Which payment method should you add to your checkout – Google Pay or PayPal? They’re both big names in online payments and claim to offer fast, easy checkouts. But if you dig deeper, you’ll find downsides: pricey transaction fees, delays in getting paid, and checkout steps that turn customers away.

In this guide, we break down PayPal vs Google Pay for business—and introduce an alternative that cuts costs and helps you convert more sales.

Google Wallet vs PayPal: Quick Overview for Merchants

| Google Pay | PayPal | Open banking | |

| Device compatibility | Works only with Android devices | Works across devices for web and mobile | Works across devices for web and mobile |

| Customer reach | 3.5 billion active Android users | 429 million active users | Over 11 million active users in the UK; 64 million in Europe |

| Transaction fees | Merchants pay the standard credit/debit card processing fees | 2.9% + 30p for UK domestic transactions | Eliminates card network fees as transactions happen from account to account |

| Integration | Via Google Play Business Console, APIs, SDKs, plugins | Via PayPal or a provider (usually via API or SDK). | Via a provider with API, plugins, payment links, QR codes |

| Key regions | India, Poland, Finland | UK, Europe, US | UK, Europe |

What Is Google Pay and How Does It Work?

Google Pay is a free digital wallet that lets customers pay quickly using their Android smartphone, tablet, or smartwatch—online or in-store. They can use saved cards, gift cards, or loyalty points. For merchants, it offers faster checkout and better security (than with card checkout), since card details aren’t shared.

There are a few options to integrate Google Pay into your checkout. The Google Pay API isn’t open source, but Google shares a lot of free tools and example code to help you use it. The main API is owned by Google, so you need to register and follow their rules. Alternatively, you can partner with a payment provider for integration, depending on your business type.

Google Pay gives businesses access to a massive global audience. With Android running over 70% of smartphones worldwide—and more than 3.5 billion users across 190 countries—Google Pay taps into the largest mobile market out there. Google Pay is especially popular for online payments in India, where it was used by 80% of survey respondents, followed by Poland and Finland.

Disadvantages of Google Pay

- Processing costs: Google Pay might feel different for the customer, but for merchants, it works just like a regular card payment. The transaction still runs on card rails, so you’ll pay the usual processing fees—like interchange and scheme charges. Providers like Stripe and Square charge the same rates whether it’s a card or a digital wallet.

Read: How to reduce card processing fees

- Slow payouts: Google Pay doesn’t speed things up for merchants. Since it runs on traditional card networks, it usually takes 1 to 3 business days for the money to hit your account—just like with regular card transactions.

