Running an online business today means juggling rising card fees, endless chargeback disputes, and complex payment integrations. Open banking offers a simpler way forward. Built on secure bank connections, this alternative to cards lets customers pay you directly from their accounts.

It’s also growing fast. The UK now has over 15 million active open banking users, up more than 50% year-on-year, with millions of pay-by-bank payments made every month. For merchants, that means a proven, scalable alternative to traditional payment systems.

Open Banking UK: Regulations 2025

Open banking started in the UK as a government-backed effort to make banking more open and competitive. It was introduced by the Competition and Markets Authority (CMA) and Financial Conduct Authority (FCA) after a law called the Payment Services Regulations 2017, which brought the EU’s PSD2 rules into UK law.

The idea was simple: customers should have the right to safely share their banking data or make payments through third-party apps if they choose to. To make this possible, banks had to open up their systems using secure digital connections – application programming interfaces (APIs).

Open banking created two new types of regulated providers:

- Account Information Service Provider (AISP) – can read data. With customer consent, an AISP can securely access account details such as balances and transactions to help with things like credit checks, budgeting, or personalised offers.

- Payment Initiation Service Provider (PISP) – can move money. A PISP lets customers make direct payments from their bank account – referred to as pay-by-bank or open banking payment gateway – without needing cards.

Now, open banking is entering its next phase. Regulators are preparing for Variable Recurring Payments (VRPs) – a new way to process flexible, automated payments like subscriptions. VRPs already account for 13% of all open banking payments, with full commercial rollout expected in late 2025.

Alongside this, the FCA is developing a long-term roadmap to open finance, expected to launch by 2027. In parallel, the Data (Use and Access) Act 2025 will create the legal foundation for a broader data economy.

How Does Open Banking Work in Practice?

As we established before, open banking lets customers pay-by-bank (PISP) and aggregate financial data from multiple accounts (AISP).

Open Banking Payments (PISP)

When someone chooses to pay by bank, they give explicit consent for the transaction. Their bank then confirms their identity using Strong Customer Authentication (SCA) – for example, Face ID, fingerprint, or a one-time passcode. SCA is a legal requirement for open banking payments.

Once verified, the payment moves directly from one bank account to another through the UK’s Faster Payments network, meaning the money usually arrives within seconds. Each transaction is protected by tokenisation, which replaces sensitive information with temporary, encrypted tokens, keeping data private throughout the process.

| Category | Pay-by-Bank | Cards |

| Cost | Much lower – open banking helps to reduce payment processing fees. Start from around 0.1% with Noda. No interchange or scheme fees. | Higher – merchants typically pay 0.2–1.5% interchange + scheme and provider fees. |

| Chargebacks | No chargebacks, as payments are authorised directly by the customer through their bank. | Chargebacks are common, especially for online purchases; merchants bear financial and admin risk. |

| User Experience (UX) | Fast and seamless, users approve payments directly in their banking app; no card numbers needed. | Familiar but slower, users must enter card details, and sometimes go through 3D Secure checks. |

| Settlement | Instant or near-instant, funds arrive within seconds or minutes. | Delayed, as card settlements typically take 1–3 business days. |

| Security | Bank-grade security and Strong Customer Authentication (SCA) with, typically, a biometric check. | Depends on card data entry and may be prone to fraud or data breaches. |

Open Banking Data (AISP)

Open banking isn’t just about payments – it also enables secure data sharing between banks and licensed financial apps. Once permission is granted, the AISP connects to the customer’s bank through API. This allows the provider to view account information such as balances, transactions, and spending patterns – but they can’t move money.

Open Banking for Merchants: Use Cases

In e-commerce, pay-by-bank helps merchants cut card fees and lower cart abandonment. For instance, online retailers can offer instant checkout through the customer’s banking app – no need to manually insert card details.

Here are some real-life examples of open banking used by Noda’s clients:

- A strong example of open banking in e-commerce is Plokštelė.lt, a Lithuanian vinyl store that modernised its checkout with Noda by offering pay-by-bank alongside card payments. Customers loved the faster payment process, and the business saw fewer drop-offs at checkout.

- A Brazilian deli in London integrated pay-by-bank QR codes so customers could pay instantly from their bank. This enabled fully mobile payments, which their customers loved.

- Scotland-based educational business Mathnasium Glasgow South ran a campaign, giving £50 discounts for students who paid via pay-by-bank. It simplified payments and reduced admin overhead.

