Food delivery services made our lives much more convenient. With just a few taps, we can enjoy our favourite meals at home. These services surged in popularity after the global pandemic when in-person dining was shut down. According to Statista, the online food delivery market will reach $1.20 trillion in revenue by 2024.

Yet if a business lacks an efficient payment system, customers will likely abandon orders and choose a competitor. Offering a wide range of popular payment options is crucial. Without it, even the best service will lose out.

In this article, we explore popular food delivery payment methods, their use cases, and benefits. We'll also guide you on setting up efficient payment processing.

Integrating Payments into Food Delivery Business

Before we dive deeper, let's consider the key factors for a food delivery business when its choosing payment methods.

- Multiple Payment Options: Offering a variety of payment methods is essential when serving a diverse clientele. You want to make sure customers don't abandon their orders because they couldn't find their preferred food delivery payment options.

- Simple UX: Tools like one-click checkout can simplify the payment process. Allowing customers to securely save their payment details for future transactions reduces friction and enhances convenience, leading to higher revenues.

- Security: Payment security should be the top priority. Food merchants must focus on the best ways to protect sensitive customer data. When choosing a payment provider, ensure compliance with PSD2 and PCI DSS and review their security measures.

Popular Food Delivery Payment Methods

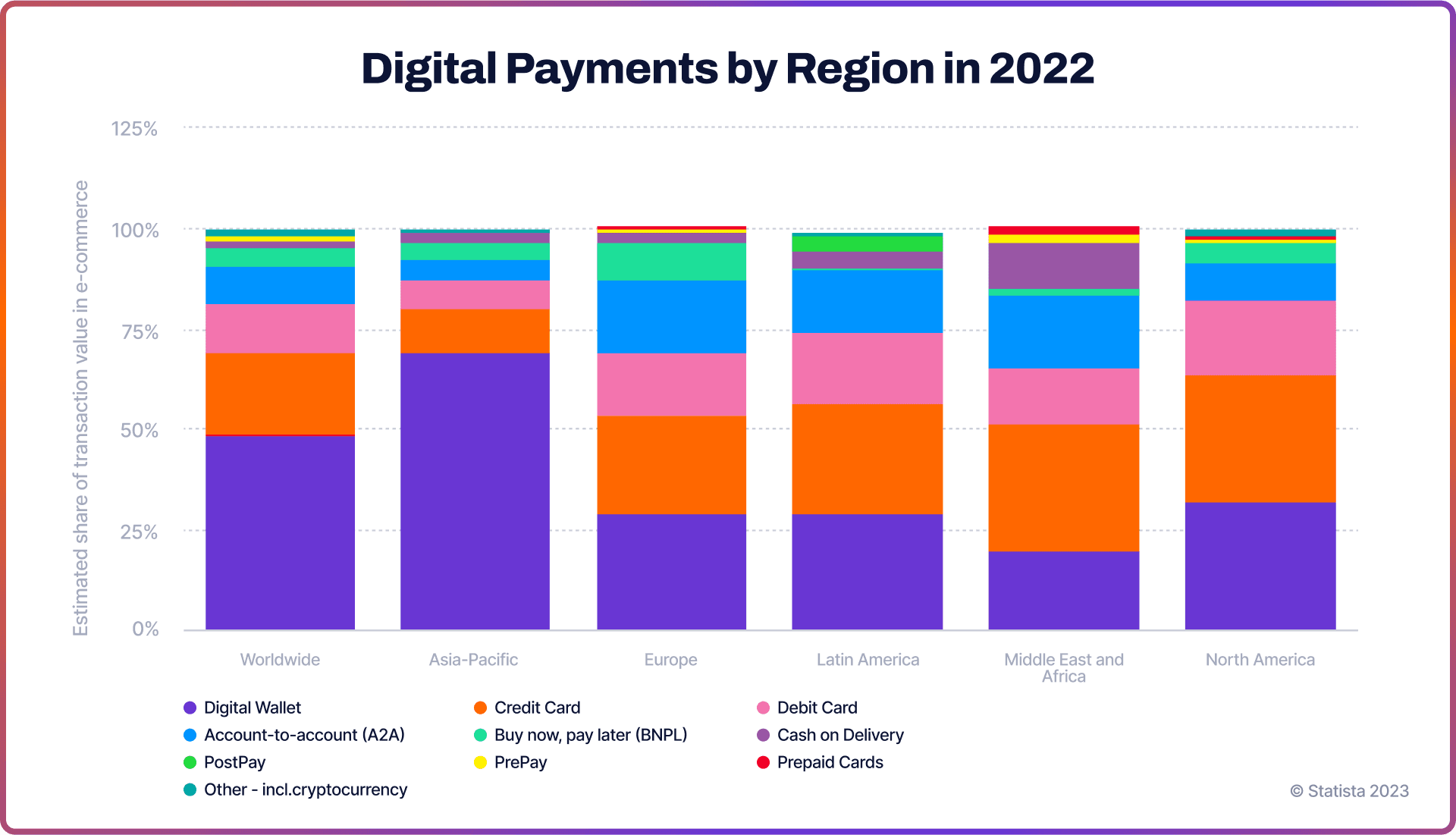

As a food delivery business, it's important to research your customers' payment preferences. These often vary by age, region, and other factors. Here are some of the most popular payment options around the world.

