Marketplaces have been central to commerce for centuries, from Istanbul's Grand Bazaar to Barcelona's La Boqueria. The modern age, however, has moved marketplaces online.

These new digital marketplaces – Amazon, AliExpress, Etsy, the list goes on – connect buyers and sellers, just like traditional markets. As of April 2024, Statista reports that 29% of all online purchases were made on marketplaces. That’s more than double the 9% on direct-to-consumer websites.

Yet serving as a touchpoint between multiple sellers and customers may have its drawbacks. Managing payments for marketplaces is complex, involving both efficient pay-ins and payout systems. Here, we take a look at different marketplace payment solutions and what may be the best system for your marketplace business.

What Are Marketplace Payments?

Marketplace payments refer to transactions on third-party platforms that connect buyers and sellers under one marketplace brand. These marketplaces can be general, like Amazon, or niche, like ASOS for apparel or Vinted for vintage and second-hand clothes.

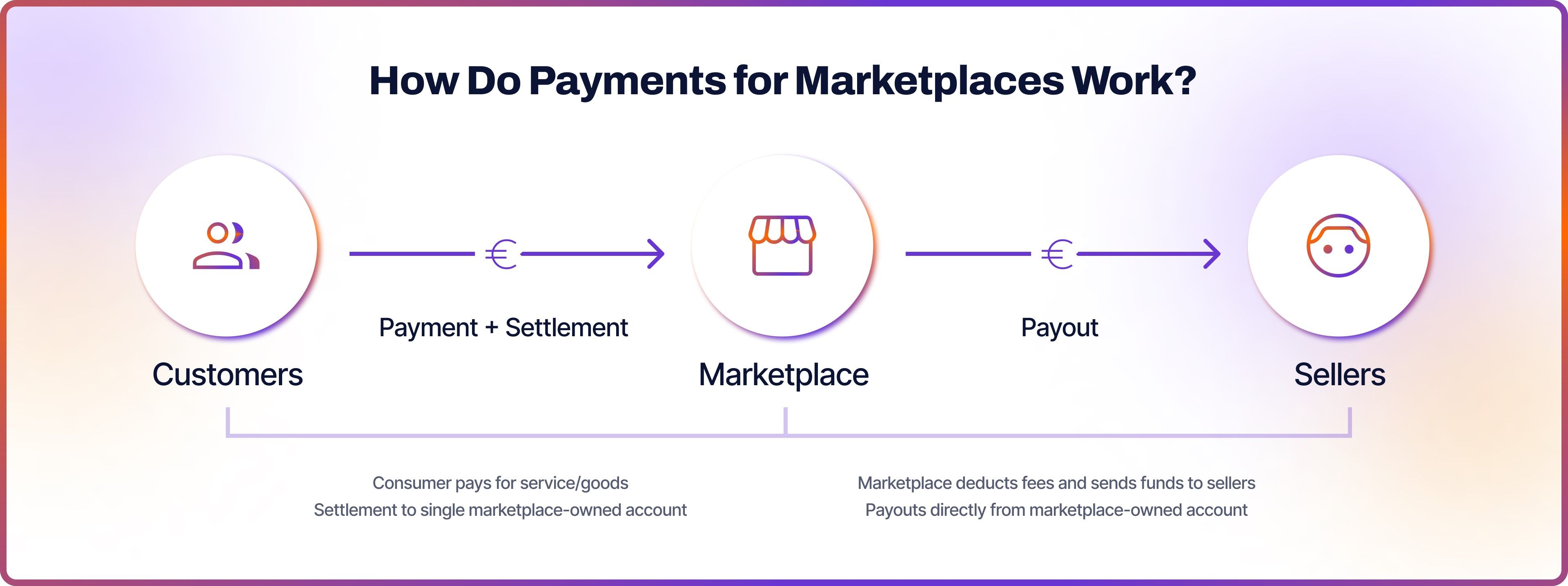

How Do Payments for Marketplaces Work?

Unlike e-commerce sites that take payments directly from buyers, marketplaces interact with both buyers and sellers. When a buyer makes a payment on a marketplace, they pay the marketplace first. The marketplace then takes a commission and pays out the seller.

