Choosing between Apple Pay versus Google Pay for business might seem like a small detail—but it can have a big impact. Pick the wrong one, and you risk losing customers, increasing cart abandonment, and paying more in processing fees.

Apple Pay only works for iOS users, while Google Pay only for Android. So if you offer just one, you’re excluding a chunk of your customer base. And both still run on expensive card networks, with the settlement delays and fees.

In this article, we break down the key differences—and show you a smarter third option that cuts costs, speeds up payouts, and works for everyone: open banking.

Apple Pay vs Google Pay: Key Differences for Merchants

| Apple Pay | Google Pay | |

| Device compatibility | iOS | Android |

| Customer reach | 1.4 billion active users | 3.5 billion active users |

| Key regions | North America, the UK, Japan, Australia, and more | Europe, China, India, Brazil, and more |

| UX | Smooth for iOS, built for mobile | Smooth for Android, built for mobile |

| Transaction fees | Card network fees | Card network fees |

| Security | Biometric/passcode authentication, encryption, tokenisation | Biometric/passcode authentication, encryption, tokenisation |

| Privacy | Minimal data collection, user-focused | More data collected, service-focussed |

| Settlement times | Up to 1-3 days | Up to 1-3 days |

Google Pay versus Apple Pay: Reach

Apple Pay or Google Pay? That is the question. The main difference between them is simple: they support different devices. Apple Pay is for iOS users, while Google Pay is for Android. Although Google Pay is available on iOS, its features are limited and the user experience is not as strong.

Google Pay gives merchants access to a huge global audience. It’s a digital wallet for Android users, who make up over 70% of the world’s smartphone market—more than 3.5 billion people across 190 countries.

Apple Pay, on the other hand, is built into iPhones, iPads, and Apple Watches, offering quick, easy checkout for around 1.4 billion active Apple users worldwide.

