Running a business in today’s digital world comes with constant challenges – streamlining payments, keeping costs low, and ensuring a smooth customer experience.

Instant online payment links are changing the game. They offer a quick, flexible way to accept payments, cutting out the complexity of traditional methods. Fast, secure, and easy to use, they’re built to make transactions seamless for both you and your customers.

What Is a Payment Link?

A payment link is a unique URL or QR code that enables an online payment.

Instead of using traditional point-of-sale (PoS) or online payment gateway, businesses can accept payments by sending their customers a link for payment. The transaction process begins when a customer clicks on it.

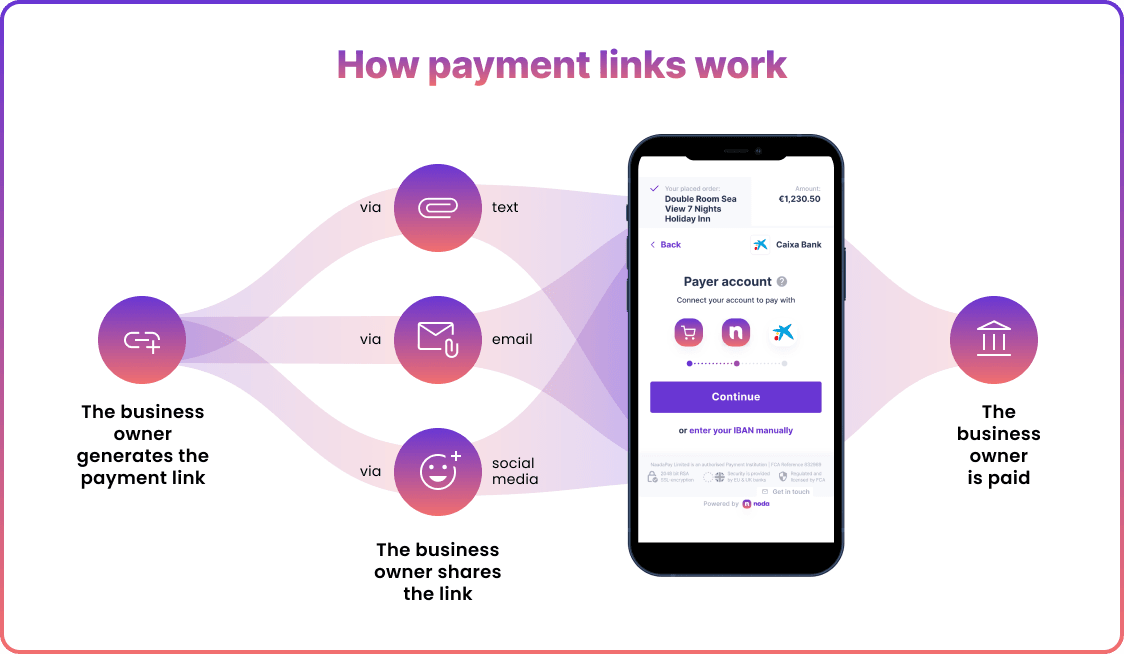

How Do Payment Links Work?

Payment links can be sent to clients via various channels, such as emails, SMS, social media platforms, or even messaging apps like Facebook and Whatsapp.

Customers are directed to a branded payment page, where they can choose from multiple payment methods, such as pay-by-bank or card payments. In essence, a payment link connects customers to a checkout where they can finish the transaction.

How to Create a Payment Link

Creating and sharing a payment link involves a few simple steps. Here’s how it works.

Set up a Payment Page

Your payment provider will either offer a ready-made payment page or let you customise one to match your brand. This is where customers land when they click your payment link.

Creating a Payment Link

Once your payment page is set up, creating an online payment link is simple.

You’ll typically choose the product or service you want to sell, input the necessary details like price and description, and generate a payment link through your provider’s dashboard. At Noda, for example, you can generate a link via our AI chatbot.

This link directly connects to the payment page, making it easy for customers to complete their purchase seamlessly.

Send a Payment Link to Your Customer

The payment link can be now shared with customers in several ways. You can send a payment link via email, text message, or even through social media.

For businesses managing a higher volume of transactions, automating the process of sending payment links means a smoother workflow.

