The payment method you offer can make or break a sale. If you’re using WooCommerce or PrestaShop, you’ve likely faced the same challenge: finding a payment setup that’s secure, affordable, and doesn’t push customers away at checkout.

In this guide, we’ll compare the most common WooCommerce vs PrestaShop payment options—and show you why open banking could be the smarter choice for your e-commerce store.

WooCommerce versus PrestaShop: Quick Overview

Let’s first compare WooCommerce and PrestaShop e-commerce platforms, before moving on to their payment features.

| PrestaShop | WooCommerce | |

| Platform type | Standalone e-commerce platform | WordPress plugin |

| Open source | Yes | Yes |

| Regions | 244 countries & regions, but particularly popular in France, Spain, Poland, Italy | 160+ countries, particularly popular in the US, the UK, India |

| Global market share | 1.6% | 29% |

| Total websites | 662,573 | 15,335,839 |

| Templates | 2,500+ | 28+ |

| Modules or add-ons | 4,000+ | 638+ |

| Languages | Back office 75+ | Extensions required |

| Default payment options |

|

|

What Is PrestaShop?

PrestaShop is an open-source e-commerce platform. It’s highly customisable, with thousands of modules and templates you can use to shape your e-commerce website, supporting over 75 languages for merchants that want to sell worldwide.

PrestaShop is built to support businesses and customers almost anywhere in the world. It comes with a built-in list of 244 countries and regions. Merchants can turn countries on or off depending on where they operate.

PrestaShop is particularly popular with e-commerce businesses selling fashion, shoes, make-up, bags, and computers, groceries and food, and jewellery.

Even though PrestaShop offers global coverage, it’s especially popular in the US and Europe, with the biggest number of users in:

- The US currently has the highest number of PrestaShop websites – 39,000, according to BuiltWith.

- France, where it started. Around 12% of online stores there use it. France holds 34,000 PrestaShop websites.

- Spain, where about 14% of the e-commerce market runs on PrestaShop, amounting to 21,000.

- Poland, where it powers roughly 8–12% of online stores, which is 14,500.

- Italy, with around 7% market share, amounting to 14,000 e-commerce websites.

It’s also used in the US, Germany, Romania, the Czech Republic, and other countries though it’s less dominant in those countries compared to platforms like Shopify or WooCommerce.

