High payment gateway costs can seriously impact your bottom line. Transactions may come with extra costs – setup fees, processing fees, and monthly charges – and they add up quickly.

But here’s the good news: you can reduce those costs. In this guide, we’ll break down payment gateway fees, explain what you're really paying for, and show you how to optimise your setup to keep more of your revenue.

What Is a Payment Gateway?

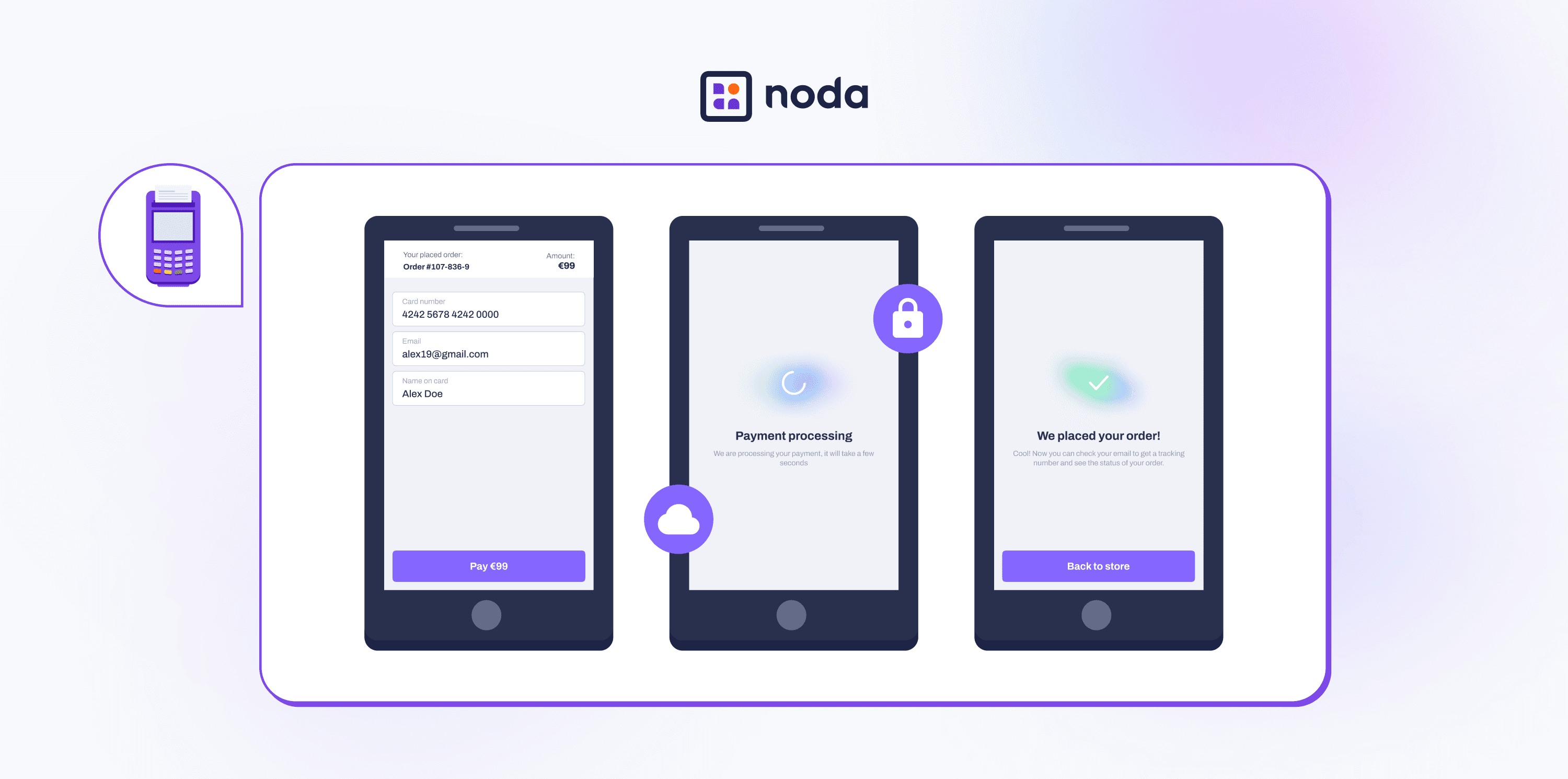

A payment gateway processes payments for online and in-store businesses.

