Improve Your Online Sales with Noda

The way we pay for things has evolved significantly over time. From bartering goods to using shells and coins, the payment methods we use have continuously improved. Paper money first appeared in China in the 10th century, eventually bringing about the development of modern banking with checks and credit cards in the 20th century.

Today, customers benefit from numerous ways to pay online: from open banking and digital wallets to mobile payments, offering greater convenience and security. But what are the best online payment methods for e-commerce merchants?

Importance of Payment Methods for Merchants

Choosing efficient online shopping payment methods is crucial for merchants to reduce cart abandonment rates. Just like being ghosted in dating, merchants can experience cart abandonment, which is a common issue in e-commerce.

According to Baymard Institute research, about 70.19% of online shopping carts are left incomplete. In simple terms, for every 10 customers who add items to their shopping cart, seven leave without making a purchase. Research indicates that this results in approximately $260bn worth of potential orders being lost.

This highlights the importance of having convenient and preferred payment methods to encourage customers to complete their purchases. Some of the lost revenues can be avoided by offering a wide list of payment options for online shoppers.

How to Choose the Best Payment Method

Firstly, it is essential to understand your customers' preferences. Consider their age, location, and profession, and conduct thorough research. Shopping habits differ across various demographics, so knowing your audience is crucial.

For example, digital wallets are particularly popular in Asia, whereas open banking payments are gaining momentum in Europe. Younger customers often favour alternative retail payment methods such as Buy Now Pay Later (BNPL) and cryptocurrencies.

Integration capabilities are crucial. Partnering with a reliable payment service provider, such as Noda, is advisable. They can offer a variety of payment options for online orders through a single integration.

Top Five Payment Methods for Selling Online

Digital Wallets

Digital wallets are now the most popular e-commerce payment method globally. These apps can store various payment cards in one interface, allowing users to make payments without manually entering their details. Mobile wallets, like Apple Pay and Google Pay, are a type of digital wallet designed specifically for use on smartphones and tablets.

