Expanding your business globally comes with huge opportunities—but also big challenges. If you’re selling to customers in different countries, you need a payment system that works everywhere. A clunky checkout experience, high transaction fees, or limited payment options can lead to shopping cart abandonment and lost revenue.

This is where an international payment gateway makes a difference. Whether you’re a small online store testing new markets or a large company scaling worldwide, the right payment solution makes it easy to accept global payments.

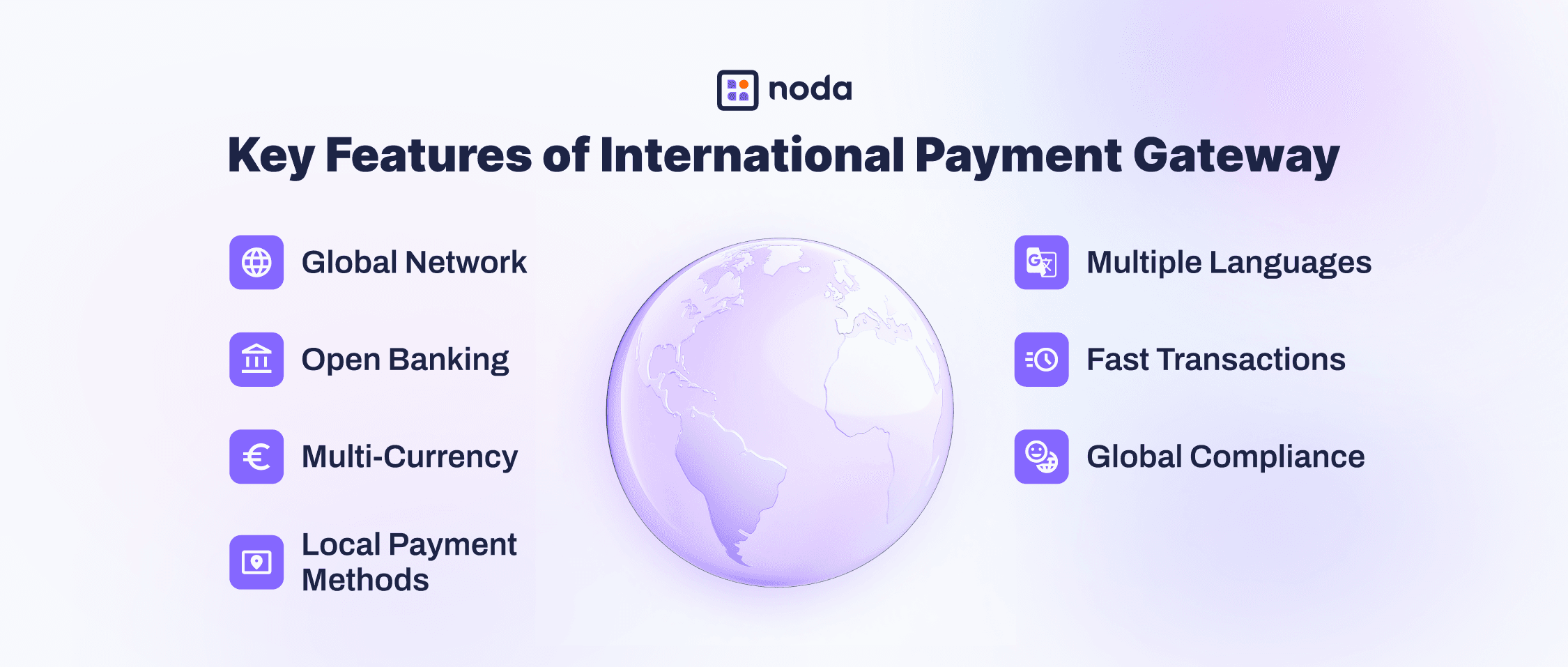

In this article, we’ll break down what to look for when choosing the best international payment gateway for your business.

What Is an International Payment Gateway?

A payment gateway is an important tool in digital payments. It acts as a middleman, collecting and encrypting payment data from the customer on the merchant’s website or app, and securely routing this information to the payment processor and appropriate financial networks for authorisation.

An international payment gateway is exactly that, but for cross-border payments. It lets businesses accept payments from customers in different countries, processes multiple currencies, supports local payment methods, and routes money safely across international financial networks.

