Klarna is making a big move by withdrawing Sofort as a standalone payment method. If you're a merchant relying on Sofort for bank-to-bank transfers, it's time to prepare for changes.

In this article, we’ll explore why Klarna is making this shift, what it means for your business, and how you can smoothly transition to new payment solutions.

Why Is Klarna Stopping Sofort?

Klarna is discontinuing Sofort, a European pay-by-bank payment service, as a standalone payment method. The Swedish buy-now-pay-later (BNLP) provider acquired Sofort in 2014, and since then it has expanded the service into dozens of markets and started powering additional in-house services via open banking.

Yet after 30 September 2024, merchants using Sofort for European pay-by-bank transfers will need to switch to an alternative payment method for their customers. From 1 October 2024, Sofort will be fully discontinued across all integrations.

Klarna is merging Sofort’s business into the main Klarna corporate brand. This means that Sofort’s pay-by-bank payment method will be integrated into Klarna Payments. By doing so, the provider aims to simplify the processes for merchants.

What Should Merchants Do?

Preparation is everything. Even though there is still time until October 2024, merchants that use Sofort payments should take some steps to prevent any disruptions for their customers.

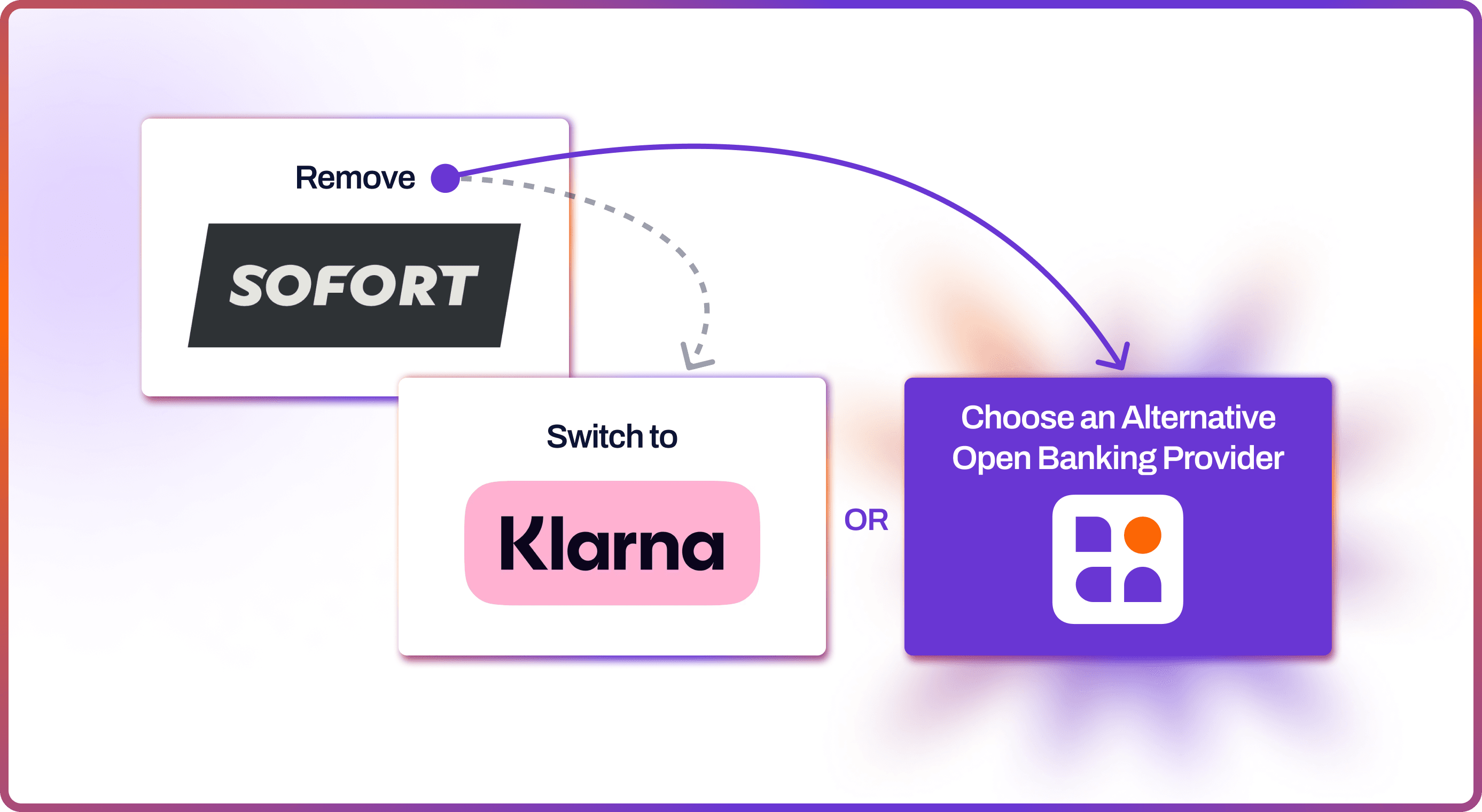

Removing Sofort

Firstly, merchants need to update their checkout process to remove Sofort. This involves removing it from the front end or any other components, as well as updating support and integration documentation.

Switching to Klarna Payments

Sofort merchants can decide to switch to Klarna’s ecosystem. The bank-to-bank transfer payment option will be integrated into Klarna Payments. In this case, Klarna will be assisting them to transition to a new product smoothly.

Finding an Alternative

Finding alternative payment methods to replace Sofort – not necessarily plugging into Klarna’s ecosystem - is an option too. Although it can be frustrating to change payment providers, there is always a silver lining. You can use this opportunity to re-evaluate and enhance your payment system.

Why Consider Other Alternatives to Sofort

As noted earlier, if you’re planning a new integration, you might want to consider alternatives to Klarna. Here are a few reasons why.

- Cutting Costs

Payment giants like Klarna act as intermediaries to access open banking payment technology. Meanwhile, there are providers, such as Noda, that offer direct access to bank-to-bank payments in Germany and other regions. This reduces middlemen and lowers costs for merchants.

- Geographical Coverage

As Klarna integrates Sofort into its corporate brand, it's important to verify Klarna's geographical coverage and ensure it aligns with your target clientele. For example, Klarna’s Payment Methods don’t cover all of the European countries. At Noda, we connect to banks in the UK, EU, and Canada and we are now expanding to Brazil.

- Additional Features

While Klarna offers a comprehensive payments and marketing suite, it does not include features like payouts, which are crucial for certain businesses, for example, gaming and marketplaces. Plus, Klarna does not offer open banking data features like verification and Know Your Customer (KYC) products. If your business needs these solutions, it's more efficient to integrate payments, payouts and data products from the same provider. For example, at Noda, we offer seamless payouts as well as Know Your Whales, a user insights tool based on open banking.

- Restricted Industries

Since Klarna is a BNPL provider, which essentially involves providing a loan, it’s not suitable for certain types of businesses. Klarna has a comprehensive list of prohibited industries, including age-restricted products (e-cigarettes, tobacco, alcohol), gaming and gambling businesses (including in-game purchases), certain financial and legal services, and travel, tour, and event companies. Be sure to check if Klarna is a suitable option for your business.

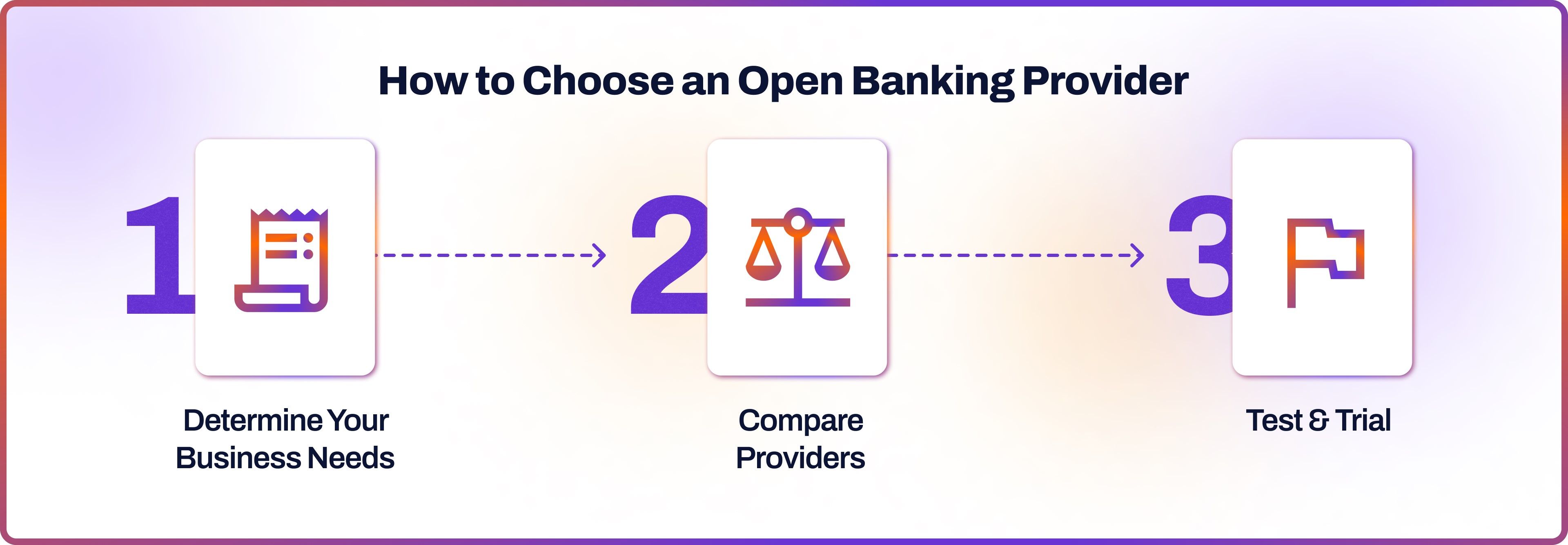

How to Choose an Open Banking Provider

If you choose to explore alternatives to Klarna, here are the essential steps to follow.

Determine Your Business Needs

First, establish your overall payment strategy. Consider your business model and what additional payment features you’d need, for example, subscription payments, BNLP, or open banking data solutions.

Compare Providers

Next, make a list of potential payment partners. Compare their fees and products, and don’t forget about the reviews from their previous clients. It’s always a green flag when a provider has a proven track record of companies in your industry.

Another factor you may want to look out for is security and compliance. A secure payment provider would adhere to regulations and industry standards such as PCI DSS, PSD2, GDPR, and any other local regulations. Furthermore, a reliable provider would implement security measures such as encryption and anti-fraud transaction monitoring.

Test & Trial

Consider testing the pay-by-bank solution first. A demo or trial period can help you assess the platform’s functionality, ease of use, and reliability. Focus on the UX, transaction speed, and any issues that arise during the trial.

Pay-by-Bank with Noda

Noda is a global payment and open banking provider, ideal for instant business transactions. We operate in the UK, EU, and Canada, and are expanding into Brazil. Our services support a wide range of currencies, catering to globally-minded clients. We partner with 2,000 banks across 28 countries, covering over 30,000 bank branches.

Noda's advanced Open Banking API allows online businesses to easily integrate pay-by-bank transactions. In addition to payments, Noda helps merchants with know-your-customers (KYC), lifetime value (LTV) forecasting, and user experience (UX) optimisation.

Noda’s other products and features include card payments with smart AI routing and acceptance recovery; intuitive UX and UI customisation for seamless checkout; bank and card payouts; sign-in via bank; know-your-whales user insights feature; and a range of plugins for easy integration with popular e-commerce platforms.

FAQs

Why is Klarna discontinuing Sofort as a standalone payment method?

Klarna is phasing out Sofort to integrate its functionality into the broader Klarna Payments system. This move aims to streamline processes and offer a unified payment experience under the Klarna brand.

When will Sofort be fully discontinued?

Sofort will be fully discontinued across all integrations from October 1, 2024. Merchants using Sofort will need to switch to an alternative payment method by September 30, 2024.

What other pay-by-bank Sofort alternatives are available besides Klarna?

Merchants can consider other payment providers such as Noda, which offers direct access to bank-to-bank payments in Germany and other regions, reducing costs by avoiding intermediaries.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each