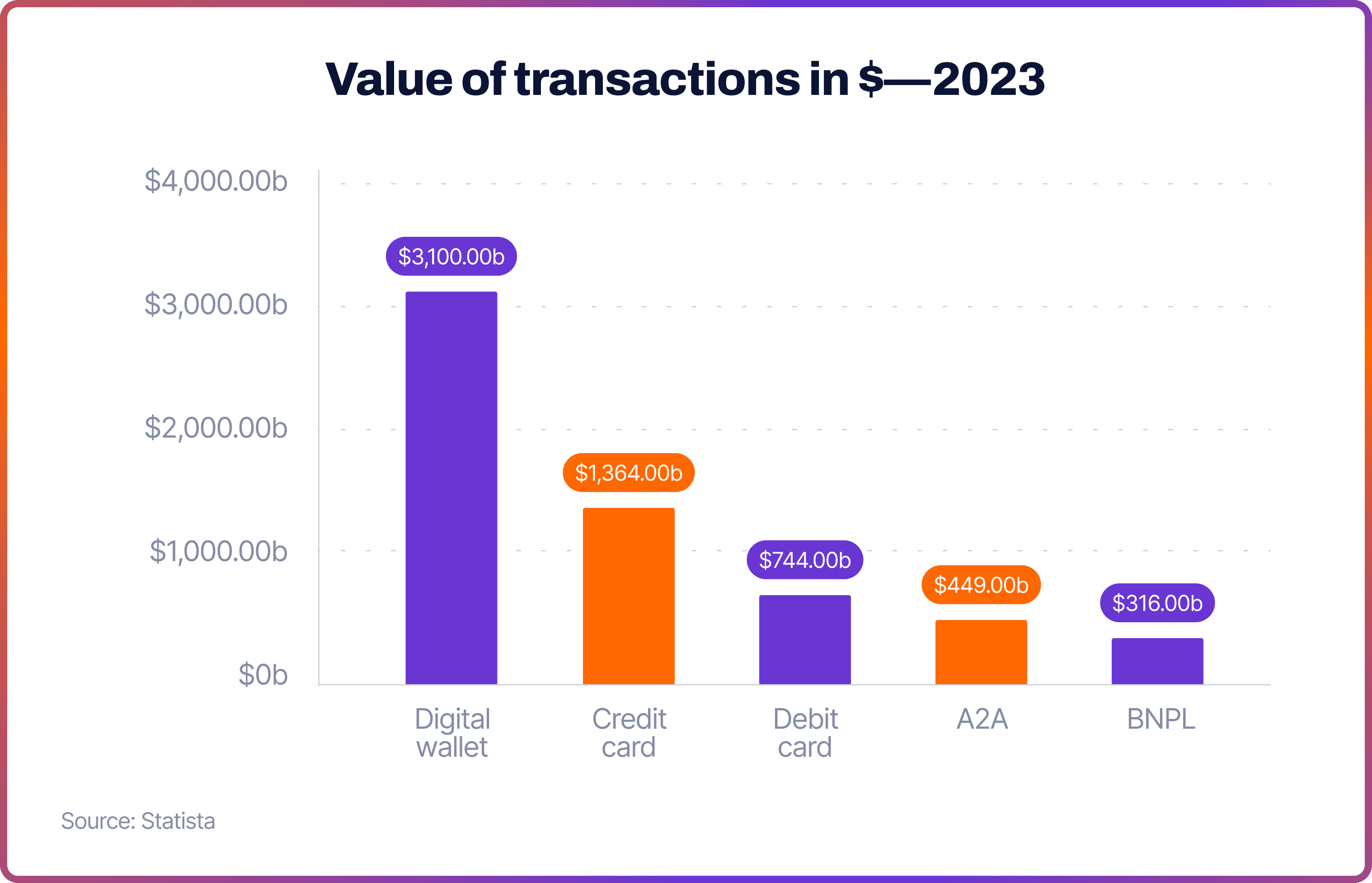

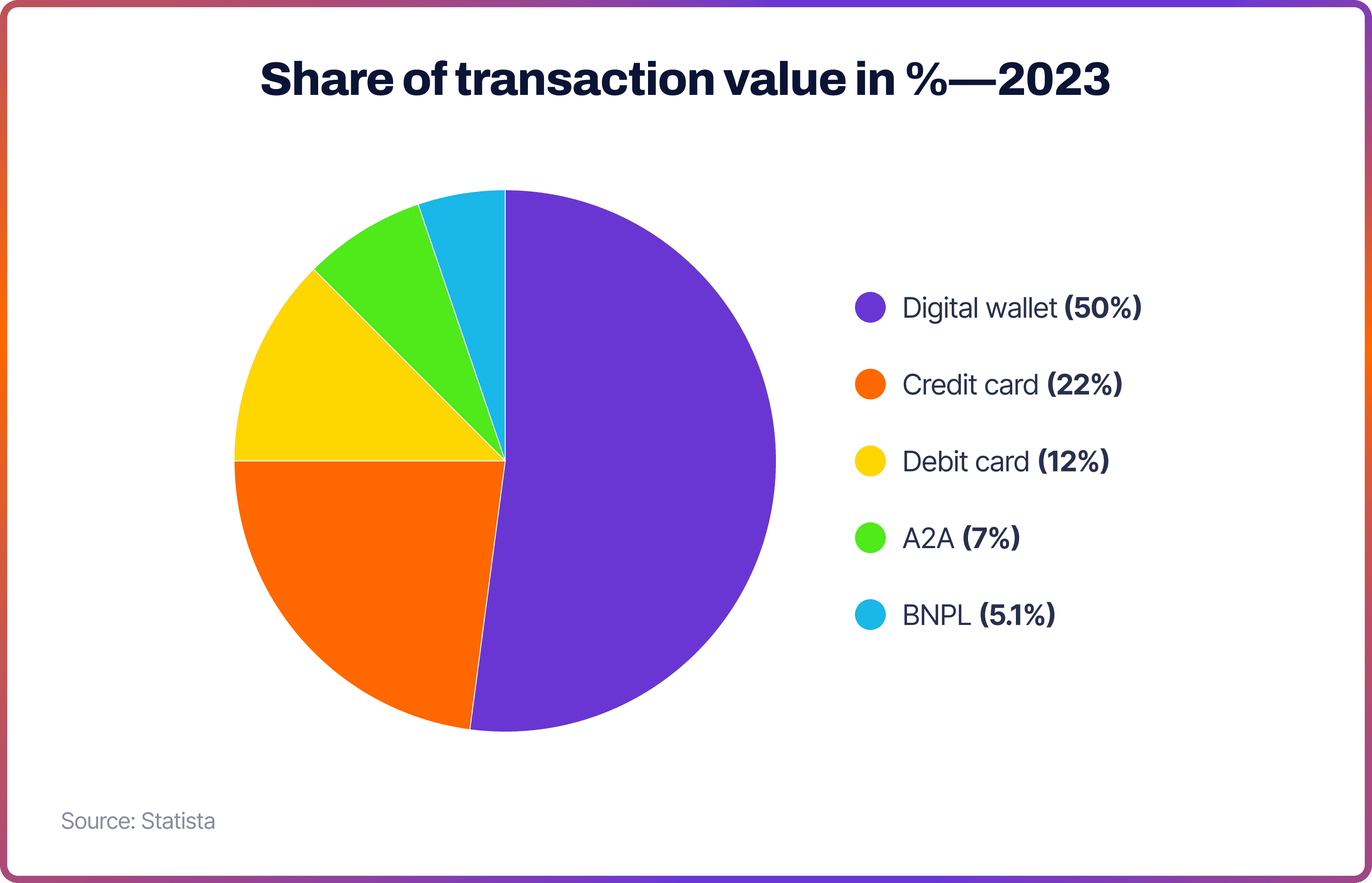

Digital wallet usage surged after the global pandemic. According to Merchant Machine, from 2015 to 2020, the number of users increased nearly five-fold, rising from 0.4 billion to 2.3 billion. Today, they amount to 50% of all e-commerce transactions in the US. Statista projects this number to grow to 61% by 2027.

Digital wallets are extremely popular in Asia, with China leading the trend. Alipay and Tenpay are the top digital wallets in China, established well before the introduction of Apple Pay and Google Pay.

