Please note that the information about the companies in this article was sourced from their respective websites as of May 2025. This information may be subject to change.

ApplePay or PayPal — which one actually works better for your business? Both are popular payment methods. Both promise smooth checkout. But behind the slick user experience, they come with hidden costs: high fees, slow payouts, limited reach, and checkout friction.

In this article, we compare PayPal vs Apple Pay as payment methods to install into your checkout— and show you a smarter third option that could save you money and convert more customers.

Apple Wallet vs PayPal: Quick Overview for Merchants

| Apple Pay | PayPal | Open banking | |

| Device compatibility | Exclusive for iOS; mobile only | Works across devices for web and mobile | Works across devices for web and mobile |

| Customer reach | 1.4 billion iPhone users | 429 million users | Over 11 million users in the UK; 64 million in Europe |

| Transaction fees | Merchants pay the standard credit/debit card processing fees | 2.9% + 30p for UK domestic transactions | Eliminates card network fees as transactions happen from account to account |

| Integration | Via Apple Developer or a payment service provider (usually via API or SDK). | Via PayPal or a provider (usually via API or SDK). | Via a provider with API, plugins, payment links, QR codes |

| Key regions | North America, the UK, Japan, Australia, and more | UK, US, Europe | UK, Europe |

What Is Apple Pay & What Does It Offer?

Apple Pay is a mobile wallet built into Apple devices like iPhones, iPads, Macs, and Apple Watches, giving merchants access to 1.4 billion of active iPhone users worldwide.

It lets customers pay quickly in-store, online, or in apps using Face ID, Touch ID, or a passcode—no need to enter card or shipping info, which is a smoother UX.

Card details stay hidden, and each payment is authorised with a biometric authentication, making it more secure than card payments, which make up 70% of all payment fraud. For merchants, it means faster checkouts and fewer abandoned carts—but it only works for Apple users.

Downsides of Apple Pay

- Сard network fees: Apple Pay transactions still go through card networks, so you’ll pay standard processing fees (like interchange and scheme fees). Providers Stripe and Square, for example, charge the same rates for Apple Pay as they do for cards.

Read: How to reduce card processing fees

- Slow payouts: Settlements can take 1–3 business days, just like regular card payments—no speed advantage for merchants.

