Open banking is no longer just a trend – it’s a power that is actively changing how businesses and consumers interact with financial services. What started as a regulatory push in Europe has now grown into a global movement, bringing more intuitive, comfortable payments and data insights to customers and merchants.

As adoption across Europe (and the world) rises, with new technologies like AI reshaping the fintech industry, each day brings new challenges and changes to the open banking ecosystem. In this article, we explore the key trends shaping the future of open banking and what they mean for merchants.

What Is Open Banking?

Open banking is a financial framework that allows traditional banks to securely share data with licensed third-party providers via application programming interfaces (APIs) with customer consent. In Europe, open banking started with the enforcement of PSD2 in 2018, which required banks to share APIs with authorised companies.

Open banking ended banks’ monopoly over customer data. With access to data, licensed providers can create new, innovative products and services such as payments, personalised data insights, aggregated account management, and more. Since its introduction, open banking has gained traction worldwide, transforming the world of fintech.

Key Open Banking Trends in 2025

In the following section we will examine the trends that are actively shaping the industry in 2025 and are set to influence the innovations in the future.

1. Growing Adoption and Market Maturity

Open banking continues to become more popular in Europe and globally. In the UK, for example, 13% of digitally active consumers and 18% of small businesses were using open banking services, according to the Open Banking Impact Report published in March 2024. This marks a jump from mid-2023, when overall penetration stood at 1 in 9 users.

The UK leads Europe in the sizes of their open banking markets. When it comes to the open banking market sizes in Europe, the UK leads the way. In key countries like France, Germany, Spain, and Italy, only 2% of digital consumers used open banking in 2022, compared to the UK’s 9.2%.

Small businesses remain at the forefront, with nearly 1 in 5 relying on open banking to simplify payments and manage finances. Consumer adoption, now at 1 in 7, is catching up as more and more discover the benefits of faster payments and improved financial tools.

For businesses, the rapid maturing of the open banking market means greater open banking opportunities to innovate. It’s also a chance to stay ahead in markets where open banking is quickly becoming a standard.

2. Digital wallet integrations

Digital wallets and payment platforms are gradually embracing open banking in different ways. Apple Pay now integrates richer account data, such as in‑wallet balances and spending insights. Google Pay has publicly committed to open‑banking standards and already routes instant payments via UPI in India, but similar flows are not yet live globally. PayPal uses open‑banking APIs to link accounts, verify identities and check balances, streamlining the onboarding process.

As more providers experiment with these rails, businesses can expect faster settlements, lower fees and clearer transaction records, while loyalty programmes and rewards can become more tightly integrated with how customers actually spend.

Earlier in 2024, Apple rolled out its first open‑banking integration in the UK, signalling a major shift toward wallet‑native A2A flows. And it’s not alone: over the next two years, roughly 75 percent of payment service providers and independent software vendors plan to embed instant A2A functionality into their platforms. As open‑banking payment volumes continue to grow, by around 10 percent month‑on‑month in the UK, digital wallets are set to become the primary channel for both merchants and consumers to access real-time balances and transaction history directly via their wallet app.

3. Payments versus Data

Open banking payments – the so-called pay-by-bank – are driving the growth of open banking adoption, according to the report, including variable recurring payments (VRPs) and single immediate account-to-account transactions.

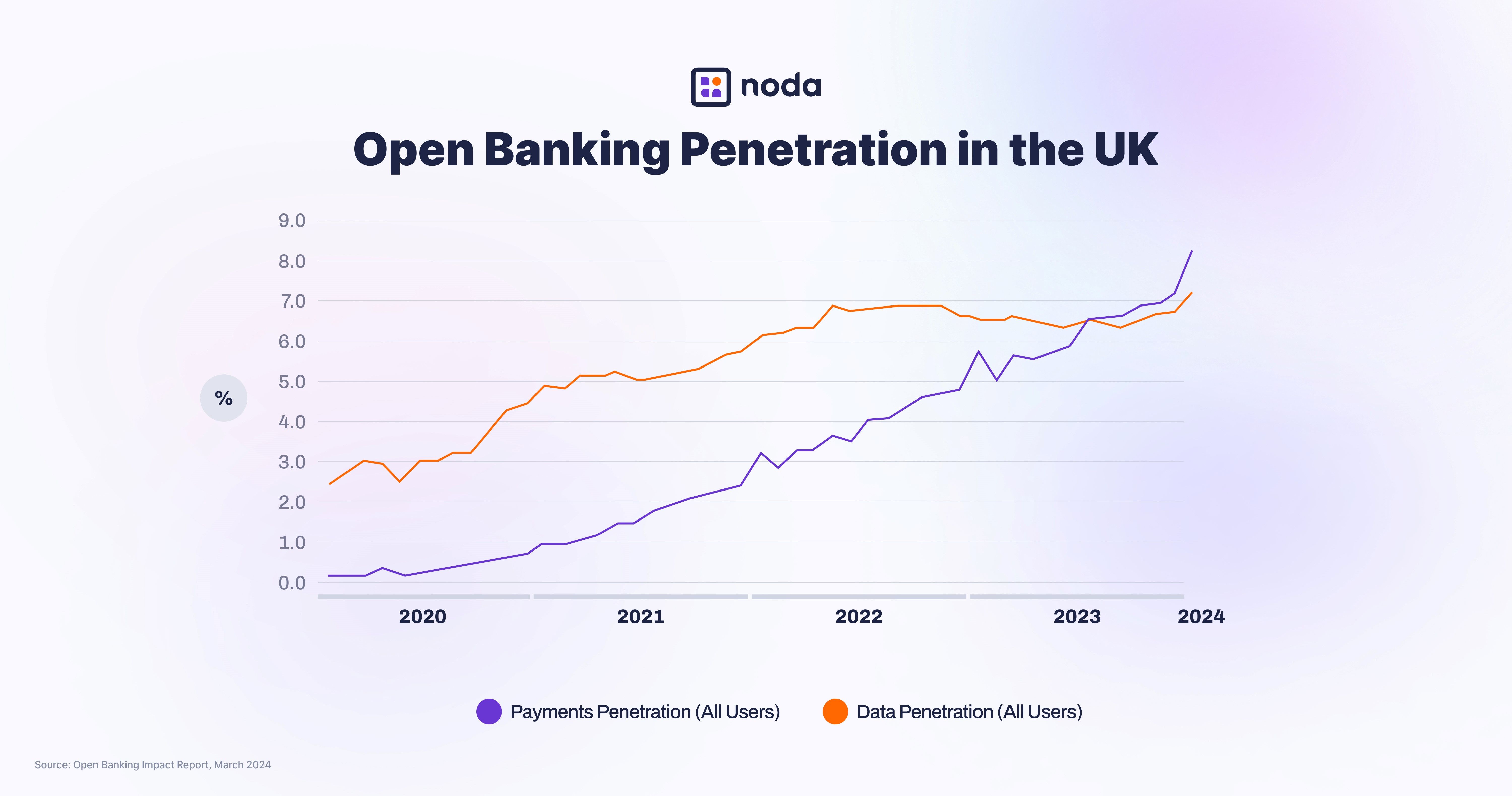

In August 2023, open banking payments surpassed open banking data tools for the first time, according to the report. Payment penetration stood at 8.2%, while data penetration reached a new high of 7.2% in January 2024, following steady growth. This growth in data services may have been influenced by the rollout of open banking connections to Apple Wallet.

Small businesses remain more likely to use data services, while consumers are balancing payments and data in the UK. Among active consumers, 56% use payment services, compared to 25% of active small businesses. Despite payments leading the adoption, data services are also regaining momentum, highlighting a broadening appeal of open banking.

4. Variable Recurring Payments (VRP)

Variable recurring payments (VRPs) are the latest promising open banking opportunity. They allow customers to make payments of varying amounts at regular intervals, delivering a smoother and more flexible user experience.

