Today’s consumers expect everything to happen in seconds, including how they pay. From streaming a film to buying groceries, customers want fast, seamless digital experiences. Payment is no exception. While individuals have embraced real-time payments via banking apps and wallets, businesses have often lagged behind. That is beginning to change as e-commerce companies recognise how instant payments can improve customer experience, reduce costs and increase liquidity. If you are an online merchant, this is the time to jump on the instant payments train.

In this article, we will guide you through the workings of instant payment processing, explain what it is, and why it matters.

What Is Instant Payment?

Instant payment transfers are bank transfers that are completed in real time, meaning the money is sent, received and available to the recipient within seconds. Unlike traditional transfers that can take hours or days, especially over weekends or public holidays, instant payments are processed twenty-four hours a day, seven days a week, including evenings and non-working days.

These payments do not rely on manual processing or traditional clearing cycles. Instead, they move through modern infrastructure designed specifically for speed and availability. Behind the scenes, a real-time clearing and settlement system ensures that funds are transferred securely and almost immediately from the payer’s bank account to the recipient’s.

How Does Instant Payment Work?

To send an instant payment, the customer typically approves the transfer through their banking app or an interface powered by open banking. Once authorised, the money leaves their account right away and is credited to the recipient’s account almost instantly. Both accounts must be held with banks that support the relevant instant payment service scheme, and both need to use standard identifiers like an IBAN (International Bank Account Number) or national equivalents.

Instant Payments Systems Around The World

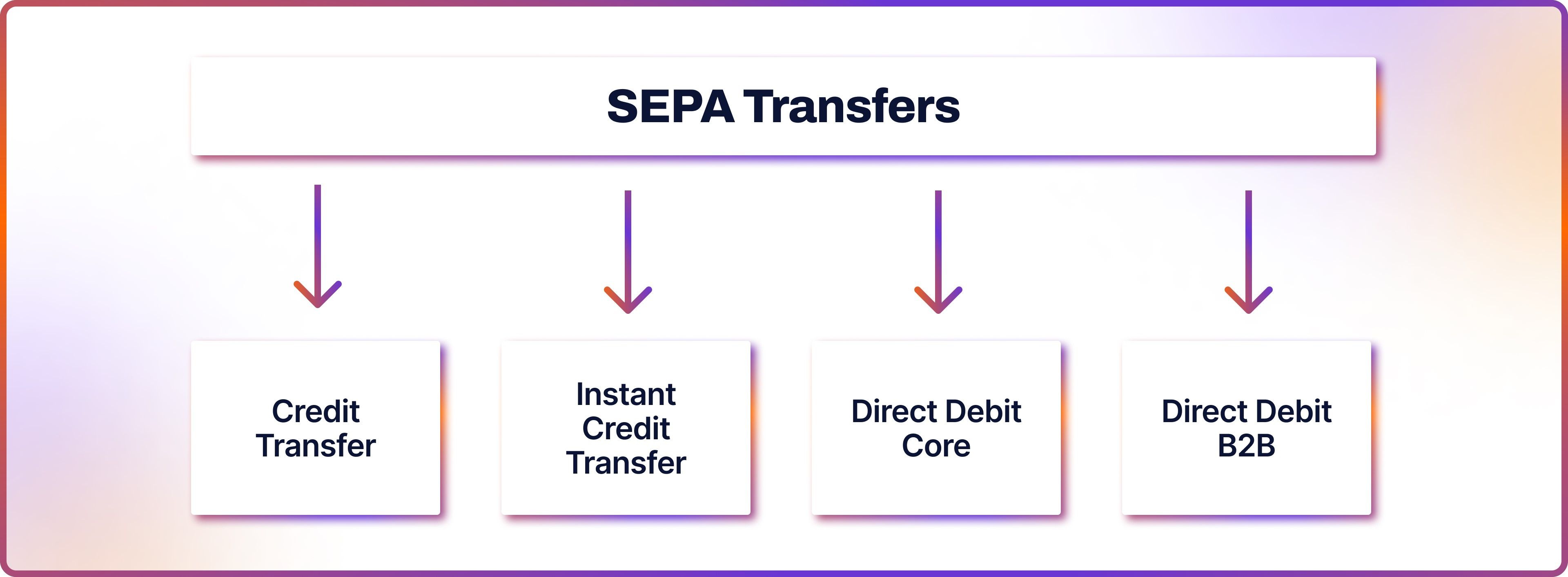

Around the world, many instant payment examples help customers shop and online merchants run their businesses. Instant payments are supported by different systems depending on the country and currency involved. In the eurozone, the SEPA Instant Credit Transfer system allows euro payments up to one hundred thousand euros to be completed in under ten seconds. Developed by the European Central Bank, instant payments are available in all Single Euro Payments Area (SEPA) countries. There are four main types of SEPA money transfers: Sepa Credit Transfer; SEPA Instant Credit Transfer; Sepa Direct Debit Core and SEPA Direct Debit B2B. Out of those, it’s the SEPA Instant Credit Transfer that supports real-time payments.