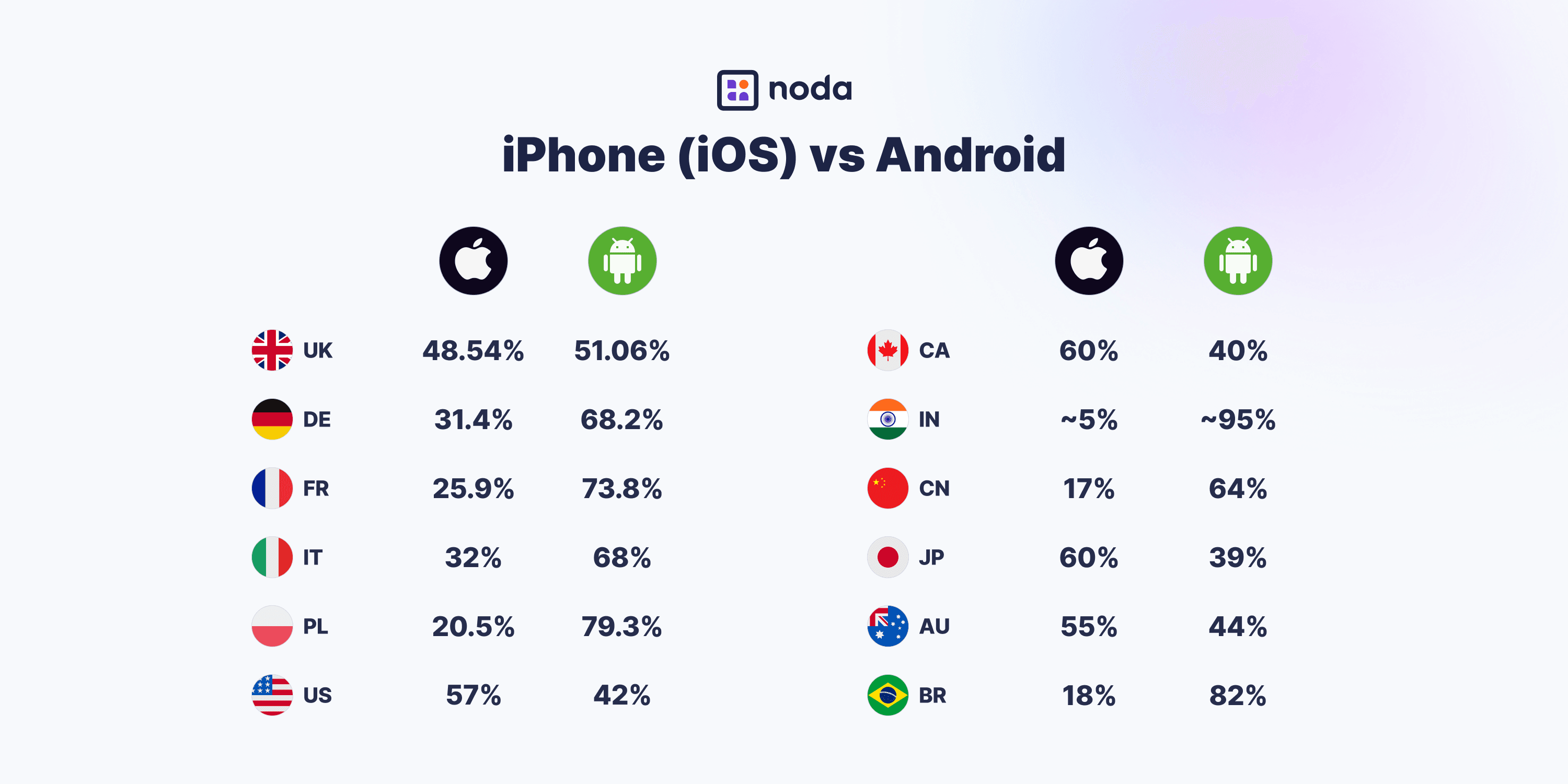

- Excluding iOS: Google Pay isn’t fully supported on Apple devices, and the user experience is limited. In Apple-heavy markets like the UK and US, that means you could miss out on a big chunk of potential customers. For example, below is the breakdown of iPhone and Android usage in key markets.

What Is PayPal & How Does It Work?

PayPal is a popular digital wallet that works on any device and supports multiple payment types—like cards, bank accounts, or PayPal balance. It’s especially big in countries like the UK, Germany, and Switzerland, but it’s also highly recognised internationally, with 429 million active users.

While flexible, it’s not the cheapest: UK merchants pay 2.9% + 30p per domestic sale, and international fees are even higher. Most payments still rely on old card or bank rails, and requiring customers to log in can make checkout slower and increase shopping cart abandonment.

PayPal doesn’t make its integration tools open source, but it does offer plenty of guides, code samples, and SDKs to help you set up payments on your site or app. You don’t have to pay to use these tools, but you will be charged transaction fees for any payments you receive through PayPal.

One advantage of PayPal is that it doesn’t rely solely on cards—customers can link a bank account or top up their balance. In some regions, PayPal connects with open banking through Tink, but most transactions still use older, slower payment methods.

Downsides of PayPal

- It’s pricey: PayPal isn’t the cheapest option out there. Fees can add up fast—especially if you're dealing with customers overseas.

- It’s not instant: Payments don’t hit your account right away. Because PayPal still runs on old-school card and bank systems, you might wait a couple of days to get your money. For instant withdrawals, PayPal charges extra fees.

- It slows customers down: To pay, people need to log in—or worse, sign up. That extra step can kill the momentum at checkout and lead to more lost sales.

Google Pay vs PayPal Fees for Businesses

| Google Pay | PayPal | Open banking | |

| Transaction fee | Merchants pay the standard credit/debit card processing fees | 2.9%+30p for domestic UK transactions, more for international | Merchants only pay payment gateway fees, avoiding card network fees as transactions happen from account to account. Open banking fees are significantly lower than card-based transactions. |

When it comes to Google Pay fees, it doesn’t cost merchants anything extra—Google won’t send you a bill for the wallet. But here’s the catch: the payments still run on card networks, so you’ll pay the usual processing fees to your provider, including interchange and scheme charges.

PayPal fees, on the other hand, take a bigger bite. In the UK, it charges 2.9% plus 30p per domestic transaction. There’s no monthly fee to keep a business account open, but the costs go up for international payments, currency exchange, or dealing with chargebacks.

Better Way to Get Paid Online: Pay-by-Bank

Google Pay and PayPal might look slick, but behind the scenes, they still run on old-school card networks. That means high fees, slow payouts, and extra middlemen eating into your margins.

Pay-by-bank is different. It cuts the card networks out entirely. No cards, no wallets—just a fast, secure bank-to-bank payment. Here’s how it works:

- Your customer picks pay-by-bank at checkout

- They choose their bank (with Noda, you can connect to 2,000+ banks in the UK and Europe)

- They approve the payment in their banking app—using multi-factor authentication such as Face ID, fingerprint, or passcode

- The money lands in your account instantly

It's fully regulated under PSD2, runs on bank-grade APIs, and it's taking off—14+ million users in the UK alone are already on board, especially among digitally native clients, such as Millenials and Gen Z. Why stick with old payment rails when your customers (and profits) can move at the speed of open banking?