Customer Pays by Link

When the customer receives the payment link, they simply click to start the process. The link takes them to a secure payment page where they review details, pick their payment method, and pay. It’s fast, smooth, and easy for everyone.

Once the payment is completed, the funds are processed and transferred to your account, giving you quick access to your earnings.

Create Instant Payment Links with Noda

With Noda’s payment links, creating and sending takes under five minutes – no coding required. Generate a payment link using our AI-powered chatbot and send the link to your clients. You can also set up QR payments and no-code checkout pages instantly. It’s effortless to get started.

Our platform offers both card payment gateway and pay-by-bank options. With Noda’s Open Banking API, customers can pay directly from their bank accounts, enjoying bank-level security while merchants skip costly card networks. This means lower fees, no chargebacks, reduced cart abandonment, and real-time payments.

Simplify payments, cut costs, and boost your business with Noda’s payment link generator.

When You Can Use Payment Links

Payment links are more than just a tool – they’re your growth strategy. Whether you’re starting out or running a multi-channel operation, they will fit smoothly into your set-up. Here’s how they can work for you:

- No website? No problem

If your business doesn’t have an e-commerce site, payment links provide a perfect way to accept payments. Share a link to pay directly with your customers (for example, when invoicing) and get paid instantly, no extra infrastructure needed.

- One more payment method to your arsenal

Even if you already accept payments online, payment links serve as an excellent additional method. They are quick and simple for one-off transactions without complicating your current setup.

- Perfect alternative to physical terminals

For businesses on the go, payment links eliminate the need for physical card readers. Accept payments anywhere – whether it’s at a pop-up event, a trade show, or on-site with a client. Just share a link.

- Customised checkout for different audiences

You can create tailored payment pages for unique audience segments. For example, from VIP customers to specialised campaigns, payment links let you personalise the payment process effortlessly.

- Multi-channel selling made easy

Boost your sales across platforms like social media, email, SMS, phone, chatbots, or blogs. Payment links integrate smoothly into these channels, allowing you to reach customers wherever they are.

Noda makes creating and managing payment links fast and intuitive. Whether you’re sharing them via email or in a blog post, you can count on Noda for reliable and smooth solutions that work for your business.

Benefits of Using Payment Links for Business

- Simplify UX: Imagine sending a bill as easy and user-friendly as emailing. That's how straightforward payment links are. Clients, too, can settle their dues with just a few taps and swipes. No more rummaging around for physical cash or cards, and businesses don't need to be tech wizards to create payment links.

- Recover card abandonment: With a seamless payment process, customers are less likely to leave mid-purchase. This leads to less cart abandonment and improved conversion rates, giving your business a boost.

- Get funds quickly: No more waiting for checks to clear or processing transfers. Payments via links are immediate, keeping the financial gears of your business turning smoothly and promptly.

- Boost revenue: Reduced cart abandonment and enhanced customer satisfaction encourage repeat purchases. A smoother payment experience translates to increased sales and long-term customer loyalty.

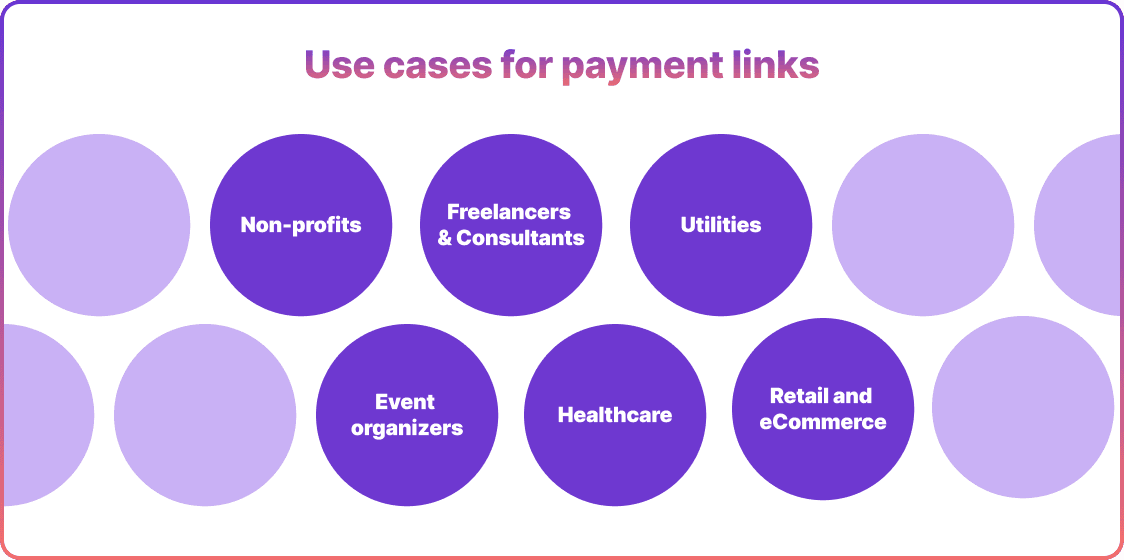

How to Use Payment Links: Key Use Cases

We’ve already discussed, payment links are incredibly versatile, making them a perfect fit for businesses of all sizes and industries. At Noda, we provide flexible solutions tailored to diverse sectors. Here’s how payment links can be used across various industries.

Retail and E-commerce Businesses

Payment links are a game-changer for merchants and e-commerce platforms. They can be added to product pages, emails, or promotional materials, allowing customers to make purchases quickly without navigating a lengthy checkout process. Additionally, businesses can track payment links to gain insights into customer behaviour and preferences.

Event Organisers

Payment links are ideal for simplifying ticket sales and event registrations. They can be shared on social media, websites, or emails, making it easy for attendees to book their spots. This easy process boosts sales, enhances the customer experience, and saves time for event organisers.

Freelancers and Consultants

After completing a service, freelancers and consultants can send links via email or text with the invoice, avoiding delays from traditional methods. It’s a faster, more organised way to manage transactions and ensure timely payments.

Non-profit Organisations

Non-profit organisations can simplify fundraising with easy-to-share payment links. These links can be included in newsletters, social media posts, or on their website, making it easy for donors to contribute. A smoother process encourages more frequent and generous donations.

Utility Providers

Utility providers like electricity, water, and telecom companies can streamline bill payments with payment links. Sent via SMS or email, these links let customers pay quickly and conveniently. This improves satisfaction and ensures clients pay on time.

Healthcare Providers

Healthcare providers can use payment links after appointments (online and offline) or any other services. Patients receive a link after their session, making payments quick and convenient. This also helps healthcare businesses streamline their financial processes.

How to Choose a Payment Link Provider

Choosing the right payment links provider can make or break your payment experience. Here are the essential questions to guide your decision:

1. Does the provider support my currencies?

If you serve international customers, make sure the provider can process payments in the currencies you use.

2. How customisable is the payment page?

Can you add your logo, adjust branding, or personalise the payment page to match your business?

3. Can I create different payment types?

Does the provider offer options for recurring payments, instalments, or one-off transactions?

4. Is it easy to use?

How quickly can you create a payment link? The process should be intuitive and straightforward. At Noda, for example, merchants can create and send a payment link in under five minutes.

5. What are the transaction fees?

Are the fees transparent and cost-effective? Make sure you understand the charges before committing.

6. What payment methods are supported?

Does the provider cater to a wide range of payment methods like cards, open banking, and other options?

7. What level of customer support is available?

Will the provider offer timely and effective assistance when you need help?

At Noda, we provide excellent support, as shown by our 4.5 TrustPilot rating. Merchants get help whenever needed and a dedicated manager to assist with onboarding.

FAQs

Is link payment safe?

Paying with a link is usually safe, depending on the provider and their security systems. To pay with a link, customers are typically directed through secure payment gateways that keep sensitive information well-guarded.

How can a payment link be sent to a customer?

A payment link can be sent to a customer through various channels like email, SMS, or social media. The link payment method offers a quick, simple, and secure way to accept payments.

How does Noda send a payment link to a customer?

At Noda, a merchant can generate a payment link using our AI-powered chatbot. From there, the merchant can send the link to their clients and get paid.

What is the difference between an invoice and a payment link?

An invoice is a detailed document requesting payment, usually with itemised charges. A payment link is a clickable link that directs customers to pay. It can be sent with an invoice.

Do payment links expire?

Yes, most payment links have an expiry date set by the payment provider. The time frame depends on the provider’s settings, but it’s often adjustable.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know