For any merchant accepting online payments, it’s essential. Think of it as the digital version of a card machine in a shop. In other words, your payment gateway is the behind-the-scenes technology that runs your website’s checkout page.

The payment gateway’s software secures customer data and ensures payments are processed safely between the customer, the bank, and your business. When a customer pays, the gateway encrypts the payment details, verifies the transaction, and transfers the funds securely.

What Are Payment Gateway Fees?

Using a payment gateway comes at a cost, but knowing the fees upfront helps you avoid surprises. Here’s what you might pay:

- Setup fees: A one-time fee to set up a hosted checkout page or integrate an API for custom development. Prices range from £0 to £200, with more complex setups costing more.

- Monthly fees: A recurring cost to keep the service running. Payment gateway software monthly fee is typically between £0 – £25 per month.

- Annual maintenance fees: Software updates, operations, and customer support.

- Processing fees: A small cut taken from every payment you process via the payment gateway.

Payment Gateway Fee Comparison

| Payment gateway monthly charges | Online processing fee for domestic UK cards (per transaction) | |

| PayPal | £20 | 1.2% + 30p |

| Square | Free | 1.4% + 25p |

| Stripe | Free | 1.5% + £0.20 |

| Adyen | Free | £0.11+ Interchange + 0.60% for Visa and Mastercard |

Fees as of January 2025. For up-to-date fees, please visit providers' websites.