Why Pay-by-Bank Outperforms Digital Wallets

If you’re fed up with high card network fees, delayed payouts, and refund disputes, it might be time to rethink how you get paid. Open banking offers a cleaner, smarter alternative to wallets like Google Pay or PayPal.

- More money in your pocket: You’re not paying card or wallet provider fees. No scheme charges. No hidden cuts. Just straight-up savings.

- Instant cash flow: Payments arrive in seconds—not days. No more waiting around for your money to clear.

- Built-in security: No need to share card numbers. Customers confirm the payment inside their bank app, using multi-factor authentication such as biometrics or a passcode. The data is shared via regulated APIs.

- No chargebacks: Since customers trigger and authorise the payment, they can’t just reverse it later. Fewer disputes, less admin.

- Mobile-native UX: Fast, app-based checkout that feels as smooth as a wallet—without the fluff. Just tap, approve, done.

- Works for everyone: Whether your customer is on Android, iOS, or desktop—it doesn’t matter. Everyone has a bank account. Pay-by-bank keeps it simple and universal.

- Easy integration: With Noda you can set up open banking quickly and easily. There is a wide range of integration: no-code payment links and plugins, APIs.

Add Pay-by-Bank with Noda

Looking to cut costs and speed up payments? Noda makes it easy to add pay-by-bank to your checkout. Connect to over 2,000 banks across 28 countries in Europe. Accept multiple currencies. Get paid instantly.

Choose what works best: quick plugins for e-commerce platforms like WooCommerce and Magento, payment links and QR codes, or full control with our Open Banking API.

PayPal vs GPay: Key Difference

The biggest difference between Google Pay and PayPal is how they work behind the scenes—and how much they cost you.

Google Pay gives Android users a slick, fast checkout, but it still uses card rails, so you’re stuck with regular processing fees. PayPal, on the other hand, works on any device and supports more ways to pay—cards, banks, PayPal balance—but it hits merchants with higher fees, especially for international sales or currency conversion.

How to Pick the Right Payment Options

Sticking to just Google Pay or PayPal might not be enough. Offering more ways to pay can help you reach more customers and reduce drop-offs at checkout.

Think about how your customers like to pay—it depends on where they are, how old they are, and what they’re used to. Some prefer wallets, others go for bank payments or even crypto. It also helps to see what your competitors are offering—chances are your customers expect something similar.

Read: Popular Payment Methods by Country

GWallet vs PayPal: What to Use, When, and Why

- If you serve a lot of Android users and want faster checkouts, Google Pay can be a helpful addition—but keep in mind, you’ll still pay card fees, and iOS customers may be left out.

- If you’re looking to reduce fees and speed up cash flow, add pay-by-bank (open banking) to your checkout. It cuts out card networks, so you keep more of what you earn—and get paid instantly.

- If cart abandonment is a problem, offering multiple payment options—wallets, bank payments, even local methods—can make checkout smoother and help more customers complete their purchase.

- If you want to keep things simple and universal, open banking is the most inclusive option. No need for your customer to own a certain device or download a specific app—everyone has a bank.

FAQs

Is Google Pay the same as PayPal?

No, they’re different. Google Pay is a digital wallet for Android users, while PayPal is an online payment platform that works across all devices and supports more payment types.

Is Google Pay like PayPal?

They’re similar in that both offer digital payments and smooth checkout, but PayPal supports more options like linking bank accounts and is more widely used across devices.

Is Google Pay safer than PayPal?

Both are secure. Google Pay uses tokenisation and biometric authentication, while PayPal uses encryption and buyer/seller protections—but they follow different models.

Is Google Pay secure like PayPal?

Yes, Google Pay is secure in a different way. It doesn’t share card details with merchants and relies on your phone’s biometric security, while PayPal uses login protection and account encryption.

Which is better, PayPal or Google Pay?

It depends on your customers and goals. PayPal supports more payment types and works on all devices, but charges higher fees; Google Pay is fast and smooth for Android users but still runs on card networks.Open banking is a smart alternative that cuts costs, improves UX, and provides a wide coverage across devices.

Is Google Pay better than PayPal?

Google Pay may be better for mobile-first, Android-heavy markets with fast checkouts. But PayPal wins on flexibility and device coverage—if you’re targeting a wider audience. Open is also a great option, offering smooth UX, lower fees and works across devices.

Does Google Pay have fees?

Google doesn’t charge merchants extra to use Google Pay. However, standard card processing fees still apply, just like regular card payments. Open banking is a smart option that eliminates card processing fees.

Can you use PayPal on Google Pay?

No, you can’t use PayPal within Google Pay. They are separate services with their own systems and checkout flows.

What’s the difference between PayPal and Google Pay?

The key difference is that PayPal works across all devices and offers more payment types, while Google Pay is Android-only and works more like a card—fast but limited in scope.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each