It’s finally happened – your online clothing store is open and ready for orders. But first, you need to set up a fashion retail payment system to ensure smooth transactions. Processing e-commerce payments can be nerve-wracking. It’s crucial for keeping your business running and involves sensitive financial information.

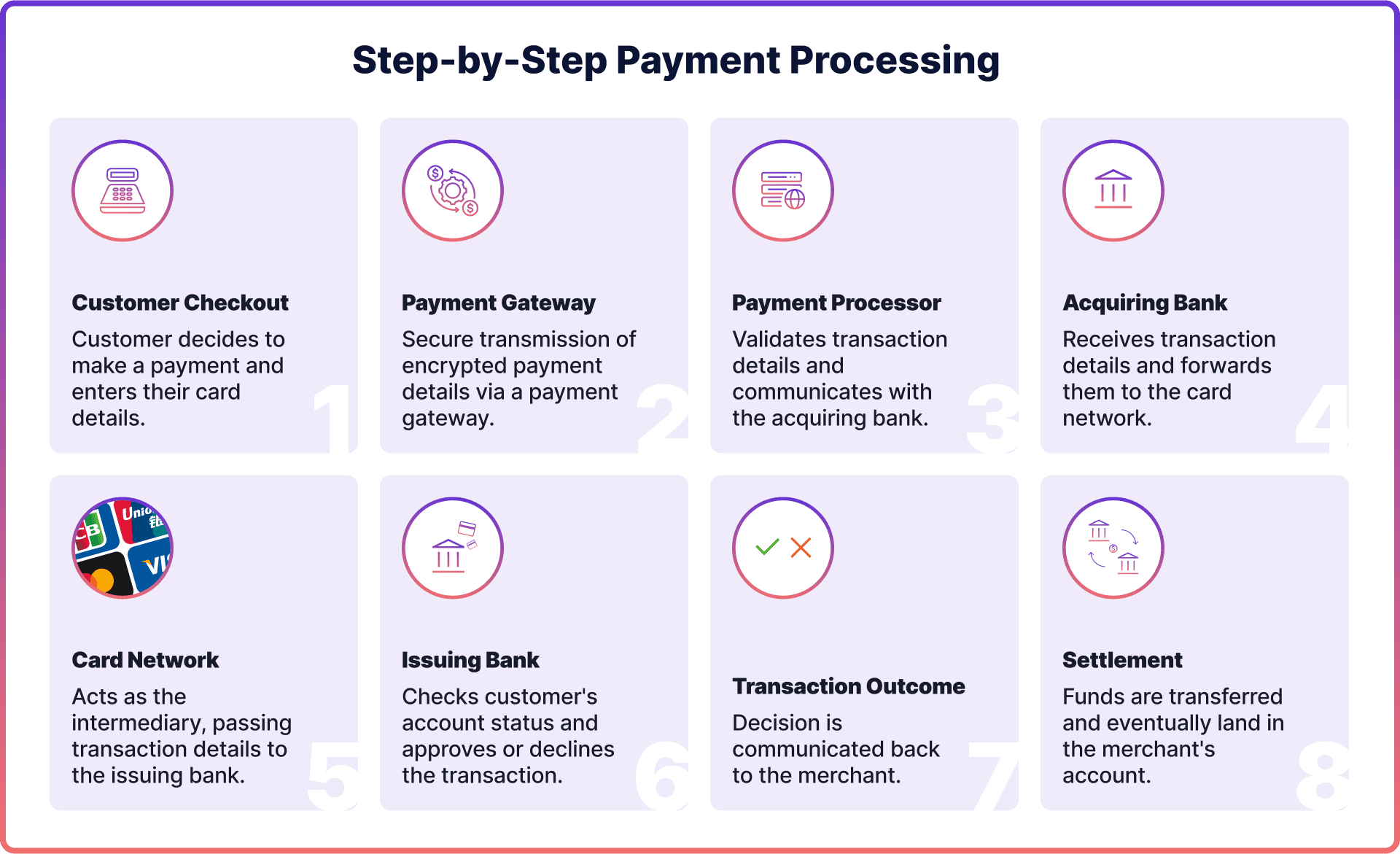

Most customers think paying for clothes online is as quick as clicking a button. However, it involves multiple steps and parties: the customer, merchant, payment processor, merchant account service, and both the customer's and merchant’s banks.

In this guide, we'll explain credit card processing for an online clothing store to help you choose the best fashion e-commerce solutions for your business. We will also discuss integration methods, and alternatives to credit cards such as open banking.

Credit Card Processing 101

The central figure in credit card payment processing is the processor itself. This fashion retail payment system enables your online boutique to accept payments from customers. The flow looks like this:

- Customer initiates the payment

The customer starts the payment process by entering their credit or debit card details at checkout on your online clothing store website or mobile app. These encrypted details are then sent to the processor through a payment gateway, which connects your site to a merchant services provider.

