Payments are crucial, but what about payouts? Payouts involve transferring money in the opposite direction: from the merchant's account to the individual's account. Many businesses require this feature as well.

For instance, ride-sharing services need to compensate their drivers, insurance companies must disburse claims to policyholders, online marketplaces often send earnings to their sellers, and gaming publishers need to pay influencers.

Here we take a look at Noda’s payouts, how they work, integration options and key benefits of payouts for merchants.

Noda's Payout Capabilities

Noda’s Payouts meet the needs of businesses that require efficient and reliable payouts. It’s ideal for industries such as gaming, where frequent payouts are common. Noda offers two solutions:

- API-only Payouts: This option allows businesses to start payout processing with minimal effort. Application Programming Interfaces (APIs) are sets of defined rules that enable software to communicate with each other. They ensure quick and easy integration.

- Full Payout Module: Our second payout product enables the collection and storage of user data. It’s perfect for fast, repetitive payments.

We support instant Open Banking payouts and card payouts in EUR, GBP, and BRL.

Open banking emerged as an innovative payment method in Europe in 2018, when PSD2 enforced traditional banks to share consumer data with licensed fintech companies, like Noda. The data sharing is done securely, via APIs, and only with customers’ consent. This gave rise to account-to-account (A2A) payments, which remove card networks from the transaction flow.

At Noda, we also offer smart routing, which means we optimise which banking routes the funds travel via guaranteeing maximum speed and cost-efficiency. Our bank payouts offer free receipt of funds for individuals, unlike some card and wallet systems that may charge fees for the same service.

