It is popular for its seamless user experience and integration with Klarna’s BNPL services. Trustly money transfers, on the other hand, has a broader reach, connecting to 12,000 banks in over 33 countries. It supports more merchants and handles higher transaction volumes. For businesses needing wider coverage and more advanced features, Trustly might be better. For those focused on the European market with a preference for Klarna's services, Sofort could be a better fit.

Is Trustly safe?

Yes, Trustly is safe. It uses secure APIs to connect with banks and complies with the EU's PSD2 regulation. This ensures secure sharing of customer data and protects transactions.

How does Trustly work?

Trustly works by connecting merchants with customers' bank accounts through secure APIs. When a customer chooses to pay with Trustly, they are directed to their bank’s login page. They log in and approve the payment, which is then confirmed in real time. Trustly also offers additional services like payouts, bank-grade data retrieval, and identity verification to streamline various financial operations for merchants.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know