Payment Gateway vs Payment Processing Fees

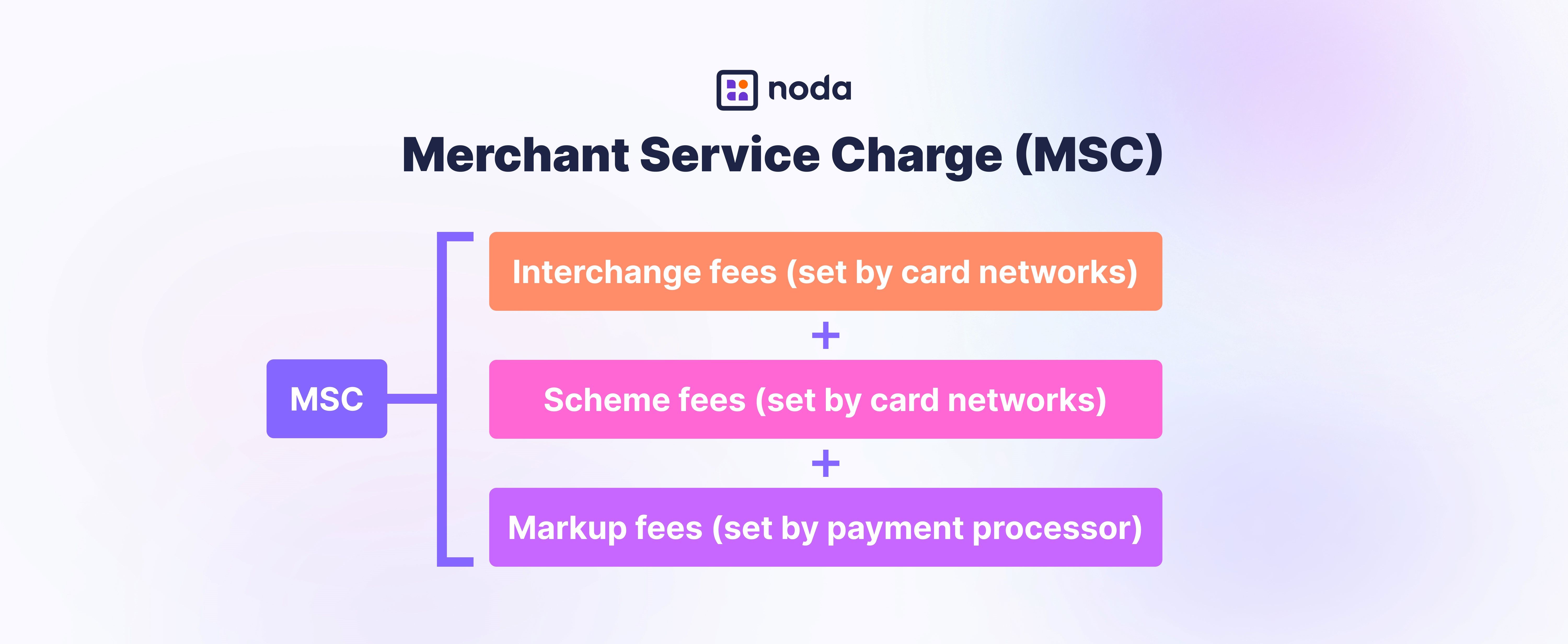

Payment gateway processing fees and payment gateway fees are often bundled together, but they’re not the same. Gateway fees go to the payment provider, while processing fees are split between multiple parties.

Processing fees, also known as Merchant Service Fees (MSC), cover costs from banks, card networks, and payment processors. This includes interchange fees and scheme fees set by card networks and paid to issuing banks.

The markup fee is usually the only part you can negotiate with your provider. Understanding these fees helps you cut costs and get a better deal.

Read: How To Reduce Card Processing Fees

Reduce Fees with Open Banking

Cut payment gateway transaction fees completely with open banking payments. Also known as pay-by-bank, it moves money directly between accounts – no card networks, no interchange fees, no extra costs.

But it’s more than just cheaper. Open banking eliminates chargebacks, reduces cart abandonment, and speeds up checkout. No long card details, just a secure bank login for a seamless payment experience.

Backed by Europe’s PSD2 regulation, open banking is fully secure. Payments are processed through bank APIs, keeping both merchants and customers safe.

At Noda, we make open banking easy and reliable. With connections to 2,000+ banks across 28 countries, we support multiple currencies so you can reach more customers worldwide.

Get started fast with our plug-and-play ecommerce plugins or integrate seamlessly with our Open Banking API. Lower fees, faster payments, global reach—switch to Noda today.

How to Reduce Payment Gateway Fee

- Negotiate with the provider

While interchange and scheme fees are set by banks and card issuers, payment gateway price for set-up as well as any monthly or transaction fees are decided by your provider.

There are a few tactics you can use to negotiate a lower fee:

- Higher transaction volume: If your sales have grown, negotiate a better payment gateway rate. Processors often offer discounts to high-volume businesses.

- Show loyalty: A long-term partnership and a strong payment history can make you a more valuable customer. Use it to your advantage.

- Compare offers: Get quotes from multiple providers to strengthen your position in negotiations.

- Bundle services: Combining multiple tools into one contract can help you secure better terms.

- Optimise payments

Encourage customers to use lower-fee payment methods like bank transfers or debit cards. Better yet, switch to open banking payments (pay-by-bank) to eliminate card fees entirely.

Choose providers with smart routing to automatically send payments through the most reliable channels. This boosts approval rates and reduces failed transaction fees.

FAQs

Which payment gateway has the lowest fees?

The payment gateway with the lowest transaction fee depends on your provider and pricing model. Some providers offer competitive rates with interchange-plus pricing, while open banking payments can eliminate card fees entirely.

What are the payment gateway fees on credit card processing?

The lowest payment gateway fees for credit card processing vary. Most providers charge a percentage plus a fixed fee per transaction. For example, as of January 2025, PayPal starts at 1.2% + 30p, while Stripe and Square offer similar rates around 1.4%–1.5% + 20p–25p. Remember, open banking eliminates card processing fees completely.

What is the average payment gateway integration cost?

Integration costs range from £0 to £200 depending on the provider. Some offer free setup, while custom API integrations or advanced features may cost more.

Are there any payment gateways without hidden fees?

Yes, many providers offer transparent pricing. Open banking payments also reduce extra costs by bypassing card networks.

What’s the payment gateway with zero transaction fee?

A payment gateway with zero transaction fee is rare. Some providers offer free processing for specific payment types, but open banking is the best way to completely avoid card fees. You can significantly reduce transaction fees with open banking payments as they avoid expensive card networks.

What’s a payment gateway with no transaction fee?

Most gateways charge per transaction, but open banking (pay-by-bank) payments can remove these fees entirely. Some providers also offer subscription-based pricing to reduce per-transaction costs.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each