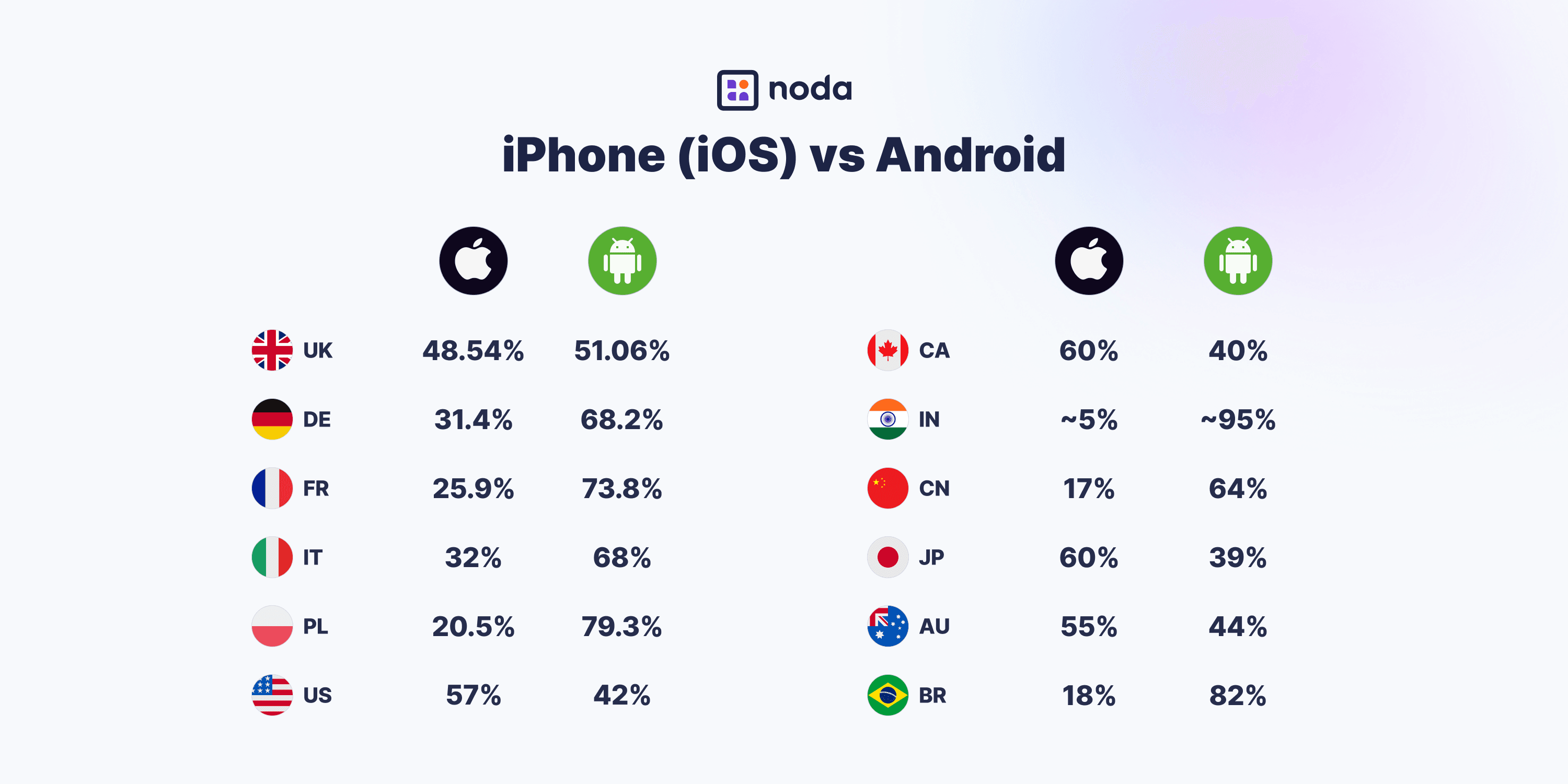

Yet, a big difference is their adoption across regions. In terms of the biggest markets, iPhone (and therefore Apple Pay) dominates North America, UK, Japan and Australia. Android (and Google Pay) is a major player in Europe, China, India, Brazil.

Google Pay vs Apple Pay: Security & Privacy

Both Apple Pay and Google Pay offer better security and smoother mobile checkout than traditional card payments, as they don’t share card details, use encryption, and biometric multi-factor authentication.

However, their key difference is their approach to privacy. Apple Pay is seen as more private for users as it collects very little data, and follows strict privacy rules. Google Pay, on the other hand, stores information in the cloud and collects more data.

Apple Pay vs Google Pay: Shared Drawbacks

But are Apple Pay and Google Pay really ideal for merchants? In reality, they share the same key drawbacks. Here’s why you might want to consider an alternative.

Slow Settlements of Both Wallets

Although Apple Pay and Google Pay are distinct payment options, they still rely on traditional card networks. As a result, they use traditional payment rails via card networks––and funds can take 1 to 3 days to reach your account.

Google Pay vs Apple Pay: Merchant Fees

For the same reason as above, merchants still face standard card processing fees—like interchange and scheme charges—which reduce profit margins.

For instance, top providers like Stripe and Square charge the same rates for digital wallets as they do for regular credit and debit cards. Here are the current UK rates:

| Online | In-person | |

| Stripe | 1.5% + 20p | 1.4%+10p |

| Square | 1.4% + 25p | 1.75% |

Transaction fees as of April 2025. For more up-to-date information, please visit the providers’ websites.

Read: How to reduce card processing fees

Device Incompatibility

Apple Pay and Google Pay each work only on certain devices—Apple for iOS and Google Pay for Android. If you offer just one, you risk shutting out customers on the other platform.

To avoid shopping cart abandonment, it’s important to understand which devices your customers use in different regions. Or search for a payment method that is not linked to a specific operating system.

Smarter Alternative to Mobile Wallets: Pay-by-Bank

Most mobile wallets, including Apple Pay and Google Pay, rely on card networks to process payments, which means higher fees, chargebacks, and slower access to funds for merchants.

A better alternative is open banking, or pay-by-bank. It skips the card networks entirely, allowing for quicker, lower-cost transactions. The money moves straight from your customer’s bank account to yours—no middlemen such as card networks or digital wallets are involved.