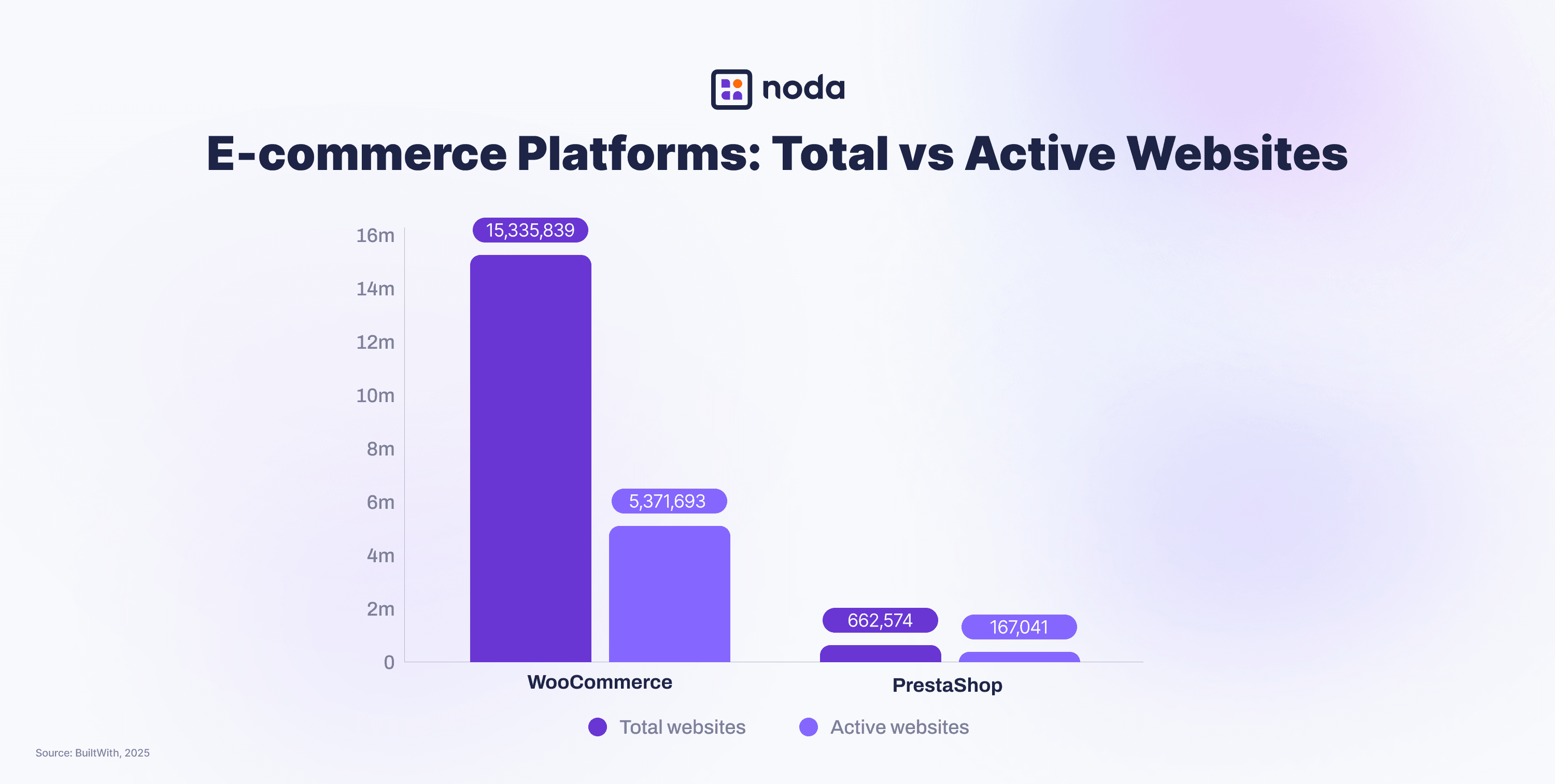

Compared to the e-commerce giant WooCommerce, PrestaShop is a relatively small platform. Currently, there are 662,573 websites of which 187,000 are active. This is compared to 15,335,839 websites using WooCommerce, 5,371,693 of which are active.

What Is WooCommerce?

WooCommerce, on the other hand, is an open-source plugin that turns a WordPress site into an online store. It’s an absolute e-commerce giant, with a market share of 29% and 5,371, 693 e-commerce websites using its plugin.

WooCommerce is flexible and customisable, but you’ll need extra plugins to add more advanced shop features. It’s a great fit for small to mid-sized businesses, especially those already using or looking to use WordPress to build their website.

Like with PrestaShop, WooCommerce store owners can choose to sell worldwide, to specific countries, or block certain regions if needed. It supports different shipping, tax, and payment setups, and with plugins, you can add detailed support for over 160 countries.

Even though the platform serves clients internationally, WooCommerce is particularly popular with the following countries:

- The US is by far the biggest WooCommerce market, with over 2.1 million WooCommerce stores.

- The UK is the second largest, with around 200,000 shops.

- India has strong usage, with about 160,000 stores.

- Germany is also a leading market, with roughly 156,000 stores.

- France has around 151,000 stores.

The platform is also popular in Brazil, Italy, Netherlands, Spain, Australia, and many more other countries.

PrestaShop vs WooCommerce for Payments

| PrestaShop | WooCommerce | |

| Cards | Default | Default |

| Open banking | Via Noda’s Open Banking plugin | Via Noda’s Open Banking plugin |

| Digital wallets | Default | Default |

| Bank transfer | Default | Default |

| Cash-on-delivery | Default | Default |

| Cheques | Default | Default |

| Buy-Now-Pay-Later | Via plugin | Default |

In terms of PrestaShop payment options, the default offering is bank transfers, cheques, cash on delivery and their native solution PrestaShop Checkout, powered by PayPal, offering cards and digital wallets.

When you install WooCommerce to your Wordpress website, it comes with a few built-in default payment options like bank transfer, cheque, cash on delivery, and WooPayments, which includes cards, digital wallets, buy now pay later (BNLP), and local payment methods.

The key difference between PrestaShop and WooCommerce payment options is that WooCommerce offers BNPL by default, but in PrestaShop this option is only available via a plugin.

Does PrestaShop and WooCommerce Support Open Banking?

PrestaShop and WooCommerce do not offer open banking (pay-by-bank) as a default payment option. To start accepting open banking payments on the two e-commerce platforms, you’ll need to install a separate plugin—like Noda’s open banking plugin for popular e-commerce platforms. These tools aren’t built in by default, so you’ll have to add them separately.

PrestaShop vs WooCommerce: Payment Drawbacks

PrestaShop and WooCommerce offer lots of payment options via configurations and modules but it’s up to the merchant to pick and set them up. That’s where many run into common challenges.

- High fees and slow payouts

Neither WooCommerce nor PrestaShop are payment providers—they’re e-commerce platforms. To offer card payments and digital wallets, they partner with companies like PayPal and Stripe, and recommend them as their default options.

But both predominantly run or card networks. For merchants, this means dealing with slow payouts and card processing fees, which can quickly cut into profits—especially for low-margin or high-volume sales.

While both platforms offer direct bank transfers as an option, these are manual, require effort from customers, and often take a long time to process.

- Chargebacks and fraud risk

For the same reason, both platforms can face issues with fraud and chargebacks. This means merchants may lose money and spend extra time handling disputes and paperwork.

- Complex or time-consuming integration

Merchants often struggle with a large number of API versions. Integration for additional payment methods can be time-consuming and may require technical expertise. Setting up and maintaining payment modules can be complex.