How Consumers Experience Open Banking

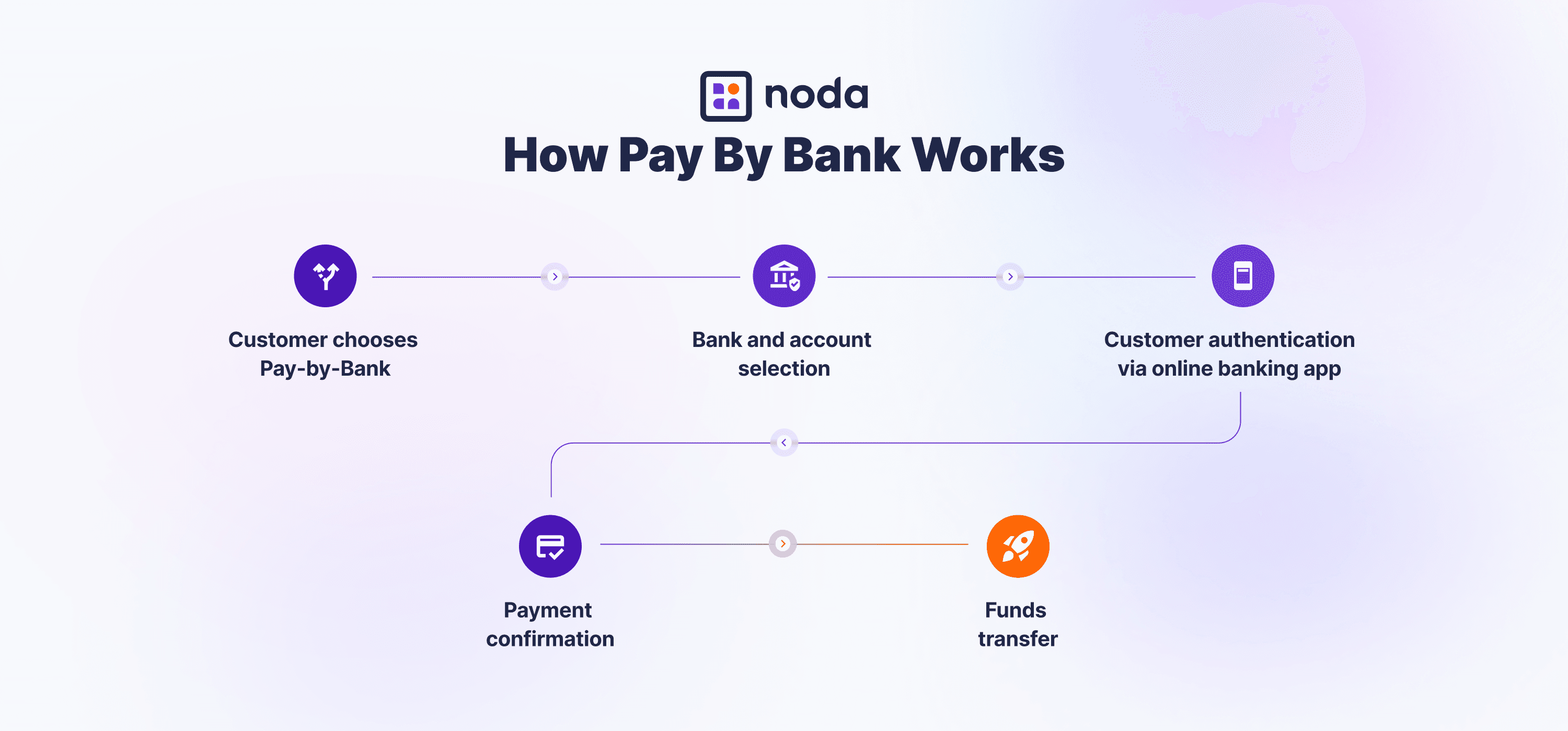

When paying with open banking (pay-by-bank), consumers benefit from a smoother user experience (UX). Here is how the payment flow typically looks like:

- Customer selects Pay-by-Bank at checkout

- Customer chooses their bank – at Noda, we cover 2,000+ banks in the UK and EU; full UK bank coverage.

- Multi-factor authentication via their online banking app, typically with biometric authentication

- Customer reviews details and confirms payment

- Funds are debited instantly

Noda Open Banking: UK-Based Solution for Merchants

Noda makes it easy for businesses to accept payments online in the UK – faster, safer, and far cheaper than cards.

Our open banking payment gateway connects you directly to over 2,000 banks across 28 countries, with full UK bank coverage. Customers pay straight from their banking app, and the money lands in your account almost instantly through Faster Payments. You can also offer cards, Apple Pay, and Google Pay to give customers more options – all in one platform.

Getting started takes minutes. Use ready-made e-commerce plugins, instant payment links or QR codes, or build your own checkout with our fully custom API open banking integration.

With fees starting from just 0.1% per transaction, no chargebacks, and instant payouts, Noda gives merchants a simpler, smarter way to get paid. Plus, every new SME gets a 90-day free trial and personal manager support.

For UK businesses, Noda is a complete payment solution – built for speed, security, and growth.

How to Get Started with Open Banking for Your Business

Getting started with open banking is straightforward – especially for UK merchants already accepting payments online. Here’s what you need to know.

Set up your business account

To use open banking, you’ll need a registered UK business bank account. This is where your payouts will arrive when customers pay through pay-by-bank.

Choose a licensed provider

Pick an FCA-authorised open banking provider – such as Noda – to handle payments securely. You can find providers in the Open Banking Directory. Regulated providers use bank-approved APIs and comply with PSD2 and UK Payment Services Regulations.

Select your integration type

- E-commerce plugins – the fastest option for e-commerce platforms. For example, at Noda, we offer plugins for WooCommerce, Magento, PrestaShop, and OpenCart.

- Payment links and QR codes – ideal for quick, no-code setups in digital or in-person sales.

- Open Banking API integration – gives full control for custom websites or apps.

- Trial and track results

Start small – test open banking payments alongside your existing methods. Track key metrics such as conversion rates, checkout completion time, refund turnaround, and customer satisfaction.

With Noda, you can launch in hours, test performance during a 90-day free trial, and see the impact directly in your merchant dashboard.

FAQs

Is open banking safe?

Yes, it’s very safe – payments are protected by bank-level encryption and verified through your bank using Strong Customer Authentication (SCA).

Do I need an app to use open banking?

As a customer, you don’t need a separate app to use open banking – you authorise payments via your banking app, which you do need. As a merchant, you can accept open banking payments directly through your website or platform without needing a separate app. You do need to partner up with an open banking provider, though.

Can I use open banking for refunds?

Yes, refunds can be processed directly through your payment provider, but there are no chargebacks under UK Payment Services Regulations (Regulations 76–77). This means disputes are handled between you and the customer, not through chargebacks.

What if my bank doesn’t support it yet?

You can still complete the checkout using another option such as cards or digital wallets.

Is open banking better than PayPal or cards?

It’s faster and cheaper – there are no card fees or chargebacks – but most merchants still offer all payment methods to give customers choice.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each