Getting customers to your website is great—but if your checkout isn’t smooth, you’re likely losing sales. Nearly 70% of online shoppers abandon their carts, often because the final steps are too slow, confusing, or limited.

In this article, we’ll break down how to build the best online checkout experience for your business. You’ll learn how to set it up and how to design a high-converting checkout page.

We’ll also show why open banking is becoming a top choice for merchants—it’s faster, more secure, and solves many of the issues that cause cart abandonment.

Why Is Online Checkout Important?

Checkout is one of the most important parts of the customer journey. It’s where people decide whether to complete their purchase or leave. A clunky experience here can mean lost sales and frustrated customers. Here’s why it matters:

- Final step in conversion funnel: Checkout is your last chance to secure a sale. If it’s smooth and simple, more people will complete their purchase.

- Impact on revenue: The global average cart abandonment rate is 70%. That means nearly 7 out of 10 people walk away without buying if the online checkout is difficult.

- Customer retention and loyalty: A fast, easy checkout builds trust. It makes people more likely to come back. A bad one might not see them return at all, especially digital natives. 57% of Gen Z and 58% of Millennials have abandoned an online purchase in the past six months due to difficulties during checkout.

Different Types of Online Checkout

The best online checkout process for your business depends on your needs and how much control you want. Each type offers a different experience for you and your customers.

Here’s a quick breakdown of the four main types of online checkout integration—and how they affect customer experience.

| Type | Best UX features | Drawbacks | Best for |

| Hosted | Easy setup, secure | Disruptive redirection | Small businesses prioritising simplicity |

| Self-hosted | Branded experience, seamless flow | Requires PCI compliance | Mid-sized businesses wanting more control |

| Embedded checkout | Seamless, branded experience, fewer redirects | Moderate technical effort | Businesses seeking a balance between UX and easy set-up |

| API | Fully customisable, mobile-friendly | Higher technical effort | Businesses with development resources |

| Plugins | Quick setup, pre-configured features | Limited customisation | Businesses using e-commerce platforms |

Hosted Checkout

In a hosted checkout, customers are sent to a third-party payment provider’s page to finish the payment. It’s easy to set up and doesn’t need much technical work.

Since the payment provider processes the data, it’s secure and already meets compliance standards. It also supports different payment methods and languages, which is great for global customers.

Best for: Small businesses that want a simple, secure solution without worrying about customisation.

No-Code Payments & Payment Links

A great example of hosted checkout is payment links. They work by sending customers to a secure, third-party-hosted payment page. It’s a popular option for small businesses, freelancers, or anyone who wants to take payments without building a full checkout system.

With Noda’s instant payment links, you can create a branded, no-code, high-converting checkout pages where customers pay directly from their bank using pay-by-bank. You can even generate QR codes. It’s quick to set up, doesn’t need any dev work, and is a simple way to start accepting payments fast.

Embedded Checkout

With embedded checkout, customers can pay right on the merchant’s website—without being sent to another page. The payment form is built into your site using tools like JavaScript or iframes, so the experience feels smooth and on-brand.

The sensitive payment details are still handled by your provider, so it’s secure and PCI compliant. You get the best of both worlds: a checkout that matches your website’s look and feel, and one that’s safe and reliable.

Best for: Businesses that want a clean, branded checkout and a frictionless customer experience.

Self-Hosted Checkout

Self-hosted checkout lets customers enter their payment details directly on your site, but the payment is processed by a third-party provider in the background. It keeps the experience smooth and on-brand, as users never leave your site.

You get more control over how the checkout looks and feels, but you’ll also need to handle PCI compliance and make sure everything is secure. It takes more technical know-how to set up and manage.

Best for: Businesses that want a branded checkout experience without managing the full backend.

API Checkout

API checkout processes payments directly through your site or app using an API, giving you total control over how the checkout works and looks. It's how many card processors and open banking providers operate. At Noda, for example, we offer Card Payments API and Open Banking API.

You can fully customise the experience, keep customers on your site, and build mobile-optimised flows. But it takes more dev work, and you’ll need to manage PCI compliance and security yourself.

Best for: Businesses with in-house tech teams or those that want full control over the checkout experience.

Online Checkout via Plugins

Plugins make it easy to add payments to your site without much coding. These are pre-built integrations for platforms like WooCommerce or OpenCart. At Noda, for example, we offer open banking plugins for major platforms, so you can start accepting pay-by-bank payments fast.

They’re simple to install, even without tech skills, and often come with useful features like multi-currency support or fraud protection. But you're limited to what the plugin allows—so there’s less flexibility than an API setup.

Best For: Small to mid-sized businesses using popular e-commerce platforms that want a fast, plug-and-play payment option.

Why Customers Abandon Online Checkout?