Built on open banking infrastructure, VRPs let customers authorised providers to process multiple payments directly from their bank account. Each transaction is secured with strong customer authentication (SCA).

There are two main types of VRPs: sweeping and non-sweeping. Sweeping involves transferring money between a customer’s own accounts, such as automating monthly investments or avoiding overdraft fees. These are already available in the UK. Non-sweeping VRPs, on the other hand, manage payments between a customer and a merchant.

Although not currently mandated in the UK, non-sweeping VRPs are growing in popularity. In 2022, UK bank NatWest partnered with open banking providers to launch non-sweeping VRPs as a payment option.

5. Use case: Wero and Europe’s Progress Towards Banking Autonomy

Open banking is driving a wave of innovation across Europe, with account-to-account payments emerging as a faster, cheaper alternative to traditional card rails. One of the most ambitious examples of this shift is Wero, a new digital wallet designed to unify payments across the continent.

Launched in June 2025 by the European Payments Initiative, the product is quickly becoming Europe’s leading digital wallet for instant account-to-account payments. Instead of storing money like PayPal, Wero connects directly to users’ bank accounts, making transfers fast, secure and seamless. It already has over 40 million users across France, Germany and Belgium, and is backed by 16 major European banks including BNP Paribas, Deutsche Bank, and ING.

Users can access Wero either through their bank’s mobile app or by downloading a standalone Wero app. It supports simple peer-to-peer payments, and merchant payments are rolling out throughout 2025. Unlike card-based wallets like Apple Pay or Google Pay, Wero uses SEPA Instant transfers, cutting out card networks and reducing fees. For merchants, this could mean quicker settlements and lower costs.

Wero’s main strength lies in its pan-European approach. While many European countries have their own payment systems, like iDEAL in the Netherlands or the now deprecated giropay in Germany, they often don’t work well across borders. Wero aims to solve this by offering one unified system that works with a large number of banks across the continent. This means users will likely only need a phone number to send money, regardless of the recipient’s country.

New features are on the way too. By the end of 2025, Wero will support one-click online checkouts, and in 2026, it plans to introduce tools like subscription payments, instalment plans and loyalty programmes. These updates show that Wero is not just about catching up to existing payment apps – it is about building a Europe-first alternative that reduces the need for American giants like Apple Pay and PayPal.

Looking ahead, Europe is likely to continue its efforts to reduce reliance on US-dominated card networks such as Visa and Mastercard. Local payment methods like Wero will play a central role in this shift, supported by open banking technology that allows for direct bank transfers without intermediaries. Solutions like Noda are already demonstrating how open banking can eliminate the bounds of traditional card schemes altogether. As this movement gains momentum, open banking is set to become an even more critical pillar of Europe’s digital finance ecosystem.

6. Innovations in Artificial Intelligence

Artificial intelligence (AI) is expected to play a key role in the future of open banking. According to McKinsey, AI could add between $2.6 trillion and $4.4 trillion annually to the global economy across various industries.

One of the most exciting open banking trends is how it’s combining with AI to power smarter, more personalised financial services. With access to real-time, enriched bank data through secure APIs, AI models can now deliver insights that go far beyond traditional tools. This makes financial advice more tailored, responsive, and accessible — without the need for a human advisor.

For example, users can ask questions like “How much do I usually have left before payday?” and receive instant answers, followed by smart suggestions like automatically moving idle funds into savings. Spending patterns can be broken down by merchant or category, helping users make more informed decisions — even down to offering recipe ideas based on frequent takeaway habits.

Lenders also benefit, using live transaction data to make faster, more accurate decisions with less risk. Instead of static credit scores, AI can assess someone’s financial health in real time, suggest improvements, or offer tailored repayment plans. In regulated sectors like finance or gambling, this same data helps detect fraud and money laundering more effectively, spotting anomalies and suspicious patterns that manual systems might miss.

As open finance expands to include areas like pensions, loans, and insurance, the combination of AI and open banking will continue to evolve. Together, they’re laying the groundwork for a more intelligent, personalised and proactive financial future — built around users’ actual behaviour and needs.

