Marketplaces have been a cornerstone of commerce for centuries. Today, they've shifted online, giving rise to platforms like Amazon, AliExpress, Etsy, and many more. According to Statista, as of April 2023, 35% of all online purchases were made on marketplaces. That's more than double the 14% made on direct-to-consumer websites.

Open banking is a relatively new framework that enables direct bank-to-bank transfers through data sharing via APIs. It has great potential to improve marketplace operations, making them more efficient and user-friendly in the digital world. Here, we take a look at the open banking integration for marketplace businesses.

Marketplace Payments & Payouts

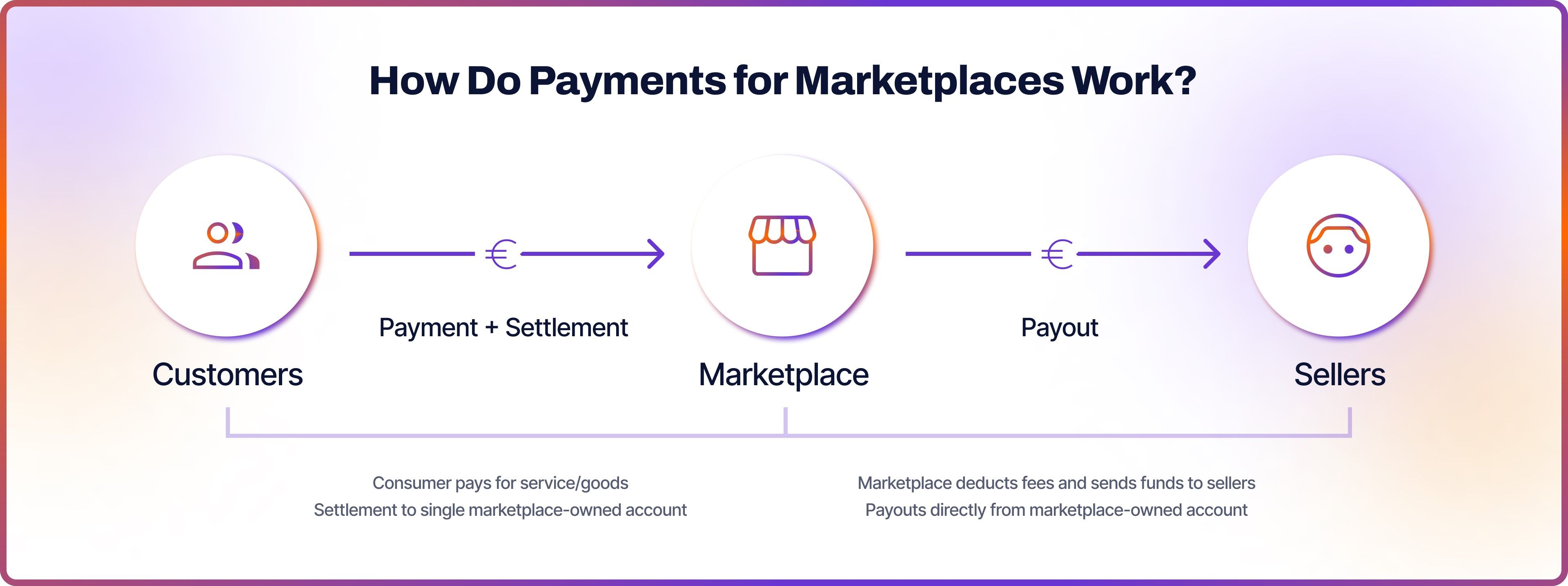

Unlike traditional e-commerce platforms where buyers pay sellers directly, marketplace payment gateway is more complex.

Marketplaces essentially act as an intermediary between buyers and sellers. When a buyer makes a purchase, the payment is first received by the marketplace. The marketplace then takes its commission before forwarding the remaining amount to the seller.

Therefore, a payment gateway for a marketplace would require the following features:

- Commissions: Marketplaces typically charge sellers a fee for sold products or services, covering the cost of the platform. There are three types: fixed, variable, and compound.

- Split Payments: Marketplaces enable buyers to purchase from various sellers in one go. After receiving the payment, the marketplace takes its commission and splits the remaining funds between sellers.