In the United Kingdom, the Faster Payments system enables fast and secure transfers in pounds sterling. Other countries have their own equivalents. Denmark uses Straksclearing for Danish krone, Romania has TransFonD, while Australia offers the New Payments Platform (NPP). In the United States, real-time payments are handled by the FedNow service and the RTP network, supporting instant settlement in US dollars for both businesses and consumers.

Despite differences in naming and technical details, the goal of these systems is the same: to make money move instantly between accounts, with full transparency, security and reliability.

Why Instant Payments Matter for Online Businesses?

For ecommerce merchants, instant payments allow you to receive customer payments immediately rather than waiting days. This not only improves cash flow but also reduces reliance on card networks or wallet platforms that may hold funds temporarily. Instant payments are also generally cheaper, more secure and less prone to chargebacks compared to card payments.

Whether your customers are in the UK, the EU or elsewhere, instant payment methods are becoming the new standard, and businesses that accept them can offer a faster, smoother checkout experience while also streamlining their own financial operations.

How Can Instant Payment Be Used By E-Commerce?

Instant payments are becoming increasingly relevant in the e-commerce industry as online retailers look for ways to improve speed, efficiency and customer experience. These payments allow funds to move directly from the buyer’s bank account to the merchant’s account in real time, without the delays often associated with traditional payment methods such as cards or manual transfers.

For e-commerce businesses, this means faster access to working capital. Instead of waiting several days for card settlements, merchants receive cleared funds almost immediately, which can be particularly valuable for managing inventory, fulfilling orders quickly and improving overall cash flow. This level of immediacy is especially beneficial during high-volume sales periods such as seasonal promotions or flash sales.

On the customer side, instant payments offer a smooth and secure checkout process. Many instant payment systems operate through open banking’s application programming interfaces (APIs), where the customer selects their bank during checkout and authorises the payment directly through their banking app. This process avoids the need to manually enter card numbers or sensitive information, reducing payment friction and minimising the risk of errors or fraud.

Another advantage for online retailers is the lower cost of instant payment transfers. Compared to card processing fees, real-time bank transfers are often significantly cheaper, especially for high-value or cross-border transactions. This can improve profit margins or be used to offer better prices or enhanced instant payment services to customers.

Merchants can arrange secure account-to-account billing with customer consent, commonly referred to as “Pay-by-Bank” allowing regular payments to be processed without the risk of card expiry or failed transactions. This approach increases reliability for both the business and the customer.

E-commerce businesses that operate internationally benefit from access to regional instant payment schemes. Whether it is Faster Payments in the United Kingdom, SEPA Instant in the eurozone, or FedNow in the United States, modern open banking platforms make it easier for merchants to connect with a wide range of banks and payment networks.

With the help of providers like Noda, which integrates with thousands of banks across 28+ countries in Europe, online merchants can offer instant payment transfers as a standard option during checkout. This not only improves conversion rates but also builds trust by offering customers a convenient and familiar way to pay.

In essence, instant payments allow e-commerce businesses to move faster, operate more efficiently and provide a better experience at every stage of the transaction.

What Are the Benefits of Instant Payments for Businesses?

Instant payments are transforming the way businesses handle their financial transactions, offering a speed and convenience that traditional payment methods cannot match. As customers and partners increasingly expect faster settlement times, adopting instant payment solutions becomes essential for businesses looking to stay competitive. By understanding the benefits and practicalities of instant payments, companies can improve cash flow, reduce costs, and build stronger relationships with suppliers and clients.

- Faster bill settlements mean outstanding invoices can be paid almost immediately, improving liquidity and enabling better financial management.

- Quick payments to business partners help strengthen relationships by fostering trust and potentially securing better terms.

- Transaction costs are generally lower than with traditional payment methods, even though transfers happen very quickly.

- Improved cash flow allows businesses to manage their finances more effectively and plan for future expenses with greater confidence.

- Businesses can spend less time monitoring transactions or chasing overdue payments, freeing staff to focus on core activities and growth.