Difference Between E-Commerce and Marketplace Payments

On the technical side, there are key differences between e-commerce and marketplace payments. E-commerce websites require a relatively simple payment gateway. In contrast, a marketplace payment system must support features like pay-ins, payouts, commissions, and split payments.

Marketplace Payment Processing

We’ve established that marketplace payment processing is more complex than direct e-commerce. Let’s take a look at the steps now in more detail.

Step 1: Buyer makes a payment

- The buyer selects a product and initiates a checkout on the marketplace.

- They choose a payment method (e.g., card, pay-by-bank, digital wallet).

- The marketplace’s payment gateway encrypts the transaction details and sends a request to the issuing bank.

- If authorised, the payment is captured, and funds are temporarily held by the marketplace.

Step 2: Marketplace holds the funds

- Usually, the marketplace does not immediately transfer funds to the seller. It holds them in escrow or a designated account. A waiting period may apply to manage refunds, disputes, or order fulfillment.

- The marketplace deducts its commission or transaction fees from the total payment.

- The remaining funds are prepared for payout to the seller.

Step 3: Marketplace sends a payout to the seller

- The payout process begins based on the marketplace’s schedule (e.g., daily, weekly, or after order completion).

- The marketplace initiates a transfer to the seller’s bank account or digital wallet.

- The seller receives the funds, completing the transaction.

Marketplace Fees and Commissions Explained

Marketplaces usually charge sellers commissions for sold products or services. This fee covers the cost of providing the platform and connecting sellers with buyers.

There are three types of commissions: fixed, variable, and compound. Fixed commission is a set amount or flat fee per transaction, ideal for low-value sales. Variable commission is a percentage of the transaction value, like 5%. Compound commission combines both a fixed fee and a percentage-based fee on the transaction value.

The commission process generally works like this:

- The marketplace charges a fee for facilitating transactions.

- This fee, either a fixed amount or a percentage, is applied to the total transaction value.

- The marketplace deducts the commission from the received payment.

- The remaining balance is then paid out to the seller or service provider.

Marketplace Split Payments

Marketplace works with multiple vendors. This means a buyer can simultaneously add products from various vendors into their shopping basket - as they would do in a physical grocery store.

Once the marketplace receives the total payment from the buyer, it should deduct the marketplace fees and then distribute the remaining funds to the respective sellers accurately and efficiently. This is where marketplace split payments come into play.

How Marketplace Split Payments Work

Marketplace split payments automate the process of dividing buyer payments between sellers while deducting marketplace charges. Here’s how it works:

Split Calculation

The system calculates how the payment should be divided. It determines the marketplace’s commission or service fees, then calculates the amount due to each seller. Any additional costs, such as processing fees or taxes, are factored in automatically.

Fund Allocation

Once the calculations are complete, the payment is split into separate portions. The marketplace retains its commission while each seller is allocated their share. Any relevant fees are deducted before the funds are prepared for payout.

Disbursement (payouts to sellers)

Finally, the allocated funds are disbursed. The marketplace keeps its portion, while sellers receive their earnings either instantly or after a designated holding period. The entire process is automated, eliminating the need for manual calculations and ensuring that payments flow smoothly.

Marketplace Payouts

Payouts are the feature that is key to marketplace payment systems. They involve sending money from the marketplace to the seller’s bank account. The marketplace may set up a payout schedule, like weekly or monthly marketplace payout, or after the transaction is complete. It might also let sellers request a manual payout.

Marketplaces often maintain a balance for each seller, which increases as the seller generates income. Sellers can use this balance to make purchases within the marketplace (an example of this is Vinted), or withdraw funds to their bank accounts.

Marketplace Payments & Payouts with Noda

Noda is a marketplace payment solution that goes beyond card payments – we offer superior open banking payment and payouts. Our payment platform also delivers advanced data solutions and no-code payment options.

Our Open Banking API provides a seamless user experience, reduces fees, and eliminates chargebacks. With connections to over 2,000 banks across 28 countries, we support multiple currencies and operate globally, reaching beyond the UK, Europe and beyond.

We offer plugins for top e-commerce marketplaces like OpenCart, WooCommerce, Magento, and PrestaShop, ensuring seamless integration.

Noda enhances conversions with a streamlined checkout form powered by AI-driven routing for real-time payments. For businesses with limited tech resources, our no-code payment pages, links and QR codes provide smooth setup.