- Payouts: Marketplace payouts involve sending money from the marketplace to the seller’s bank account. The marketplace may schedule payouts weekly, monthly, or after each transaction. It can also offer manual payout requests.

Key Challenges of Marketplace Transactions

Competition between suppliers and sellers is growing, and shoppers expect more, especially when it comes to user experience (UX).

The Baymard Institute reports that 70.19% of online shopping carts are abandoned. A long and complicated checkout process was responsible for 22% of these abandonments. Additionally, marketplaces constantly fight against fraud and chargeback loss.

What Are Open Banking Payments & Payouts?

Open banking payments and payouts are rooted in the ecosystem of data sharing via APIs. Before EU’s PSD2 enacted in 2018, traditional banks held a monopoly over customer data. With the introduction of open banking, however, they are required to share information with licensed fintech companies if customers have given consent.

This data-sharing via APIs has fuelled innovation in many areas, including payments. Open banking transfers, commonly referred to as pay-by-bank, happen from account-to-account (A2A), avoiding costly card networks. This means faster and cheaper transactions.

Plus, open banking payments are superior in terms of user experience. Users don’t need to enter payment details manually. The open banking flow directs them to their trusted banking interface, where they complete authentication and authorise the payment. The same flow works for payouts.

For marketplaces, open banking cuts costs, improves shopping experience and reduces cart abandonment – no surprise it’s rapidly gaining momentum around the world. In 2022, A2A payments made up 9% of global e-commerce transactions, according to Statista.

Benefits of Open Banking Integration

- Speed: Open banking allows sellers to receive payments faster. Instant payouts are possible without manual verification. It also provides transaction insights, enabling value-added services like cash advances during slow months.

- No Chargebacks: Payments go directly from the buyer's to the seller's bank account, bypassing card networks and PCI compliance. These payments are irrevocable, eliminating chargeback risks.

- Lower Costs: Open banking reduces transaction costs significantly. Account-to-account payments are cheaper as they bypass card networks that add commissions. These payments also minimise costs related to reconciliation and chargebacks.

- Personalisation: Transaction data helps understand customer spending patterns. This information allows targeting shoppers with relevant products, services, and deals at the right time.

How to Integrate Open Banking Payments into Marketplace

There are multiple ways to add open banking payment gateway for a marketplace platform.

Integration with an Open Banking Provider

When partnering with an open banking payment provider, marketplaces have two options of payments integration: via APIs or special integration tools.

- Open Banking API Integration: offers a customisable payment journey but demands more time and technical knowledge for implementation.

- Integration tools such as hosted payment pages (HPPs) or software development kits (SDKs) provide easier integration for developers, though comes with slightly less customisation.

The marketplace payment provider typically guides you through the integration process and outlines your responsibilities. Sometimes, they may assign a specialist to oversee your setup. Experienced providers usually have a history of successful integrations and can offer advice tailored to your specific situation.

Make sure to discuss the following questions with your provider:

- Integration Template & Timeline: Typically a provider will inform you on how long the integration will take, and the key dates.

- Objectives: Be sure to discuss your objectives with the provider. For instance, do you aim to increase acceptance rates? Reduce costs? This service should help you meet your goals, so clear communication is essential.

- UX/UI Recommendations: Your provider can advise you on the best UX and UI approach for your specific situation.

Future of Open Banking Payments

The swift uptake of open banking payments in payments is anticipated to grow even faster. Statista forecasts that A2A payments will make up 10% of all online transactions by 2026. Presently, they rank as the fourth most popular payment method worldwide, following digital wallets, credit cards, and debit cards.

Open Banking Payments with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration of open banking services.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

FAQs

What are the main advantages of open banking for marketplace business?

Some of the advantages include faster and cheaper transactions, reduced chargeback risks since payments are irrevocable, and enhanced user experience by eliminating the need for manual payment entry. Additionally, it provides valuable transaction insights that can help tailor marketing and service offerings.

How do I start integration with Noda?

First, you need to be onboarded with Noda. Just fill out the form, and our sales team will reach out to you soon. We provide seamless onboarding with personalised support from a dedicated manager, who would also help with integration.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each