Expanding your e-commerce business to Brazil is a huge opportunity, but getting payments right can be tricky. Card adoption is dropping in Brazil, and many local customers prefer alternative payment methods.

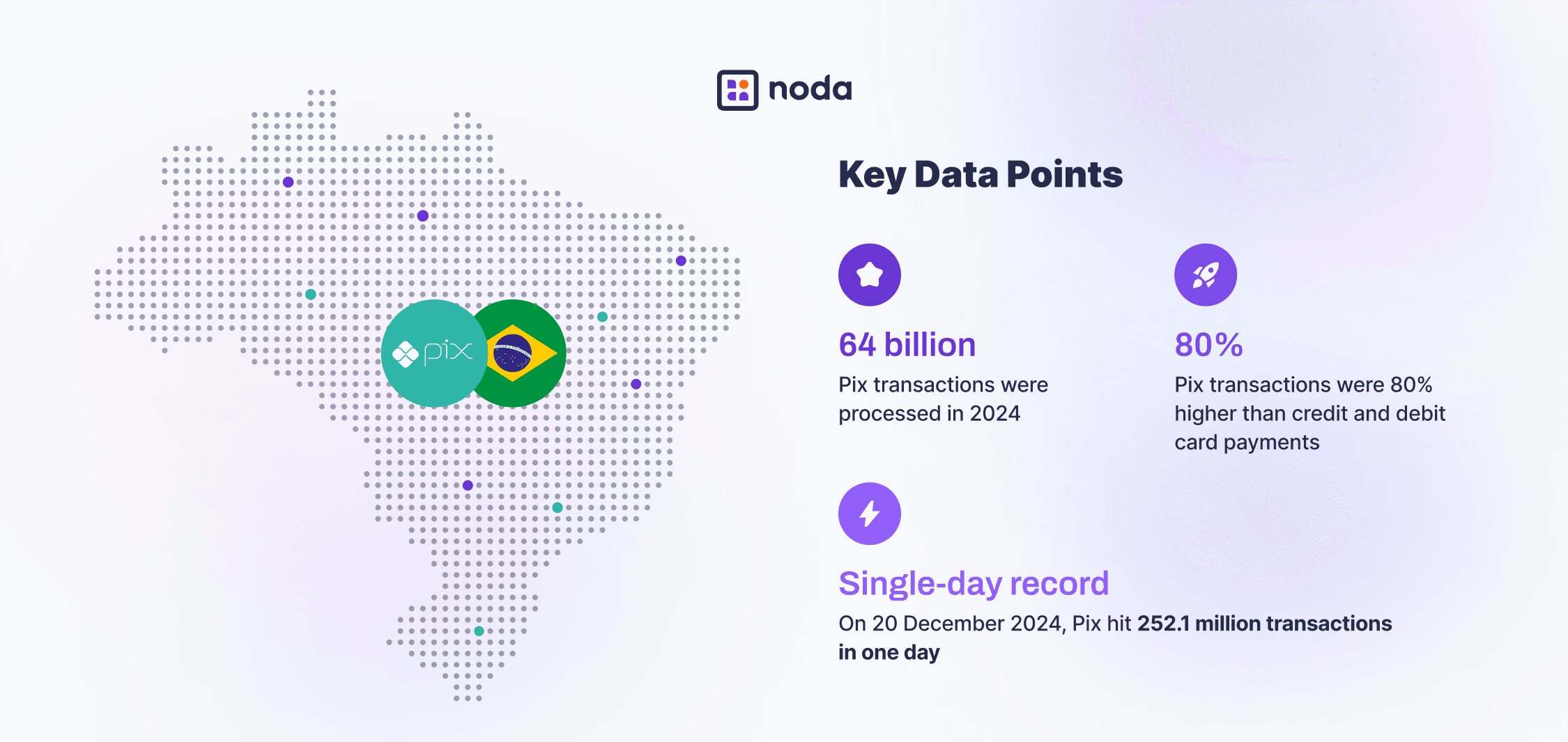

That’s because of Pix – Brazil’s instant payment system, widely used for online shopping, which has outpaced traditional cards by 80% in 2024, exceeding six billion transactions monthly. It’s fast, secure, and far more cost-effective than cards.

In this article, we’ll break down what Pix is and how UK and European businesses can tap into it through open banking. If you’re looking to enter the Brazilian market with lower costs, fewer chargebacks, and better conversions, keep reading.

What Is Pix?

Pix is Brazil’s instant payment system, launched by the Central Bank of Brazil (CBL) in 2020. It lets people and businesses send and receive money in seconds, 24/7, including weekends and holidays.

Unlike traditional bank transfers or card payments, Pix moves money directly between accounts, cutting out middlemen and reducing costs. That’s why it’s now the most popular payment method in Brazil, used by millions every day.

How Does Pix Payment Work?

The Pix system runs on its own payment network, called the Instant Payment System (SPI), managed by BCL. This system settles payments instantly and works 24/7.

To pay with Pix payment method, users scan a QR code or enter a Pix key—no need to type in bank details. Payments are processed within seconds and can’t be reversed. Both the payer and the recipient get instant confirmation, so businesses know the money is received and available immediately.

Benefits of Pix for Merchants

- Instant payments: Funds settle in seconds, giving businesses and customers immediate access.

- 24/7 availability: Works around the clock, including weekends and holidays.