Additionally, Noda’s advanced data tools, including secure bank login and Know Your Whales (KYW) insights, enable better customer behaviour predictions and informed decision-making.

With transaction-based pricing, Noda simplifies payments and accelerates your marketplace growth.

Marketplace Payment Options

A successful marketplace business needs to offer a variety of popular payment methods for both buyers and sellers to avoid shopping cart abandonment.

These payment methods often vary by region and demographics, but most widely used options worldwide include: digital wallets, credit and debit cards, pay-by-bank (open banking payments), and more.

Open Banking Payments

Open banking payments allow users to pay directly from their bank accounts via account-to-account (A2A) payments – commonly referred to as pay-by-bank - avoiding card networks. This marketplace payment solution is secure and fast. It offers lower transaction fees (as card networks aren’t involved), no chargebacks and superior UX.

Open banking payments are accelerating in adoption. The number of global open banking payment transactions is projected to increase by 209%, reaching 186 billion transactions by 2029. In Europe, they are fully regulated under PSD2.

The UK is leading the adoption, with 11.7 million active users as of 2024. Approximately 13% of digitally active consumers and 18% of small businesses in the UK are using open banking services.

At Noda, we offer open banking payments and payouts for marketplaces. We partner with 2000+ banks in 27 countries and over 30,000 bank branches worldwide.

Digital Wallets

Wallets like PayPal, Apple Pay, and Google Pay allow users to store and use their payment cards securely online, on both mobile and web interfaces.

They are now taking over traditional payment methods such as cards. According to Juniper Research, over two thirds of the global population will own a digital wallet by 2029.

Cards

Credit and debit cards are widely accepted and trusted by consumers. They are the “habitual” payment method, commonly used for online shopping.

Yet cards are losing the momentum, compared to alternative payment methods. They currently represent 41% of e-commerce payments but are projected to fall to 33% by 2026.

Buy Now Pay Later (BNPL)

BNPL services like Klarna and Afterpay let customers purchase items immediately and pay for them in installments over time. BNLP payments have gained momentum since the global pandemic.