Embracing instant transactions offers businesses a range of advantages that go beyond speed, including improved financial management and enhanced security features such as payment recalls in exceptional cases. While secure instant payments require careful attention to detail and appropriate systems, the benefits they bring to liquidity, operational efficiency and customer satisfaction make them a valuable tool for modern commerce. Businesses that integrate instant payments effectively are well placed to thrive in today’s fast-paced economic environment.

Consumer & Business Adoption

SEPA Instant payments have seen gradual adoption across the area. Despite the system being available since 2017, its uptake has been slower than anticipated. According to ECB, SEPA credit transfers amounted to 12% of the total retail payments value and 4% of the total value of credit transfers in the second half of 2022. Businesses too have yet to fully embrace instant payment options.

But what are the reasons why B2B businesses fail to adopt instant payment systems despite its obvious benefits? According to Ali Demirel, Christopher Kloß and Pim Stam from Projective Group, one of the key issues is the lack of interoperability in Europe.

“The ECB gave banks the option to choose which clearing and settlement mechanism (CSM) they wanted to use to connect to the instant payment network. The available options were the Worldline CSM (which only allows internal connectivity) and TIPS and EBA (parties that enable connectivity within Europe),” they explain.

This created a discrepancy because some banks are connected to all CSMs, while others are only linked to specific ones. As a result, a bank connected to Worldline might not be able to process payments with a bank that is only connected to EBA or TIPS.

Other constraints, according to the authors, include limited use cases and knowledge about their application. Few businesses have integrated instant payments into their processes, with digital invoicing for immediate receivables being a rare example.

Despite this, regulatory changes are set to change the landscape. Under the EU Instant Payments Regulation, euro‑area banks must be able to receive SEPA instant payments by 9 January 2025 and send them by 9 October 2025, laying the groundwork for far wider adoption.

The combination of regulatory deadlines and rising consumer demand suggests that instant credit transfers across Europe could expand their share within the next year, signalling a shift from niche to mainstream use.

How Can Businesses Set Up Instant Payments?

Businesses interested in offering secure instant payments as a payment method on their website or app should start by consulting their bank or payment service provider to explore the options available to them. Different providers may support various instant payment schemes depending on the region and currency, so understanding what fits best with the business’s needs is essential. It is also important to assess whether existing financial systems and accounting software are compatible with the instant payment infrastructure to ensure smooth integration and accurate reconciliation of transactions.

By carefully evaluating these options and working with trusted partners, businesses can successfully implement instant payments, improving cash flow, reducing payment delays and enhancing overall customer satisfaction.

Why Use Noda for Instant Payments

Noda is a leading open banking provider serving online businesses across twenty-eight countries in Europe, in the UK, and beyond. Our platform connects to over thirty thousand bank branches and supports a wide range of currencies, making us a global solution for real-time payments.

With Noda, merchants can offer direct bank payments at checkout, reducing card fees to as low as 0.1%, and improving conversion. We provide instant payment capabilities such as instant settlement directly to your bank account, alongside tools for customer verification, long-term value forecasting and user experience optimisation, no-code payment solutions like links and QR codes, and a personal manager to help with anything you may find necessary.

Our ecommerce plugins make it easy to integrate, whether you use a custom checkout, Magento, WooCommerce or other platforms. We are fully compliant with EU’s PSD2 regulation, FCA and other relevant regulations, so you can expand confidently across borders.

Final Thoughts

Instant payments are no longer a niche solution. They are rapidly becoming the default for both consumers and businesses who want faster, cheaper and safer ways to move money. Whether you are running a marketplace, a subscription service or a global ecommerce site, adopting instant payments through Noda can improve your customer journey and unlock new levels of financial efficiency.

Ready to get started? Book your demo with Noda today and bring instant payments to your checkout.

FAQs

What are the benefits of instant payments?

Instant business pay can improve cash flow by settling outstanding bills faster, enhance relationships with suppliers through quick payments, increase transparency in financial transactions, and reduce the administrative burden of processing payments.

What is the difference between instant payment and SEPA payment?

Instant payments are processed within seconds and are available 24/7. SEPA payments, part of the Single Euro Payments Area, typically take up to one business day unless specified as SEPA Instant Credit Transfers (SCT Inst).

Are bank to bank transfers instant?

Not all bank-to-bank transfers are instant. While traditional transfers can take one or more business days, instant transactions allow funds to be transferred and received within seconds, depending on the service used and the banks involved.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each