International Payment Challenges

To see why an international payment gateway matters, let’s look at the common payment challenges businesses face when selling globally:

- High costs: International transactions come with high costs, such as card processing fees and currency conversion, just to name a few. These can add up quickly and eat into your profits.

- Slow transactions: Cross-border payments can take days to process, causing delays and cash flow problems.

- Payment method limitations: What works in one country might not work in another. For example, while North American customers rely on credit cards, Asian markets prefer digital wallets like Alipay and WeChat Pay. If customers can’t find their preferred payment method, they may leave without completing their purchase. This accounts for 13% of all abandoned carts.

- Complex regulations: Every country has its own financial regulations, making compliance a challenge. For example, it’s the PSD2 regulation in Europe, NPP in Australia and The Fintech Law in Mexico. Failing to meet local requirements can result in fines or blocked transactions.

How International Payment Gateway Helps Merchants

A payment gateway for international payments makes cross-border transactions easy by taking care of the complexity behind the scenes. It converts the transaction’s currency, navigates regional regulations, and connects to local banking networks so your customers can use their preferred payment methods. Meanwhile, you can enjoy more predictable transaction flow and settlement times.

Network of Global Acquirers

International payment platforms can help you avoid high fees from local banks by connecting you to a global network of acquirers. They can offer optimised transaction routing and lower fees than when working directly with individual banks.

In payment processing, acquirers are the banks or financial providers that receive payments on behalf of merchants. An international gateway works with multiple acquirers worldwide, allowing it to process payments in different currencies and regions. For example, at Noda, we are working with acquirers from 28 countries.

To improve approval rates, many gateways, including Noda, use smart routing. This means if a payment is declined, the system automatically tries another acquirer. Our AI-powered routing finds the best route based on location, cart type, and other factors. This reduces costs and improves approval rates.

Open Banking

Some international payment gateways providers support open banking, a smarter way to process cross-border payments. It’s especially popular in Europe thanks to the PSD2 regulation, and other regions are quickly adopting it as an alternative to cards.

Open banking payments, or pay-by-bank, allow customers to pay straight from their bank accounts. This happens via secure and regulated APIs that banks share with licensed providers like Noda. Customers are redirected to their bank’s interface, where they authorise the payment using their existing banking credentials. Open banking makes checkout smoother and reduces cart abandonment. With no card networks involved, merchants eliminate card processing fees and reduce chargeback risks.

At Noda, our Open Banking payment solution connects merchants with 2,000+ banks across 28 countries, supporting multiple currencies and seamless cross-border transactions. We offer full integration via Open Banking API or quick no-code plugins for e-commerce platforms, so you can add this cost-effective, high-conversion payment option to your checkout smoothly.

Ready to simplify global payments?

Multi-Currency Support

An international payment processor lets customers pay in their local currency while you receive funds in your preferred currency. The gateway would apply current exchange rates with its built-in currency conversion functionality–no separate system or manual process needed.

This often results in more competitive overall pricing for merchants than with traditional banks, which usually require multiple steps and charge high fees for currency exchange. Payment gateways, on the other hand, have the currency conversion functionality built into the processing flow directly.

Local Payment Methods

Payment methods vary globally: for example, AliPay is popular in Asia, while Apple Pay and Google Pay dominate Europe. There are also niche payment methods that vary by country.

Look for a payment gateway accepting international cards and local payment options.The integration for merchants is usually available via APIs, SDKs or plugins.

Multiple Languages

To build a relationship with your customers, you need to speak their language.

Just like currency and payment options, the language of a payment interface matters when serving customers around the world. A familiar language makes checkout smoother and builds trust, increasing conversions.

At Noda, we offer payment interfaces in English, Dutch, Spanish, French, Portuguese, Bulgarian, and Romanian – helping you reach more customers in their native languages across multiple markets.

Fast Transactions

An international payment gateway can speed up transactions by using global partnerships and smart routing. Many countries have real-time payment systems like the UK’s Faster Payments (FPS), Europe’s TIPS, US FedNow, and Brazil’s PIX, which the payment gateway would leverage.

Look for a gateway provider that offers real-time transactions globally. At Noda, for example, we offer instant payments and funds availability so you can manage your cash flow more effectively.

Global Compliance

A payment gateway for international merchants must thoroughly navigate complex regulatory frameworks across all jurisdictions it operates in. This includes maintaining compliance with region-specific requirements for data protection legislation, such as GDPR in Europe, anti-money laundering protocols (AML), and customer identification (KYC) requirements.