To build the best e-commerce checkout (or simply the one that converts), let’s look at why customers abandon their carts. If we know what turns people away, we can design better, smoother experiences that keep them moving through with the payment.

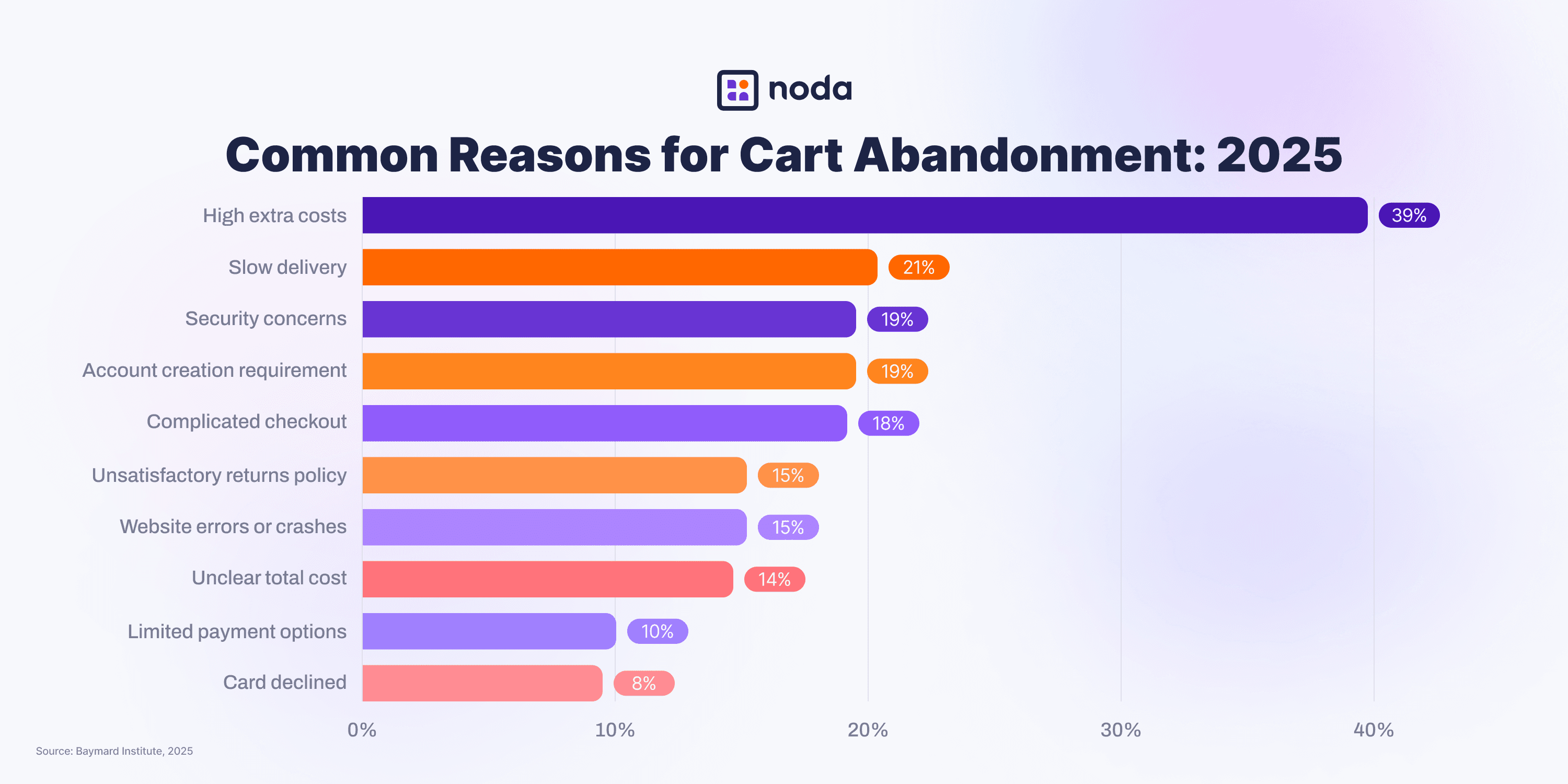

Baymard Institute conducted a survey with 1,026 customers in the US and found the following reasons for cart abandonment:

Common Reasons for Cart Abandonment: 2025

Online Checkout Page: Best Practises

Based on this data, we have compiled a list of the best e-commerce checkout experience practices that would ensure there is no friction in your payment flow.

Ensure Transparent Pricing

The absolute majority of customers would abandon their carts if they see unexpected fees–this could be shipping, taxes, or any other extra fees.

Hidden costs is the most common (39%) reason for order abandonment. Another 14% of carts were abandoned because the customer couldn’t calculate or see the total cost up-front. Therefore, it’s important:

- Display all costs transparently and upfront.