For businesses, this means that they can leverage AI tools within the open banking suite of their payments provider.

7. New Regulation: PSD3 and SEPA Instant

New wave of payment regulations in Europe, expected at the end of 2024, is set to shape the future of open banking. In June 2023, the European Commission released a draft of PSD3, an updated version of PSD2.

The EU is introducing major updates to its payments framework through PSD3 and the Payment Services Regulation, aiming to enhance security, competition, and innovation in digital finance. These changes will strengthen consumer protection, improve fraud prevention, and make open banking services more accessible by ensuring smoother API performance and more consistent implementation across all Member States. A key objective is to remove remaining barriers to data access for third-party providers, improving integration and creating a more unified payments environment across Europe.

In parallel, the SEPA Instant Credit Transfer scheme is becoming mandatory across the EU. From 9 January 2025, all banks must be able to receive instant euro payments, and by 9 October 2025, they must also be able to send them. This marks a shift toward 24/7, real-time payments becoming the norm. The widespread adoption of instant payments will significantly enhance liquidity and cash flow management, particularly for businesses. It will also increase the appeal of open banking as it allows faster, more reliable and secure account-to-account transactions.

Together, PSD3 and SEPA Instant are set to accelerate innovation and adoption in the European open banking ecosystem, supporting a more competitive and efficient open banking market.

8. Use Case: New Industries and Sustainability

Open banking is no longer just for banks and fintechs – it's branching out into a much wider range of industries, and sustainability is quickly becoming one of its most promising frontiers. Traditionally, we’ve seen open banking used by financial services, insurance, tech platforms, e-commerce, and real estate. But now, a new wave of companies in the climate tech space are tapping into the power of transaction data.

Doconomy, for example, are using open banking data to calculate the carbon footprint of everyday purchases, giving people a real-time look at how their spending choices affect the planet. They achieve this using the Åland Index, which assigns CO₂ values to transaction data. This kind of insight makes environmental impact tangible, personal and actionable – and it's resonating. Over 90 financial institutions in more than 40 countries are already working with Doconomy.

But that’s just the beginning. New players like Greener for Business are using open banking to help small businesses understand their carbon footprint and build tailored action plans to become more sustainable. Others, like Climate Savers, are rewarding consumers with cashback for shopping with eco-conscious brands.

What makes all of this possible is access to real financial behaviour through open banking. By using transaction data, climate tech firms can offer personalised, meaningful recommendations instead of generic advice. This helps build trust, create real impact, and give users a sense that their actions matter.

We're at a point now where open banking is becoming a powerful enabler for purpose-driven innovation. It’s no longer just about convenience or faster payments – it’s about aligning money with values. And as more consumers and businesses demand transparency and sustainability from the companies they support, we’ll likely see even more creative and meaningful use cases emerge.

In short, open banking is helping sustainability go mainstream. From calculating carbon footprints to shaping climate-friendly financial products, it’s opening up new ways for people and businesses to engage with sustainability.

Open Banking with Noda

With Noda’s Open Banking API, you can offer direct bank payments with better user experience, lower fees and no chargebacks. That means a smoother, more secure payment flow for your customers and more savings for your business.

Our payment plugins for popular e-commerce platforms like OpenCart, WooCommerce, Magento, and PrestaShop, or no-code payments, allow you to easily set up open banking payments. Whether you’re starting out or scaling, we’ve got flexible plans to fit your needs.

Reach More Customers

We offer instant bank payments with flexible fees and a great acceptance rate, partnering with over 2,000 banks in 28 countries, including the EU and more, supporting many currencies.

Noda lets you leverage pay-by-bank technology internationally, saving money on avoiding middlemen fees and chargebacks and offering your customers the convenience of paying through their trusted local banks.

Grow Your Business

From helping with customer verification to improving the user experience and providing customer insights, Noda’s tools are designed to grow your business. We help you make payments easier and forecast long-term value.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each