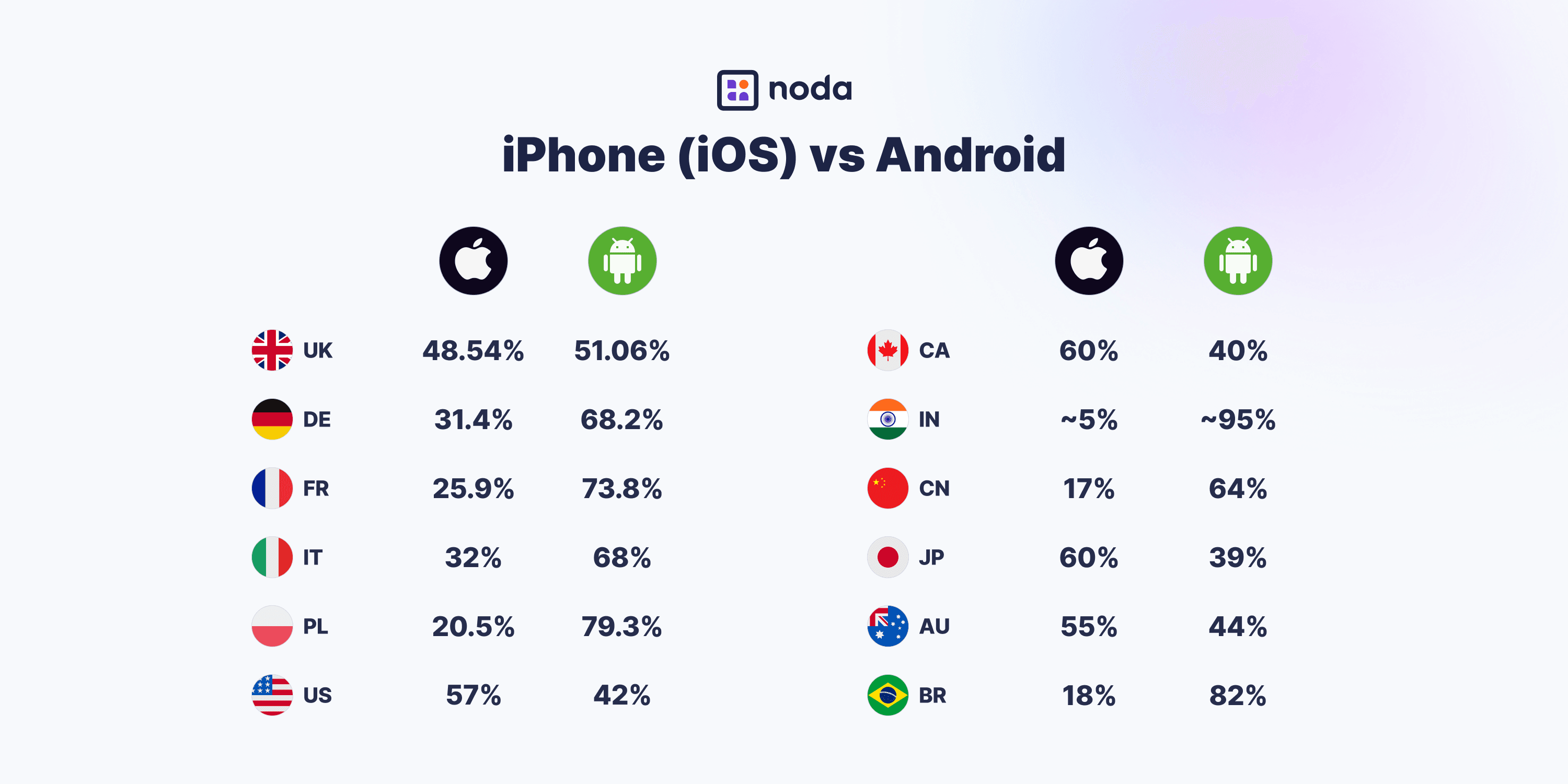

- Limited reach: Apple Pay only works on Apple devices. With Android making up over 70% of the global smartphone market, relying on it alone could mean losing potential customers. Here is the break-down in some of the biggest markets:

What Is PayPal & What Does It Offer?

PayPal is a widely used digital wallet and online payment service that works across all devices and platforms—not just Apple. It gives customers flexibility to pay with their PayPal balance, linked bank accounts, or cards, serving 429 million active users online. According to Statista, PayPal is especially popular in Germany, the UK, Switzerland, Austria, Finland, and Poland.

One benefit is that it’s not card-only—users can add funds or connect a bank. In some areas, PayPal also taps into open banking via Tink, though most payments still run through slower, traditional systems.

PayPal can be pricey—charging 2.9% + 30p for the domestic UK transactions, and more for international. Plus, customers need to log in or sign up to pay, which can slow down checkout and lead to more drop-offs.

Drawbacks of PayPal

- High fees: PayPal charges more than many other providers, especially for international payments.

- Slow payouts: Most PayPal payments still run on traditional card and bank rails. That means funds can take a few days to land in your account. For instant withdrawals, PayPal charges an extra fee.

- Friction at checkout: Customers have to log in—or sign up—to complete a payment. That extra step adds friction, slows down the checkout process, and can lead to more abandoned carts.

Apple Pay vs PayPal: Fees for Merchants

| Apple Pay | PayPal | Open banking | |

| Transaction fee | Merchants pay the standard credit/debit card processing fees depending on the payment provider. Typically, 1.5% to 3% plus a markup fee. | 2.9%+30p for domestic UK transactions, more for international. | Merchants only pay payment gateway fees, avoiding card network fees as transactions happen from account to account. Open banking fees are significantly lower than card-based transactions. |

In terms of Apple Pay fees, merchants don’t pay anything extra to accept the iPhone’s wallet—Apple itself doesn’t charge for it. But you’ll still pay the usual card processing fees to your payment provider, just like with any other card payment, including scheme fees and interchange charges, averaging to 1.5% to 3%, plus a markup fee.

In terms of PayPal fees, in the UK the wallet charges merchants 2.9%+30p of a domestic transaction. There’s no monthly fee for having a business account, but you will pay more for things like international transactions, currency conversion, or chargebacks.

Smarter Alternative to Digital Wallets: Pay-by-Bank (Open Banking)

Many digital wallets like Apple Pay and PayPal still use card networks behind the scenes. That means you’re stuck with high processing fees and delayed payouts.

A better option? Open banking, also known as pay-by-bank. It’s faster, cheaper, and doesn’t involve card providers at all—just a direct transfer from your customer’s bank to yours.