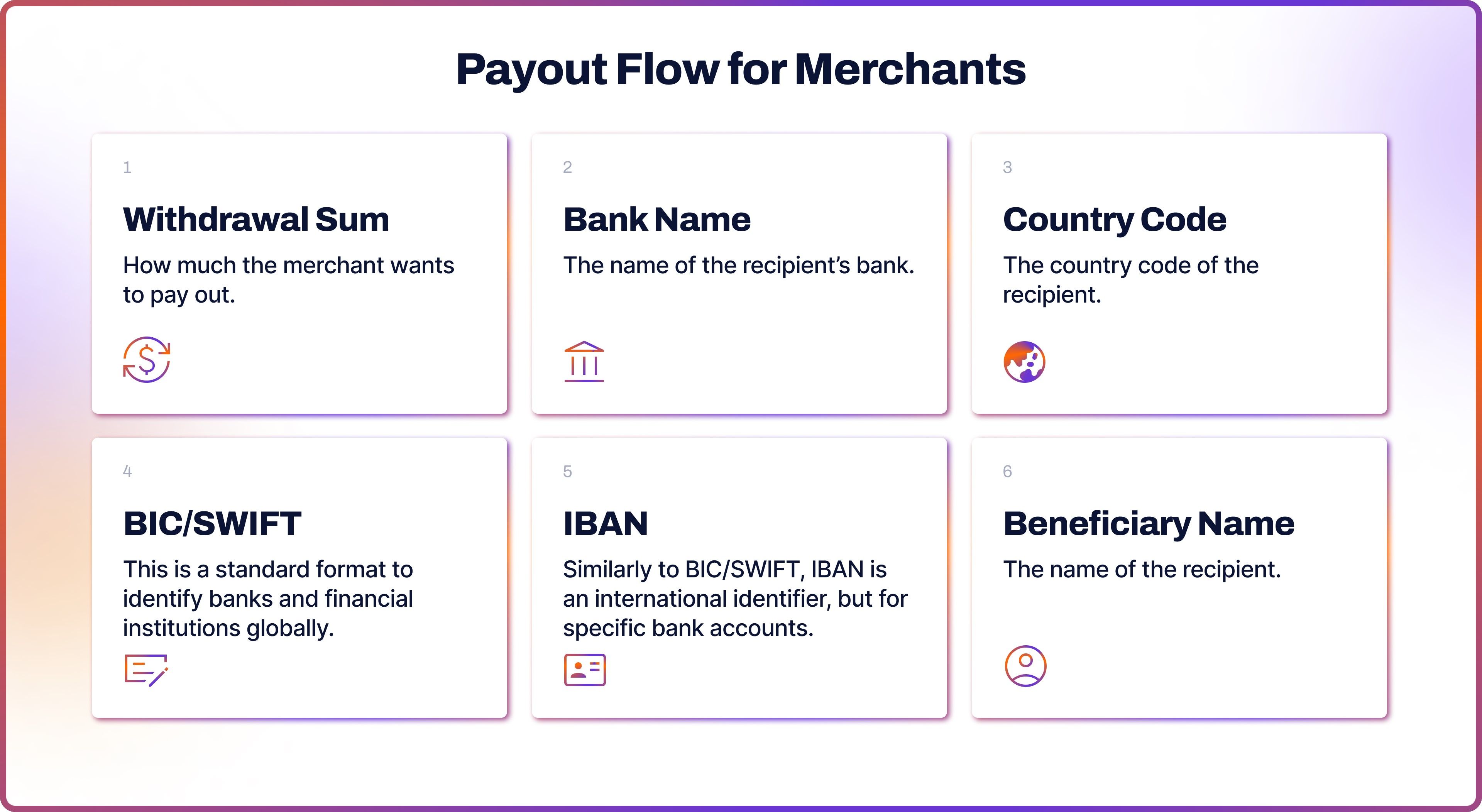

Payout Flow for Merchants

The payout flow for merchants couldn’t be easier. After choosing the instant bank transfer option, the merchant simply needs to fill in the following details:

After filling in these payment details, the merchant simply clicks the withdraw button, and vois la - the funds are being transferred. The merchant can then view the feed for all of their withdrawal history in one place.

Integration with Merchant Systems

The most common method of integrating instant payouts is via APIs. This would be direct or through a payment service provider (PSP), such as Noda. There are several types of A2A integration:

- Direct API integration offers a customisable payment and payout journey but demands more time and technical knowledge for implementation.

- Integration tools such as hosted payment pages (HPPs) or software development kits (SDKs) provide a smoother, easier integration experience for developers, though they offer slightly less customisation.

Some providers may also offer e-commerce plugins to integrate instant payments and payouts. For example, at Noda we offer plugin integration for WooCommerce, Magento, OpenCart, PrestaShop and soon BigCommerce. Merchants can implement them by installing the archive file from the admin panel, and then adding API keys available through Noda Hub.

Compliance and Security

Security and compliance are paramount, especially as cybersecurity risks are increasing with the digitalisation of payments. The MRC 2023 Global E-commerce Payments and Fraud report revealed that nearly half of the merchants surveyed (46%) considered cutting down on fraud as their primary goal.

As the industry evolves, so do the strategies used by cybercriminals. The most common types of fraud revealed in the report include phishing, pharming, whaling, chargeback fraud, card testing and identity theft. Therefore, having a reliable anti-fraud system and transaction monitoring system is crucial.

At Noda, we adhere to stringent security measures and compliance protocols to protect merchants and their customers. Our advanced fraud detection algorithms and verification processes ensure that all transactions are secure and compliant with regulatory standards.

Case Study: Wargaming

There is no more effective way to illustrate a feature than through a case study. In February 2023, we partnered with Wargaming to introduce instant open banking payments for their games.

The partnership with Noda enabled Wargaming's players to access a range of online payment options, including A2A payins and payouts facilitated by open banking.

“We believe Noda’s payment solution will enhance the player payment experience by simplifying the checkout process, allowing more time to enjoy gaming rather than dealing with complex payments flows,” said Sebastian Totté, Head of Gaming at Noda.

Key Benefits of Noda’s Payouts

- Speed: In today’s fast-paced world, customers expect rapid access to their funds once a withdrawal is initiated. Most of Noda’s payouts are processed within an average SLA of 1-2 hours.

- Reliability: Noda employs advanced algorithms and a two-layer verification process to detect and prevent fraudulent activities. This includes both non-document and full-document verification processes, ensuring compliance across jurisdictions.

- Global Reach: With support for multiple currencies (EUR, GBP, BRL) and instant payment options, Noda enables businesses to cater to a global audience.

Future of Payments & Payouts

The rapid adoption of instant transactions is expected to accelerate further. According to Statista, A2A payments are projected to account for 10% of all e-commerce transactions by 2026.

While Europe currently leads the adoption, the geographic scope is expected to expand to North America. McKinsey predicted that, by 2026, A2A could facilitate approximately $200 billion in consumer-to-business transactions in the US.

Simultaneously, other trends like recurring payments are also picking up pace. Juniper Research predicted the recurring payments market to reach $15.4 trillion by 2027, 17% higher from $13.2 trillion in 2023.

In particular, there are opportunities for non-sweeping variable payments, which are between a customer’s account and are based on the open banking infrastructure. Although they are less common, some banks are exploring the use cases. In 2022, NatWest collaborated with TPPs to offer VRPs as a new payment option for businesses and consumers.

The future of payouts and the payment industry overall will be heavily shaped by the upcoming regulation, specifically the PSD3 in Europe. PSD3 is an amendment to the existing PSD2 and is currently in the draft stage, expected to be finalised in 2024.

Payments & Open Banking with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each