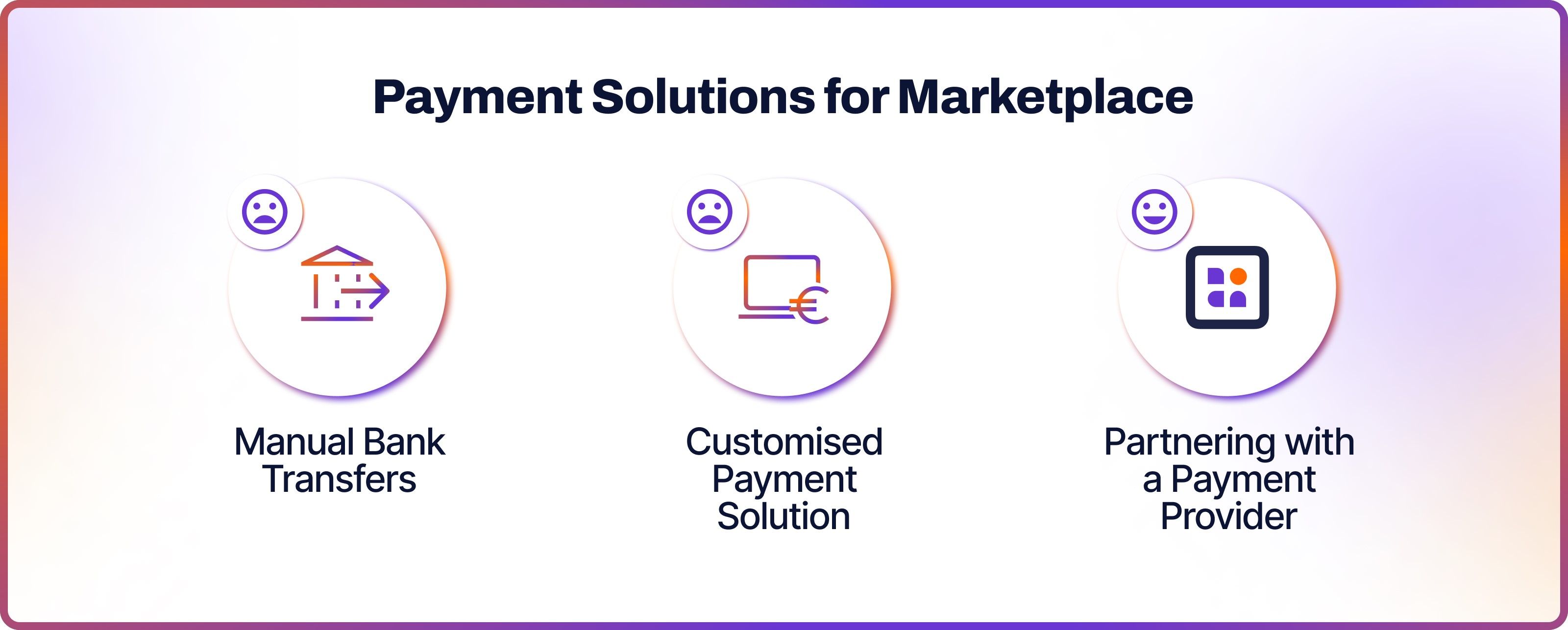

Common Online Marketplace Payment Solutions

From a technical standpoint, there are several ways of setting up a payment system. The most common online marketplace payment solution is partnering with a marketplace payment service provider, like Noda.

Customised Payment Solution

It’s possible to build your own marketplace payment system, tailored with all the features and functionalities you need. However, there are several considerations.

First, development time and cost are significant. Creating a custom payment solution can take several years and would involve hiring specialists.

Security and compliance may become a problem, too. You'll need a specific license from the regulator to be able to process payments, complying with PCI DSS, PSD2 and soon PSD3. Obtaining these licenses is a complicated process.

Parenting with a Marketplace Payment Provider

Partnering with a third-party payment processor like Noda simplifies payments for marketplace businesses and offers numerous benefits.

Specialised marketplace payments solutions typically provide a wide selection of popular payment methods such as cards, digital wallets, BNPL, and open banking payments. Integration is straightforward and requires minimal effort from your team, thanks to clear documentation and technical support.

Additionally, licensing is easier since the processor controls the funds, reducing risk for your platform, sellers, and buyers. Leading providers also offer transaction monitoring tools to prevent fraud.

When choosing a payment solution for your marketplace, consider their expertise in your market, the payment methods they support, scalability, pricing, and the advanced features they offer.

Choosing a Marketplace Payment Solution

Selecting among many marketplace payment solutions requires careful consideration.

The provider should support a wide range of payment methods that match your marketplace’s customer base, including local payment options and multiple currencies if you operate internationally.

Look for a provider with expertise in your industry, scalable infrastructure, and competitive pricing. Look for features like automated split payments, fraud prevention, and seamless payouts.

Most importantly, the solution should integrate effortlessly with your existing setup to ensure a smooth experience for both merchants and buyers. Check reviews and testimonials from other merchants to gauge the solution's reliability.

Marketplace Payments with Noda

Noda goes beyond card payments, offering faster, smarter, and more cost-effective payment solutions for marketplaces powered by open banking. Accept payments and send payouts seamlessly, cutting fees and eliminating chargebacks with direct account-to-account transfers.

With access to 2,000+ banks across 28 countries, Noda supports multiple currencies and operates globally, making expansion effortless. Easy integration is at the core of our platform – whether through Open Banking APIs or plug-and-play plugins.

Optimise conversions with an AI-powered checkout that ensures real-time, frictionless payments. For businesses without in-house tech teams, our no-code payment pages, links, and QR codes offer instant setup.

Noda’s advanced data tools provide deep customer insights, from secure bank login authentication to Know Your Whales (KYW) analytics, helping you make smarter business decisions.

One platform. All payment methods. Maximum growth.

Best Marketplace Payment Solution: Compare

| Noda | Adyen | Braintree | Stripe | Mangopay | |

| Integration | APIs, plugins | API, plugins | API, SDKs | API, SDKs | API, plugins |

| Card payments | Yes | Yes | Yes | Yes | Yes |

| Open banking payments | Yes | Yes | No | Yes | No |

| Payouts | Yes | Yes | Yes | Yes | Yes |

| Coverage | 28 countries, including EU and UK | 33 countries, including EU and UK | 45 countries, including EU and North America | 46 countries, including EU and North America | EU and the UK |

Learn more about how to choose the best marketplace payment gateway.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each