The air travel sector has bounced back strong from the Covid-19 slowdown. By the end of 2023, commercial schedules have returned to normal in most regions. However, the payment challenges that emerged during the pandemic, especially the cost of chargebacks, should encourage airline companies to modernise their payment systems for future resilience.

In this article, we’ll explore the key benefits of open banking for airlines and how they can take advantage of this technology.

Open Banking 101

Open banking allows licensed third-party service providers to access consumer banking, transaction, and financial data. It relies on application programming interfaces (APIs). With customer consent, banks share information with licensed fintech companies through secure APIs.

The rise of open banking adoption is partly due to European regulations like PSD2, which in 2018 required all European banks to open their data and ensured that APIs are standardised and regulated. Using this data, fintech companies create innovative tools for payments, personalisation, and more.

Open Banking Payments for Airline Industry

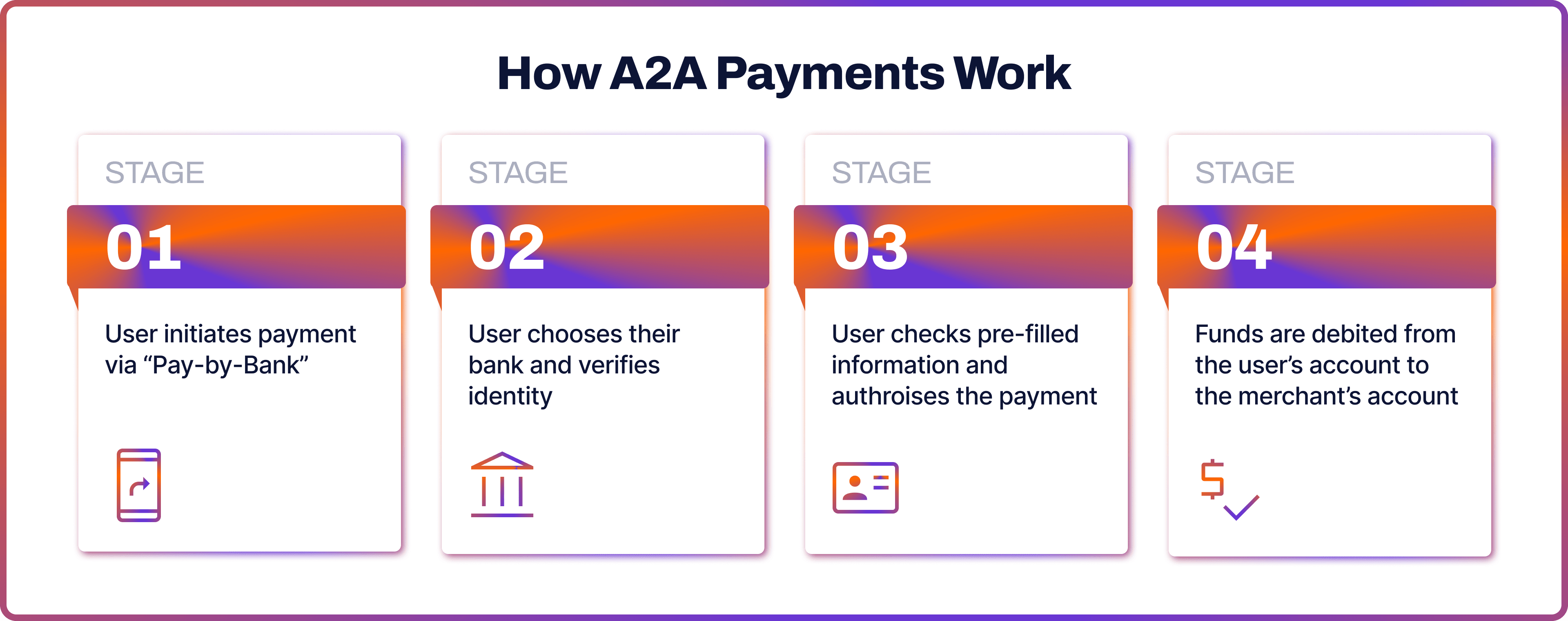

A key innovation in open banking is the pay-by-bank method, which allows account-to-account transactions that bypass traditional card networks. To enable these A2A payments under PSD2, open banking providers need a Payment Initiation Service Provider (PISP) license.

There are numerous benefits of open banking for airlines, especially as they operate in the highly competitive travel industry. To stay ahead, companies must be digital-first and provide a superior user experience. Meanwile, many travel businesses face payment challenges like high card fees, slow settlements, delayed refunds, and inconvenient payment processes.