Cash on Delivery (COD)

Cash on delivery (COD) is a traditional payment method where customers pay the rider upon receiving their order. Although still popular in some regions, especially in the Middle East and Africa, this method is declining. As a society, we are moving towards cashless transactions, a trend accelerated by the Covid-19 pandemic.

Credit & Debit Cards

Debit and credit cards have been a trusted payment method since the 20th century. They remain the second most commonly used online payment method globally. For food delivery, customers can save their card details for future orders. Security features, such as multi-factor authentication (MFA), make these transactions safer.

To set up card payment processing for a food delivery business, merchants generally have three options for payment gateway integration.

- Third-Party Payment Gateway

A hosted payment gateway, also known as a redirect or third-party gateway, takes customers to a secure third-party checkout page to enter their payment details. After the payment, they’re redirected back to your food delivery platform.

This gateway suits businesses that appreciate convenience and want to avoid handling of sensitive payment data directly. It offers easy integration and built-in security. However, some customers might hesitate to enter their payment info on a third-party site.

- Self-Hosted Payment Gateway

A self-hosted payment gateway integrates the checkout page directly into your food platform’s interface. This approach may demand more effort and resources due to its technical complexity, and it also means you're fully responsible for securing customer data.

For a food delivery website, the main advantage is building stronger client relationships. Customers trust your site and are less likely to abandon their orders.

- API-Hosted Payment Gateway

An API-hosted payment gateway allows your food delivery platform to send payment details directly to a third-party payment processor using application programming interfaces (APIs). These are sets of instructions that enable secure communication between software systems, so your business doesn't need to store sensitive data on its servers.

This method is ideal for food delivery platforms because it lets you collect customer data on your site, ensuring a smooth UX and maintaining customer trust. Yet the actual processing happens offsite.

Digital Wallets

Digital wallets like Apple Pay, Google Pay, and PayPal have transformed the payment space, becoming the most popular payment method worldwide in 2022. According to Statista, they accounted for nearly half (49%) of all online transactions.

The momentum is expected to grow even more. Juniper Research predicts that the total value of digital wallet transactions will jump from $9 trillion in 2023 to $16 trillion in 2028.

Using digital wallets for online food delivery is incredibly convenient. Customers can place orders quickly and securely without manually entering their card details. These wallets typically feature strong security measures like MFA and biometric authentication.

Buy Now Pay Later (BNLP)

Buy Now, Pay Later (BNPL) lets customers make purchases now and pay later. While it's very popular with e-commerce, it has also been introduced as a payment option for food delivery apps. In 2022, Deliveroo has partnered with BNPL provider Klarna, allowing Deliveroo customers to pay later or spread the cost of their order over three payments.

While still somewhat uncommon for food delivery, BNPL is rapidly gaining popularity. It's already a favourite among Gen Z and millennials. According to Global Data, the BNPL market was valued at $349 billion in 2023.

Open Banking Payments

Open banking, also known as pay-by-bank or account-to-account (A2A), offer an innovative type of online payments for food delivery. Customers don't need to manually enter card details. Instead, they are redirected from the food delivery platform to their trusted bank's interface and back.

The transaction bypasses card networks, transferring money directly from one bank account to another. Some of the benefits of open banking payments include:

- Lower Cost: By avoiding costly card network fees, transactions are cheaper for both businesses and customers.

- Higher Security: Direct bank payments use the bank's secure interface and authentication mechanisms, reducing the risk of fraud and customers’ trust.

- Better UX: The seamless process eliminates the need for manual card entry, providing a smoother user experience (UX).

- No Chargebacks: Funds are transferred directly, so there is no direct mechanism for a chargeback in place.

According to the FIS 2023 Global Payments Report, A2A payments hit $525 billion in global e-commerce transaction value in 2022. The report also forecasted them to account for 11% of e-commerce transactions by 2026.

You can integrate open banking payments via a licensed payment service provider (PSP) like Noda. At Noda, we also offer open banking payouts, which involves sending money in the opposite direction. Payouts are required when you have to pay your drivers for delivery.

There are multiple options to integrate open banking transactions into your food delivery business:

- Direct Open Banking API integration: This approach offers a customisable payment journey but requires more time and technical expertise from your team.

- Integration tools: Hosted payment pages (HPPs) or software development kits (SDKs) offer easier integration experience for developers, though they provide slightly less customisation.

A reliable provider should be able to advise you and guide you through the process. At Noda, we provide personalised support from a dedicated manager who helps with onboarding and integration.

Payments & Open Banking for Food Delivery Business

Noda is a payment and open banking provider. We help merchants with payment processing offer intuitive UX, smart routing and a variety of popular payment methods.

Noda's advanced Open Banking API allows online businesses to easily integrate pay-by-bank transactions – both pay-ins and payouts. With Noda, you can leverage AI-powered data analytics to forecast customer’s lifetime value (LTV) and personalise your marketing campaigns based on customers’ spending.

We ensure the highest security of payments – from PCI DSS compliance to encryption and fraud prevention systems. Noda offers scalable plans and a variety of global currencies, connecting with 2,000 banks across 28 countries (UK, EU, Canada and now Brazil), spanning over 30,000 bank branches. Noda is your partner in growth.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know