Here’s how it works:

- The customer selects pay-by-bank at checkout

- They choose their bank (for example, at Noda we offer 2,000+ banks in the UK and EU)

- They approve the payment in their banking app—usually with a fingerprint or Face ID

- The money arrives in your account instantly

It’s safe, regulated under PSD2, and uses secure APIs directly from the banks. In fact, open banking adoption is skyrocketing–in the UK, it’s used by over 14 million active users.

Why Pay-by-Bank Beats Digital Wallets

Tired of high fees, slow payouts, and chargebacks? Here’s why open banking (pay-by-bank) is a better way to get paid online:

- Lower costs: No card networks, no wallet providers, no hidden charges. You skip interchange and scheme fees entirely—more revenue stays with you.

- Faster payouts: Wallets still rely on cards, which means delays. With pay-by-bank, funds land in your account in seconds—not days.

- Stronger security: No card numbers, no sharing sensitive data. Customers approve the payment in their banking app using Face ID, fingerprint, or passcode.

- No chargebacks: Because the customer initiates and approves the payment, it can’t be reversed. That means fewer disputes and less admin.

- Mobile-native checkout: Open banking is built for mobile like a mobile wallet, but better. Customers pick their bank, confirm the payment, and they’re done. Fast, smooth, and friction-free.

- Everyone has a bank: Not everyone has PayPal or an iPhone—but no matter the device or operating system, your customers all bank somewhere. Pay-by-bank is more inclusive.

Add Pay-by-Bank to Your Checkout with Noda

Want a faster, cheaper alternative to Apple Pay and PayPal? As mentioned above, Noda’s open banking lets you connect to 2,000+ banks across 28 countries in Europe. Accept payments in multiple currencies and get your money instantly.

Pick the setup that fits your business: plug-and-play plugins for e-commerce platforms, instant QR codes and payment links, or full control with our Open Banking API.

Apple Pay vs PayPal: Key Difference

The key difference between Apple Pay and PayPal comes down to how they work and what they cost. Apple Pay is built into Apple devices and offers a fast, seamless mobile checkout—but it only works for iPhone users and runs predominantly on card networks, meaning you still pay standard card network fees.

PayPal works across all devices and lets customers pay using cards, bank accounts, or their PayPal balance—but merchants typically pay higher fees, around 2.9% + 30p per UK domestic transaction, with extra charges for things like currency conversion or international payments.

How to Choose Your Payment Methods

Don’t put all your eggs in one basket when it comes to Apple Pay or PayPal. Offering just one payment method can limit your sales and hurt the customer experience. A mix of options works best.

Take time to understand how your customers like to pay—it varies by age, region, and habits. Some prefer wallets, others trust bank payments or even crypto. Also, look at what your competitors are doing and what’s standard in your market.

Read: Popular Payment Methods by Country

Key Takeaways

- Use Apple Pay if most of your customers use iPhones and you want a fast, smooth checkout. Just know you’ll still pay card fees and might lose Android users.

- Use PayPal if you want to sell across devices. It’s widely trusted—but fees are higher, and checkout can be slower.

- Add open banking (pay-by-bank) if you want to cut costs, get paid instantly, and offer secure payments that work for everyone. It’s ideal for businesses with tight margins or lots of transactions.

- Use all three together to reach more customers, cover all devices, and give people the choice they expect at checkout. This way, you boost sales and build trust with your customers.

FAQs

Is Apple Pay the same as PayPal?

No. Apple Pay is a mobile wallet built into Apple devices, while PayPal is an online payment platform that works across all devices and browsers.

Is Apple Pay like PayPal?

They’re similar in that both let customers pay online and in stores, but they work differently. Apple Pay uses saved cards on your device; PayPal connects to your balance, bank account, or card through your PayPal account.

Is Apple Pay safer than PayPal?

To some extent, but PayPal is secure too. Apple Pay uses biometric authentication Face ID or Touch ID and never shares your card details, making it more secure than traditional logins.

Is Apple Pay secure like PayPal?

In terms of Apple Pay vs PayPal security, both digital wallets are secure, but Apple Pay has stronger privacy because it uses hardware-based security and doesn’t store your card info on servers.

Is Apple Pay better than PayPal?

It depends on your business. Apple Pay is ideal for fast mobile checkout on Apple devices. PayPal offers broader device compatibility, but higher fees. Open banking works across devices and offers significantly lower fees.

Does Apple Pay have lower merchant fees than PayPal?

Yes, usually. Apple Pay transactions go through your regular card processor, so you’ll pay standard card network fees, depending on your payment provider. PayPal fees are often higher—typically 2.9% + £0.30 in the UK for domestic transactions, and more for international ones.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know