Pay-by-bank offers solutions to these issues. With an open banking payment gateway on an airline website, customers can authorise payments directly through their bank interface, avoiding the need to enter lengthy payment information manually.

The open banking process guides users (as shown below) to their trusted banking interface and back to the airline’s site, This leads to improved UX, faster payments and cheaper costs for merchants.

Open Banking Data Tools for Airlines

Open banking platforms also introduced data tools that help companies better understand their users. For instance, airlines can use open banking data to analyse customer behavior and spending habits, allowing them to tailor campaigns and create personalised experiences.

Noda’s Know Your Whales (KYW) tool is an example of this, providing insights that help merchants refine their marketing strategies and identify high lifetime value (LTV) clients.

How to Integrate Open Banking Payments into Airlines

The easiest way of open banking integration for airline business is partnering with a provider like Noda. There are a few options to choose from:

- Direct Open Banking API Integration for Airlines: This offers a customisable payment journey but requires more time and technical expertise to implement.

- Integration Tools (HPPs or SDKs): Hosted payment pages (HPPs) and software development kits (SDKs) provide an easier payment integration for airline developers, though with slightly less customization.

The right method depends on the payment flow you want on your airline’s website and the resources you have. At Noda, we guide you through this process and help you find the best way to integrate open banking for your airline.

We also assign you an onboarding manager to assist with setup. With our experience across industries, we know what works best for different use cases and business models.

When discussing integration with your provider, consider these key points:

- Integration Template & Timeline: A good provider will guide you through the process and help establish a clear timeline.

- Objectives: The main goal of any payment process is to increase conversion rates. Your integration team should offer advice on designing a payment flow that enhances conversions.

- UX/UI Recommendations: Your provider can give tailored UX/UI advice to match your specific goals.

Benefits of Open Banking Integration for Airlines

- Superior UX: The pay-by-bank airline payment gateway streamlines the payment process by eliminating the need to manually enter card details, making the user experience smoother and faster.

- Instant Settlement: Open banking transactions settle in seconds, or at most, a few minutes, depending on the market. Refunds initiated by merchants are processed just as quickly.

- Enhanced Security: Open banking uses secure online banking credentials and biometrics for payment authorisation. Under PSD2, Secure Customer Authentication (SCA) is mandatory, reducing the risk of compromised card information.

- Lower Costs: Since open banking transactions bypass traditional card networks, there are no interchange or card scheme fees, resulting in lower costs for merchants.

- No Chargebacks: With no card networks involved, there’s no chargeback mechanism. Open banking payments are account-to-account, giving airlines and merchants greater control over disputes and potential charge reversals.

- Higher Conversions: Open banking removes friction from the payment process, leading to higher conversions and less shopping cart abandonment. According to a Hilton survey, 76% of global travelers prefer apps that reduce the stress of travel, including the payment experience.

Why Choose Noda for Open Banking

Noda is a licensed open banking provider that’s changing the way airline merchants process payments. With Noda’s Open Banking APIs, your customers can pay directly from their bank accounts—no card details needed. This speeds up checkout, eliminates chargebacks, and reduces cart abandonment.

We partner with 2,000 banks across 28 countries, and support multiple currencies, making it easy for global merchants to succeed.

By partnering with Noda, you avoid costly card processing fees and keep more of your revenue. Our Open Banking API integrates seamlessly, providing your customers with a secure, fast, and straightforward payment experience.

Ready to simplify payments and increase profits? Discover how Noda can transform your business today.

FAQs

What are the main advantages of open banking for airline industry?

Open banking payment gateway for airlines offers several key benefits for airlines. It lowers transaction fees by bypassing traditional card networks. It also eliminates chargebacks, giving airlines more control over payments. With instant settlements, payments process much faster, improving cash flow. Plus, open banking provides a smoother, more secure user experience, leading to higher customer satisfaction and fewer abandoned bookings.

How do I start integration with Noda?

First, you’ll need to get onboarded with Noda. Just fill out the form, and our sales team will reach out to you soon. We provide easy onboarding with personalised guidance from a dedicated manager. Our system integrates smoothly with both API and front-end components, ensuring a seamless fit with your airline’s interface.

How can airlines integrate Open Banking into their payment systems?

Airlines can integrate Open Banking through direct API integration for full customization or by using integration tools like hosted payment pages (HPPs) or software development kits (SDKs) for a simpler process.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each