The gateway provider must constantly monitor changes in regulations, maintain required licenses in each country they operate in, and conduct robust and regular compliance audits, sometimes with the help of reg-tech software solutions. This effectively transfers the compliance burden from merchants to the provider, and reduces your regulatory risk exposure while enabling global operations.

At Noda, we regularly obtain relevant certifications and maintain up-to-date PCI DSS, PCI SSLC licenses. We also follow key regulations, including GDPR protocols in our data privacy policy.

- Payment Card Industry Data Security Standard (PCI DSS) is the industry benchmark aimed at reducing payment fraud by enhancing data protection controls.

- PCI Secure Software Lifecycle Standard (PCI SLLC) ensures that payment software vendors incorporate security throughout the software development lifecycle, producing applications that are secure by design and robust against attacks

- General Data Protection Regulation (GDPR) sets the rules for how businesses process personal data in the EU. It applies to any company, inside or outside the EU, that collects or processes data from people in the EU, whether they’re selling products, offering services, or tracking online activity. This means businesses worldwide must comply if they work with EU customers.

International Payment Gateway Fees

International payment gateway fees would typically involve:

- Setup fees: A one-time fee to set up a hosted checkout page or integrate an API for custom development. In the UK, prices range from £0 to £200, with more complex setups costing more.

- Monthly fees: A recurring cost to keep the service running. Payment gateway software monthly fee is typically between £0 – £25 per month in the UK.

- Annual maintenance fees: Software updates, operations, and customer support.

- Processing fees: A small cut taken from every payment you process via the payment gateway. There may be higher charges for cross-border transactions.

International Payment Gateway Integration

To start accepting payments, businesses need to onboard and get API credentials from their chosen payment provider.

How to Integrate an International Payment Gateway

- API Integration: The most flexible option, allowing direct payment processing via a server-to-server connection.

- Hosted Payment Pages: A simple method where customers are redirected to a secure checkout page.

- Plugins: No development effort required. This is useful for small merchants who may have limited resources.

- Custom Setup: Businesses with unique needs may require tailored integrations.

Top Three International Payment Gateways with Open Banking

| Noda | TrueLayer | GoCardless | |

| Key product | Open banking, card payments | Open banking | Open banking |

| Countries | 28 | 21 | 31 |

| Settlement currencies | 10 EUR, GBP, CAD, BGN, RON, HUG, SEK, BRL, PLN, DKK | 2 EUR, GBP | 8 EUR, GBP, CAD, AUD, DKK, SEK, NZD, USD |

| Open banking connections | 2,000+ banks | No data available | No data available |

| Interface languages | 8 English, Dutch, Spanish, French, Portuguese, Bulgarian, Portuguese, Romanian | 10 English, Dutch, Spanish, French, Portuguese, German, Italian, Polish, Finnish, Lithuanian | 10 English, Futsch, Spanish, French, Portuguese, German, Italian, Danish, Norwegian, Slovenian, Swedish |

Please note that the information about the companies in this article was sourced from their respective websites as of 3 March 2025. This information may be subject to change.

Go Global with Noda

Reaching global customers shouldn’t be complicated. With Noda, you can accept payments in 28 countries, settle in 10 currencies, and offer checkout in 8 languages – ensuring a smooth, localised experience for every customer.

Noda’s pay-by-bank option eliminates card fees and chargebacks, giving you faster, more cost-effective transactions. Easily integrate via Open Banking API or use our ready-to-go e-commerce plugins for WooCommerce, OpenCart, PrestaShop, and Magento. Open banking payouts are also available.

Beyond open banking, Noda supports card payments, payouts, instant payment links, no-code checkout pages, website checkout forms, and QR codes. Plus, with bank authorisation and data enrichment, you gain deeper insights and smarter payment flows.

FAQs

How do I set up a payment gateway to accept international payments?

To start, you’ll need to onboard with a payment provider that supports international payments. Integration can be done via API, hosted payment pages, plugins, or other types. Before going live, test transactions for smooth processing.

Which is the best payment gateway for international transactions?

The best gateway depends on your business needs. Look for multi-currency support, local payment methods, multiple languages, and fast transactions. Open banking is a smart alternative to cards for cross-border payments.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each