- Offer free shipping where possible.

Ensure Quick Delivery

With next-day delivery from giants like Amazon, it’s hard to keep customers waiting. Slow delivery is behind 21% of abandoned carts. To fix this:

- Set clear expectations: Show estimated delivery times upfront at checkout.

- Choose the right partners: Work with fast, reliable couriers to avoid delays.

Build Trust and Security

Lack of trust is another common reason (19%) your customers would abandon carts. Therefore, it's key to show visible security badges, SSL certificates, and privacy policies. Opt for secure payment methods such as pay-by-bank or digital wallets.

Enable Guest Checkout

A significant 19% of abandoned carts happened because checkout required account creation. Let customers buy without creating an account. Guest checkout reduces drop-offs.

Simplify the Checkout Process & UX

18% of abandoned carts happen because of complicated checkouts and poor UX. Here are the practical steps you may want to take to simplify the flow:

- Cut down the number of checkout steps—ideally, aim for a one-page or one-click checkout.

- Use auto-fill tools so people don’t have to type in everything manually. It saves time and lowers mistakes.

- Show where customers are in the process with a simple progress bar. It keeps them on track.

- Remove any distractions—like pop-ups, footers, or busy headers. Keep the focus on completing the purchase.

- Let customers update their cart, add discount codes, or change items without leaving the page.

Transparent Return Policy

15% of the carts were abandoned due to poor return policy. This is again the influence of e-commerce giants like Amazon, who offer free and easy returns.

- Show your return policy clearly: Add it to product pages, checkout, and confirmation emails. Use plain English—explain how much time customers have, what can be returned, and how refunds work.

- Make returns easy: Offer prepaid return labels or free return shipping. Keep the steps simple—no printing, no long forms.

- Offer longer return windows: Give customers 30, 60, or even 90 days to return. It builds trust and removes pressure, especially for high-ticket or gift purchases.

Optimise for Mobile

This year’s survey didn’t highlight it, but poor mobile checkout has been a common issue in past reports. As mentioned earlier, Millennials and Gen Z prefer shopping on mobile—so your checkout needs to work smoothly across all screen sizes.

- Make sure your e-commerce checkout flow works perfectly on mobile, tablet, PC.

- Use big, easy-to-tap buttons and simple forms. That way, customers can check out quickly—even on a small screen.

Offer More Online Checkout Options

10% of customers left as their preferred payment method wasn’t available. Another 8% left because their card was declined. That’s a lot of lost sales. Here’s how to fix it:

- Add variety: Offer cards, digital wallets, pay-by-bank, and local methods–these vary by country and demographic.

- Use smart routing: Choose a payment provider that can automatically reroute failed payments to improve success rates. At Noda, for example, we offer smart routing for all card payments.

Why Open Banking Improves Online Checkout

A great solution to fix many common checkout problems is open banking.

Pay-by-bank lets customers pay directly from their bank accounts, authorising the payment via the bank’s app or website. Merchants can add it through a simple integration. Here is what problems it solves:

- Trust and security: Open banking uses the customer bank’s own biometric authorisation—like fingerprints or Face ID—for every payment. No checkout details are entered or stored, so there’s less risk of data leaks or fraud. Payment info is auto-filled straight from the bank, which helps prevent errors and scams.

- Simple checkout, superior UX: Open banking makes online checkout faster, simpler, and smoother. No need to type in long card details—customers just pick their bank, approve in their app, and the payment’s done. Fewer clicks mean less friction, and payments settle instantly.

- Built for mobile: Open banking is made for mobile. The app-to-app flow is smooth and fast, without clunky forms. It’s a seamless experience that works perfectly on smartphones, and is favoured by GenZ.

- Global payment method: Open banking is growing fast across Europe and beyond. At Noda, we connect to 2,000+ banks in 28 countries—so customers are more likely to find their trusted bank at checkout.

- Higher acceptance rates: As open banking payment happens from account to account, there is no risk of a card declining. Card networks are simply not involved in the transaction.

- Lower fees for merchants: For that same reason, there are no card fees such as scheme or interchange charges, which makes transactions more cost-efficient. There are also no chargebacks.

Create a High-Converting Checkout with Noda

Build the best online checkout with Noda’s Open Banking.

Connect to 2,000+ banks across 28 countries, accept multiple currencies, and process transactions instantly—with no card fees or chargebacks. Use our Open Banking API or choose no-code ecommerce plugins, payment links, QR codes, and branded payment pages—no dev team needed.

Plus, we offer card payments alongside pay-by-bank, so your customers always have a flexible way to pay. Whether it’s pay-ins, payouts, or both, Noda makes checkout faster, smoother, and more secure.

Take your online checkout to the next level.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each