Smarter Payment Option for E-Commerce: Open Banking

Most online payments—including digital wallets—still run on card networks. That means higher fees for merchants, the risk of chargebacks, and delays in getting paid. Manual bank transfers are an option, but they’re often slow and inconvenient for both the customers and merchants. BNPL can also come with steep costs.

A smarter solution is open banking, or pay-by-bank. It cuts out card networks completely, making payments faster and cheaper. Funds go directly from the customer’s bank account to yours—no card schemes or wallet providers involved.

Here’s how it works:

- The customer chooses pay-by-bank at checkout

- They pick their bank from a list (Noda supports 2,000+ banks in 28 European countries)

They’re sent to their bank’s app or website to approve the payment—usually with Face ID or fingerprint

The payment arrives instantly in your account

These payments are regulated by Europe’s PSD2 and use secure APIs provided by the banks themselves. Only licensed providers can access them.

Open Banking Plugins for PrestaShop & WooCommerce

Boost your checkout experience with Noda’s open banking e-commerce plugins—built for PrestaShop, WooCommerce, and other popular e-commerce platforms.

You can connect to over 2,000 banks across 28 countries in Europe, accept payments in multiple currencies, eliminate card network fees, and get your money instantly.

How It Works

Adding Noda to your store is quick and code-free:

Step 1: Upload the plugin file to your platform’s admin panel.

Step 2: Enter your API keys from Noda Hub after onboarding.

Step 3: You’re live—Noda’s pay-by-bank button is now a payment option in your store.

No developers needed. Just a few clicks, and you’re ready to start accepting instant, cost-efficient bank payments.

Why You Should Add Pay-by-Bank to E-Commerce Checkout

- Lower costs: Pay-by-bank cuts out card networks, removing interchange and scheme fees. That means more margin on every sale—especially valuable for high-volume or low-margin e-commerce businesses.

- Instant payouts: No more waiting days for funds to clear. With open banking, payments are settled instantly, improving your cash flow and giving you faster access to revenue.

- No chargebacks: Because customers authorise payments directly through their bank, there’s no way to reverse the transaction like with cards. That means fewer disputes, less admin, and reduced fraud risk.

- Better UX: The checkout UX is everything for e-commerce businesses. Poor UX can lead to cart abandonment and lost revenues. Open banking flow is simple and fast—customers pick their bank, approve in their banking app, and they’re done. No need to enter card details, remember passwords, or get redirected through multiple steps.

- Works across devices: Pay-by-bank is built for web and mobile. It works on any device with online banking—mobile, tablet, or desktop—making it a universal option for all your customers.

Best Payment Options for PrestaShop & WooCommerce

When looking at payment options of PrestaShop and WooCommerce, don’t get stuck on just one method. Using a mix of payment options is often the best way to increase sales and cut down shopping cart abandonment.

Think about how your customers like to pay. Their age, country, and shopping habits all play a role. Some prefer digital wallets, others trust pay-by-bank or even crypto.

See what your competitors use and what’s standard in your market. That’s a good guide for what your customers might expect.

FAQs

Is WooCommerce a payment gateway?

No, WooCommerce isn’t a payment gateway—it’s a plugin that helps turn a WordPress site into an online store. However, it does offer a range of default payment options such as checks, cards, cash on delivery, and some digital wallets. Yet for a more extensive coverage you’d need to configure more features, such as Noda’s open banking plugin.

How long do WooCommerce payments take?

That depends on the payment option your customers choose at checkout. For example, card payments usually settle in 1–3 business days. Open banking payments, on the other hand, are almost instant.

Is PrestaShop better than WooCommerce?

It depends on your needs. PrestaShop is a standalone e-commerce platform popular in Europe and is much smaller, while WooCommerce is popular in the US, UK and around the world, and is a giant e-commerce platform. WooCommerce may offer more complexity, yet it only works with Wordpress websites. If you’re planning to build your store on Wordpress – then WooCommerce would be a better option. This is a key point in any PrestaShop vs WooCommerce comparison.

Is PrestaShop similar to WordPress?

Not really. PrestaShop is a standalone e-commerce platform, while WordPress is a content management system. WooCommerce works as a plugin within WordPress.

Does WooCommerce hold payments?

WooCommerce itself doesn’t hold payments—it’s your connected payment provider that processes and settles them.

How long do PrestaShop payments take?

Like WooCommerce, PrestaShop doesn’t process payments directly. Timing depends on the payment methods your customers choose. For example, card payments usually settle in 1–3 business days. Open banking payments, on the other hand, are almost instant.

Is WooCommerce Payments secure?

Yes, WooCommerce supports secure gateways that offer encryption and fraud protection.

Is PrestaShop Payments secure?

Yes, as long as you’re using a reputable payment provider and keeping your software up to date.

What is WooCommerce primarily used for?

WooCommerce is used to create online shops within WordPress. When you compare WooCommerce and PrestaShop, WooCommerce stands out for content-rich sites that want to add e-commerce.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each