Here’s how it works:

- The customer selects pay-by-bank at checkout

- They choose their bank from a list (at Noda, for example, we offer 2,000+ banks in 28 countries in Europe)

- They’re redirected to their banking app or website to approve the payment—usually with Face ID or a fingerprint

- The payment is settled instantly

These payments are fully regulated under Europe’s PSD2 framework and use secure, bank-issued APIs accessed only by licensed providers.

Why Pay-by-Bank Beats Digital Wallets

Pay-by-bank gives merchants a clear advantage over traditional wallet-based payments. Here’s why it works better:

- Lower fees: By cutting out card networks and wallet providers, you avoid interchange and scheme charges—so more of the revenue stays with you.

- Instant settlements: Payments are made from account-to-account, in other words, directly from the customer’s bank to yours, often reaching your account within seconds.

- Built-in security: No card numbers are shared. Customers approve the payment in their banking app using biometrics like Face ID or fingerprint, with full bank-grade protection.

- No chargebacks: Since the customer initiates and confirms the payment, it can’t be reversed like a card transaction—reducing disputes and admin.

- Seamless mobile UX: The checkout flow is simple and fast, making it ideal for digitally-native shoppers, such as Millenials and GenZs, who expect speed and convenience. In fact, GenZs lead the adoption of open banking according to Mastercard’s Rise of Open Banking report.

Connect Pay-by-Bank with Noda

If you want a smarter, cheaper alternative to Apple Pay or Google Pay, try Noda’s Open Banking platform. You can connect to over 2,000 banks across 28 countries in Europe, accept payments in multiple currencies, and get your money instantly.

Choose the setup that works best for your business. Build a fully custom experience with our Open Banking API, or get up and running fast with easy-to-use e-commerce platform plugins and instant payment links with QR codes.

Choosing the Right Payment Strategy for Your Business

When comparing Apple Pay and Google Pay, remember the bigger picture: relying on just one wallet likely won’t cut it. The right mix of payment options can boost sales, reduce costs, and improve customer experience.

Look into your customers' habits. Age, location, and shopping behaviour all affect what payment methods they prefer—some like digital wallets, others go for open banking or even crypto-based options. Check what your competitors offer and what’s common in your industry.

Read: Popular Payment Methods by Country

In short, here are some actionable options you have:

- Offer both Apple Pay and Google Pay if your audience is split across iOS and Android. Relying on just one wallet risks excluding a large portion of your customers, especially in regions where device use is mixed.

- Choose pay-by-bank for global reach across all devices, lower costs and get paid faster. Unlike digital wallets, it bypasses card networks completely—meaning no scheme fees, no interchange, and instant settlements.

- Use open banking alongside wallets to match different customer preferences. Wallets offer familiar UX, while open banking brings smoother checkout, lower fees and instant payments. Together, they help reduce cart abandonment and improve conversions.

Accept Cards, Mobile Wallets, Pay-by-Bank with Noda

Can’t decide between Apple Pay, Google Pay, or pay-by-bank? With Noda, you don’t have to choose.

Apart from open banking, we also offer card payments––including digital wallets Apple Pay and Google Pay––integrated via Card Payments API. Our AI-powered smart routing finds the best path for every card transaction, while advanced fraud detection keeps your payments secure and your approval rates high.

FAQs

Which is more secure, Google Pay or Apple Pay?

Both use strong security features like encryption and biometric authentication. For even stronger security and no card data at all, consider open banking payments, which runs on regulated APIs and transfers money from account to account.

What’s the difference between Google Pay and Apple Pay?

The main difference is device compatibility—Google Pay is for Android, Apple Pay is for iOS. Both offer similar UX and security, but still rely on card networks. Open banking, by contrast, works across devices and skips card networks entirely.

Which is better, Apple Pay or Google Pay?

It depends on your customers—Apple Pay is best for iOS users, Google Pay for Android. The preferences vary by region and age. But both have the same drawbacks: fees, chargebacks, and device limits. Open banking is a better all-round option for merchants looking to cut costs and boost checkout speed.

Does Apple Pay have lower merchant fees than Google Pay?

No—both charge standard card processing fees since they run on the same card networks. If you want to reduce transaction costs, open banking offers a more cost-efficient alternative.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know