- Processor authorises the payment

The third-party processor then contacts the issuing bank to verify if the customer's account has sufficient funds for the transaction. The payment is either approved or declined. If approved, the customer receives an order confirmation.

- Funds are transferred

Once the customer's payment is authorised and settled, the funds are deposited into the merchant's business account. This process may take a few days, depending on the banks and payment providers involved. The card networks would charge card processing fees – interchange and scheme fees.

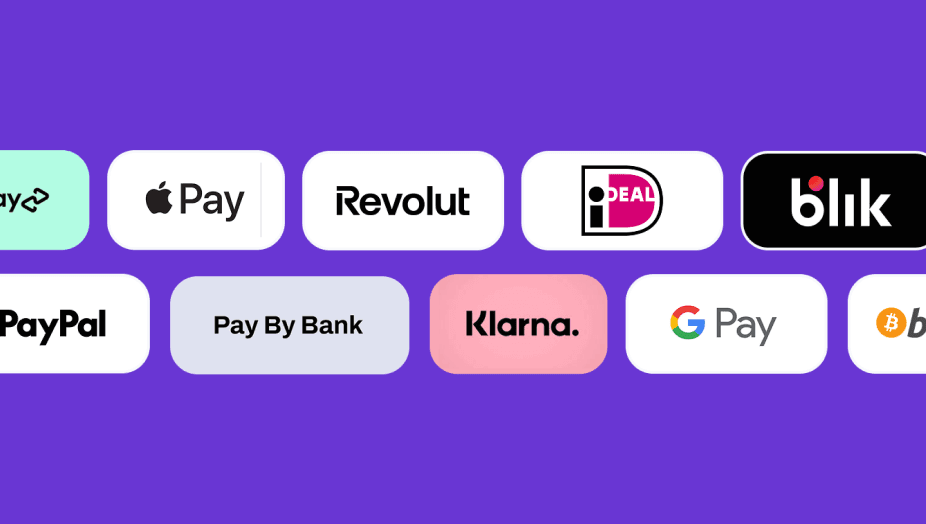

Credit Card Processing via Digital Wallets

A lot of the credit card payment processing today actually happens via digital wallets, such as Google Pay or Apple Pay, where customers store their credit cards. With digital wallets, customers can pay without manually entering card details, which has significant advantages in security and user experience.

The processing looks similar to the credit card payment processing (since it’s still a card transaction). The only difference is that there’s an additional layer of a digital wallet.

Digital wallets are the most popular payment method worldwide, making up almost half – 49% – of all transactions in 2022, according to Statista. They are particularly popular in Asian markets, with Alipay and Tenpay leading the way. Juniper Research predicts digital wallet transactions to grow from $9 trillion in 2023 to over $16 trillion by 2028, so their adoption is likely to continue growing, especially among younger consumers.

Why Credit Cards Fall Short for Fashion Merchants

Credit cards are still widely used—but they come with major drawbacks for online sellers. Let’s take a look at some of them.

Hidden Risk of Online Card Payments

Online card fraud is rising fast—and online clothing shops are prime targets. In 2022, over 70% of global card fraud came from online card transactions. In the UK alone, it’s up 26% since 2020.

By 2026, Mastercard expects losses to hit $28 billion. Why? Because there’s no way to check the card or confirm the buyer’s identity online. That makes it easy for fraudsters to use sophisticated social engineering techniques and triangulation fraud. For fashion brands selling online, this means chargebacks, lost revenue, and growing security costs.

Online Card Payments Are Expensive

Card payments cost more online—especially for cross-border transactions, which can be costly for fashion brands targeting global clientele. That’s because they carry higher fraud risks. To cover this, card networks charge extra fees. Here’s a quick look at standard interchange rates set by EEA regulations for debit and credit card transactions.

| Card type | Transaction type | Card present (in-store via card reader) | Card not present (online transactions) |

| Debit | Domestic | 0.2% | 0.2% |

| Inter-regional | 0.2% | 1.15% | |

| Credit | Domestic | 0.3% | 0.3% |

| Inter-regional | 0.3% | 1.5% |

Souce: MerchantSavvy, April 2025.

You can check up-to-date regional interchange Visa debit and credit processing fees here, and Mastercard processing fees here.

Read: How to Reduce Card Processing Fees as a Merchant

Open Banking: Credit Cards Alternative for Clothing Stores

If you run an online clothing store, it’s worth considering open banking—also known as pay-by-bank or direct bank payments. In Europe, these payments work through secure bank APIs, introduced by the EU’s PSD2 regulation in 2018 (similar regulations are being developed globally). They let customers pay straight from their bank accounts, without using cards.