Credit & Debit Cards

Card payments involve cashless transactions using either a credit or debit card. Card payments began to gain popularity in the 1970s and have since become widely used around the world. Today, major card networks such as Visa and Mastercard have hundreds of millions of cards issued by numerous banks.

Cards are the second most popular online payment method globally, amounting to 22% and 12% of e-commerce transactions in the US respectively. Yet Statista projected this number to fall to 15% and 8% by 2027.

Card payment processing involves multiple steps through card networks. At checkout, payment information is sent to a payment gateway, which encrypts and transmits it to a payment processor. The processor verifies the details and forwards them to the acquiring bank, which sends the information to a card network like Visa or Mastercard.

The card network contacts the issuing bank to check the user's account and approves or declines the transaction. Approved payments are then processed and settled by the payment processor at the end of the day.

Open Banking Payments

Pay-by-bank, also called account-to-account (A2A) or open banking transaction, enables customers to make online payments directly from their bank accounts. This method bypasses card intermediaries. Customers authorise payments using their online banking credentials.

Learn More About Open Banking with Noda

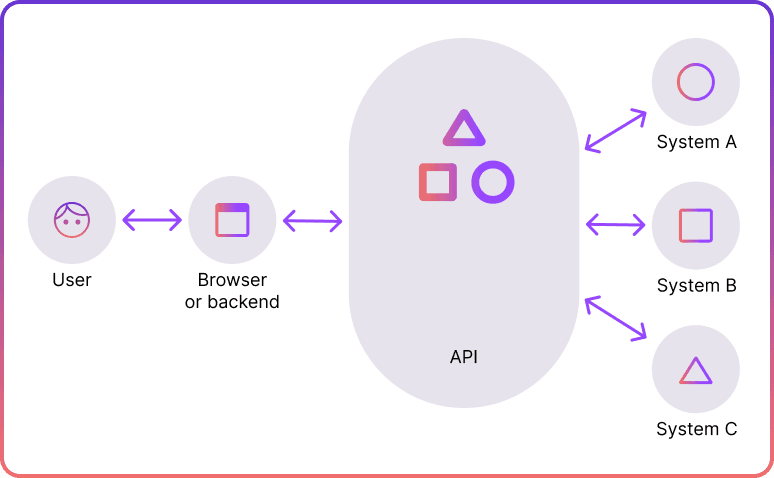

In 2018, the EU's PSD2 regulation took effect, requiring banks to share customer data with authorised fintech companies via application programming interfaces (APIs). These APIs serve as connectors, enabling secure communication between different systems. Open banking has improved the speed, cost-efficiency, and security of A2A.

BNLP

Buy Now, Pay Later (BNPL) is a payment option that allows consumers to purchase products immediately and pay for them later. This method enables them to get the products or services without making the full payment upfront. BNPL services generally offer three payment plans:

- Pay Later: Pay the full amount in 30 days.

- Pay in Installments: Divide the payment into three or four equal, interest-free parts.

- Extended Financing: Spread the cost over up to 36 months for larger purchases, with interest possibly being charged.

According to Statista, global BNPL usage in e-commerce transactions grew from 0.4% in 2016 to 5% in 2023, with Sweden, Germany, and Norway leading the market. In the UK, a 2023 Money Pensions Service report indicated that about 10.1 million people used BNPL in the past year, with a growing trend of using it for everyday essentials.

This could be driven by high inflation and the cost of living crisis, driving customers away from the traditional card due to high interest rates, and opening up opportunities to BNLP.

Recurring Payments

Recurring payments can be a useful solution if you’re running a subscription-based business model. These are charged at regular intervals and continue until the service is cancelled or fully paid. Direct debits are the most common form of recurring payments.

Juniper Research estimates that recurring transactions will reach $13.2tn in 2023. They predict the market will grow by 17% to $15.4tn by 2027. This payment method is increasingly popular for streaming services, software-as-a-service (SaaS), and digital media.

Online Payments & Open Banking with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

FAQs

What is the safest way to receive money from a buyer online?

The safest way to receive money from a buyer online is by partnering with secure payment gateway providers that offer encryption and fraud protection, such as Noda.

Which payment method is the least risky for an online seller?

Open banking payments, like those facilitated by Noda, are among the least risky for online sellers. These methods use strong customer authentication and bypass card intermediaries, reducing fraud risk and chargebacks.

What is the most common way for customers to pay online?

The most common way for customers to pay online is through digital wallets, such as Apple Pay and Google Pay. These wallets store various payment cards and offer convenience and security for online transactions.

How do I set up online payments for an online business?

To set up online payments for an online business, partner with a reliable payment service provider like Noda. Choose a provider that supports various payment methods, integrate their payment gateway into your website, and ensure it offers secure transactions and a user-friendly checkout experience.

What is the best way to pay for an online purchase?

The best way to pay for an online purchase depends on your specific preferences. Digital wallets like Apple Pay or Google Pay are currently the most popular payment method. Credit and debit cards are also widely used and accepted. Additionally, open banking payments provide direct transfers between bank accounts with strong authentication measures.