- Lower costs: Fewer intermediaries mean lower fees for businesses and no fees for consumers.

- Open system: Any bank or payment provider in Brazil that meets the rules can use Pix, making transactions seamless across different institutions.

Read more: Open Banking in Brazil: A Comprehensive Overview

Pix Security

One of Pix payment system’s advantages is its built-in security. Here are some key features that keep transactions safe.

User Authentication

Every Pix transfer happens within a secure environment. Users must log in through their bank or financial institution, using a password, biometric verification, or token-based authentication. This ensures that only authorised users can make payments or manage their Pix keys.

Transaction traceability

Every Pix payment flow is fully traceable. This means authorities can track accounts linked to fraud, scams, or other crimes, making it easier to take action against illegal activities.

Encryption

Pix transactions are encrypted and processed through Brazil’s secure financial network (RSFN), separate from the internet. Every institution that participates in Pix must have security certificates to process payments, and all transaction data is encrypted to protect user information.

Pix security protocols

Moreover, there are Pix rules in place for all transactions:

- Banks and payment providers are responsible for fraud prevention. If they fail to manage risks properly, they are held accountable.

- Privacy protections prevent data scraping. Mechanisms block unauthorised attempts to scan personal details linked to Pix keys to prevent data scraping.

- Transaction limits can be set based on risk. Banks can adjust payment limits depending on factors like time of day, user behaviour, and authentication methods.

- Users can customise their own limits. Customers can lower their transaction limits instantly or request an increase, which requires verification.

- Extra verification for unusual transactions. Banks may delay payments that seem suspicious to check for fraud.

- Fraud detection database. Institutions share data on suspicious accounts, Pix keys, and transactions to identify fraudsters.

- Secure QR codes. Only participants with special security certificates can generate dynamic QR codes for payments.

- Blocked funds and refunds. If fraud is detected, Pix allows for funds to be temporarily blocked or returned to the original sender.

How Does PIX Work with International Payments?

Pix is mainly designed for payments in Brazilian Reals (BRL), within Brazil, through participating Brazilian banks and institutions, so it doesn’t support direct global transfers, as of March 2025. However, new solutions are emerging to connect Pix with international payments.

Firstly, the CBL is exploring ways to connect Pix with instant payment systems in other G20 countries. In an interview with the European Payments Council, Carlos Brandt, Head of Management and Operation for Pix at CBL, said that this could be achieved through either bilateral or multilateral agreements.

There’s no set timeline for this, and Pix, in its current form, doesn’t support international payments. However, some open banking providers like Noda have integrated Pix into their payment systems.

Accept Pix Payments Globally with Noda’s Open Banking

Merchants looking to enter the Brazilian market and accept seamless local transactions can do so with Noda’s open banking payments in Brazil, powered by Pix and connected to every single Brazilian bank.

This means that you can offer Pix payments to your Brazilian customers without having a Brazilian bank account. With pay-by-bank, users authorise the payment directly in their bank’s app, using their existing login credentials, and the transaction settles instantly. This happens via secure and regulated APIs that banks share with licensed providers like Noda.

Why choose open banking? It speeds up checkout, reduces cart abandonment, and cuts out costly card fees and chargebacks – since there are no card networks involved.

Get instant access to the Brazilian market with Noda.

Benefits of Open Banking

- Seamless access to the Brazilian market: Accept instant payments easily from Brazilian customers using their trusted bank.

- Lower transaction costs: Cut high card-processing fees with direct pay-by-bank transfers.

- No chargebacks: Reduce fraud and eliminate costly chargeback disputes.

- Faster, smoother checkout: Customers pay directly through their bank’s app, improving user experience and reducing abandoned carts.

FAQs

What is Pix payment?

Pix is Brazil’s instant payment system, launched by the Central Bank of Brazil in 2020. It lets people and businesses send and receive money instantly, 24/7, without using card networks.

Can foreigners use Pix?

Yes, but you need a Brazilian bank account to send or receive Pix instant payments. Some payment providers, including open banking services like Noda, allow international merchants to accept Pix from Brazilian customers.

Do you need a Brazilian bank account to make a Pix payment?

Yes, Pix money transfer only works with accounts from Brazilian banks or payment institutions. However, international businesses can still accept Pix payments through open banking providers like Noda.

Can Pix be used for international transfers?

Not yet. Pix is designed for payments within Brazil and doesn’t support direct international transfers. However, Brazil’s central bank is exploring ways to connect Pix with other global payment systems in the future. Plus, global merchants can accept Pix payments through open banking providers like Noda.

Is Pix safe?

Yes, Pix is highly secure. Payments happen within a bank’s app, requiring authentication like biometrics or passwords. Transactions are encrypted and fully traceable, helping prevent fraud.

What is Pix in Brazil?

Pix is Brazil’s instant payment system, created by the Central Bank of Brazil in 2020. It allows individuals and businesses to send and receive money instantly, 24/7, without using traditional card networks.

How does Pix money transfer work?

Pix transfers money directly between bank accounts in seconds. Users can pay by scanning a QR code or entering a Pix key (like an email or phone number) without needing to input full bank details.

How do I use Pix payment?

To use Pix, you need a bank account with a participating Brazilian financial institution. Payments can be made through your bank’s app by scanning a QR code, entering a Pix key, or manually entering the recipient’s details. If you’re a merchant, you can accept Pix payments through open banking providers like Noda.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each