That means no card networks are involved, which offers lower fees, and fewer fraud risks. It’s also a faster, smoother experience. Shoppers are taken from your checkout to their trusted bank app to approve the payment via biometric authentication—no sharing their card details, and less risk of fraud.

Pay-by-bank is also getting adopted quickly, especially among digitally native customers such as Millenials and GenZs. They might not have the deepest pockets yet, but they expect speed, simplicity, and security, which pay-by-bank offers. According to Mastercard’s Rise of Open Banking study, Gen Z leads the way in adopting this new payment method.

Why Switch to Open Banking

Here is why you should integrate open banking as one of your fashion store payment options:

- More secure – Uses regulated APIs and bank-grade security like Face ID or fingerprint login. No card details to steal.

- Built for mobile – Perfect for Gen Z and Millennials who shop from their phones.

- Lower costs – No card network or chargeback fees. Great for your revenue.

- Instant settlement – Payments land in your account in real time. No delays or long settlement times like with card networks.

- Smoother UX – No long forms or card numbers. Just a few taps to pay via bank.

- Easy Refunds – Open banking payouts offer a smooth and cost-effective way to refund your customers when they return the item, for example, when ordering multiple sizes.

Integrate Open Banking with Noda

Ready for a better way to get paid? Try Noda’s Open Banking solution. Connect to over 2,000 banks in 28 countries, accept multiple currencies, and process payments instantly—with no card fees or chargebacks.

You can plug in with our Open Banking API or get started fast with no-code plugins for e-commerce platforms and instant payment links and QR codes. Whether it’s pay-ins, payouts, or both, Noda makes it easy to add secure, high-converting payments to your checkout.

Payment Gateway Integration for Online Clothing Store

To start accepting credit card payments, you need to set up an apparel business payment gateway on your website.

This gateway collects card information and passes it to the payment processor. There are various ways to integrate a payment gateway.

Hosted Payment Gateway

A hosted payment gateway, also called a redirect or third-party gateway, takes the customer to a secure checkout page of a third-party provider to enter their credit card payment details. After the payment is processed, the customer is redirected back to your online clothing store's website.

This type of a payment solution for fashion retail may be suitable to businesses that value convenience and security, as it allows them to avoid processing sensitive payment data directly. It offers easy integration and built-in security measures for businesses with limited development resources that need a quick set-up.

No-Code Payments & Payment Links

A good example of hosted checkout is payment links. They’re ideal for small fashion stores that want to start accepting payments without building a full checkout system. Customers are sent to a secure, third-party-hosted page to pay—simple and effective.

With Noda’s instant payment links, you can create a branded, no-code checkout page where customers pay straight from their bank using pay-by-bank. You can even add QR codes for in-person use. No dev work needed. Just set it up and start accepting payments fast.

Self-Hosted Payment Gateway

Self-hosted payment gateway integrates the checkout page directly into your website. This approach requires more work and resources due to its technical complexity and your ultimate responsibility for the security of customer data. The advantage of this type of payment gateway for an online boutique is that it builds a stronger relationship with the clients.

API-Hosted Payment Gateway

An API-hosted payment gateway enables your clothing store to send payment details directly to the processor through application programming interfaces (APIs). These are sets of instructions that enable secure communication between software systems. With this method, your online store doesn't need to store sensitive data on its own servers.

This method is arguably the best fashion retail payment system for merchants as it allows customer data to be collected on the merchant's site, maintaining a seamless user experience and preserving customer trust. The actual processing takes place offsite.

At Noda, for example, we offer Card Payments API and Open Banking API.

You can fully customise the experience, keep customers on your site, and build mobile-optimised flows. But it takes more dev work, and you’ll need to manage PCI compliance and security yourself.

Payment Processing via Plugins

If your fashion brand is built in on a-commerce platform–there could be plugins you can use for credit card processing (and other payment methods processing).

For example, at Noda we offer streamlined open-banking payments through easy integration via e-commerce plugins. The platforms include WooCommerce, OpenCart, PrestaShop, Magento.

Credit Cards or Open Banking? Noda Offers Both

Noda helps online fashion stores grow with flexible, secure payment options—whether you’re taking card payments or switching to open banking.

Set up credit and debit card payments with smart routing, smooth UX, and fast integration.

Or tap into our advanced Open Banking API to accept pay-by-bank transactions—cheaper, faster, and safer than cards. Noda connects you to 2,000+ banks in 28 countries and accepts payments in multiple currencies. We offer integration via APIs, plugins, or no-code payment links & branded checkout pages.

Go further with built-in AI-powered data enrichment tools to forecast customer lifetime value and personalise marketing based on real spending data.

Ready to future-proof your payments? Noda’s got you covered with our merchant services for online clothing stores.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants