Payments are the lifeblood of every business. Like a well-oiled machine, smooth payment processing systems fuel revenue growth and operational efficiency, making them crucial to perfect.

Digital payments surpassed $10 trillion in 2023 and are expected to reach $16 trillion by 2028, according to Statista. With online payments on the rise and cash usage declining, partnering with a reliable merchant payment processor is more important than ever.

What Is a Payment Processor?

A payment processor helps businesses accept online and in-store payments, including bank cards and other payment methods like digital wallets or account-to-account open banking payments. An international payment processor would need to cover regions and payment methods required by the merchant’s client base.

Payment processors act as the bridge, transferring data from where customers put their payment details—be it card readers, online checkout, or mobile phones —to the financial institutions involved in the transaction, making sure the customer has enough funds or credit.

They also usually offer services like integration with a payment gateway as well as payment security features like transaction monitoring, encryption and tokenisation.

What Does a Payment Processor Do?

As mentioned, online payment processors go beyond just facilitating payments (though that's their primary role). Let's dive deeper into each function of a payment processor.

Card Payment Processing

Let’s look at some key terms to understand how payment processor enables card payments.

- Payment Gateway: A payment gateway serves as the checkout point. In a physical store, it's the card machine. Online, it's the payment page where customers enter their details.

- Acquiring Bank: An acquiring bank receives card payments on behalf of a merchant, processing transaction approvals and fund transfers.

- Issuing Bank: An issuing bank provides credit or debit cards to consumers and manages their accounts. In the payment flow, that’s the bank on consumer’s side.

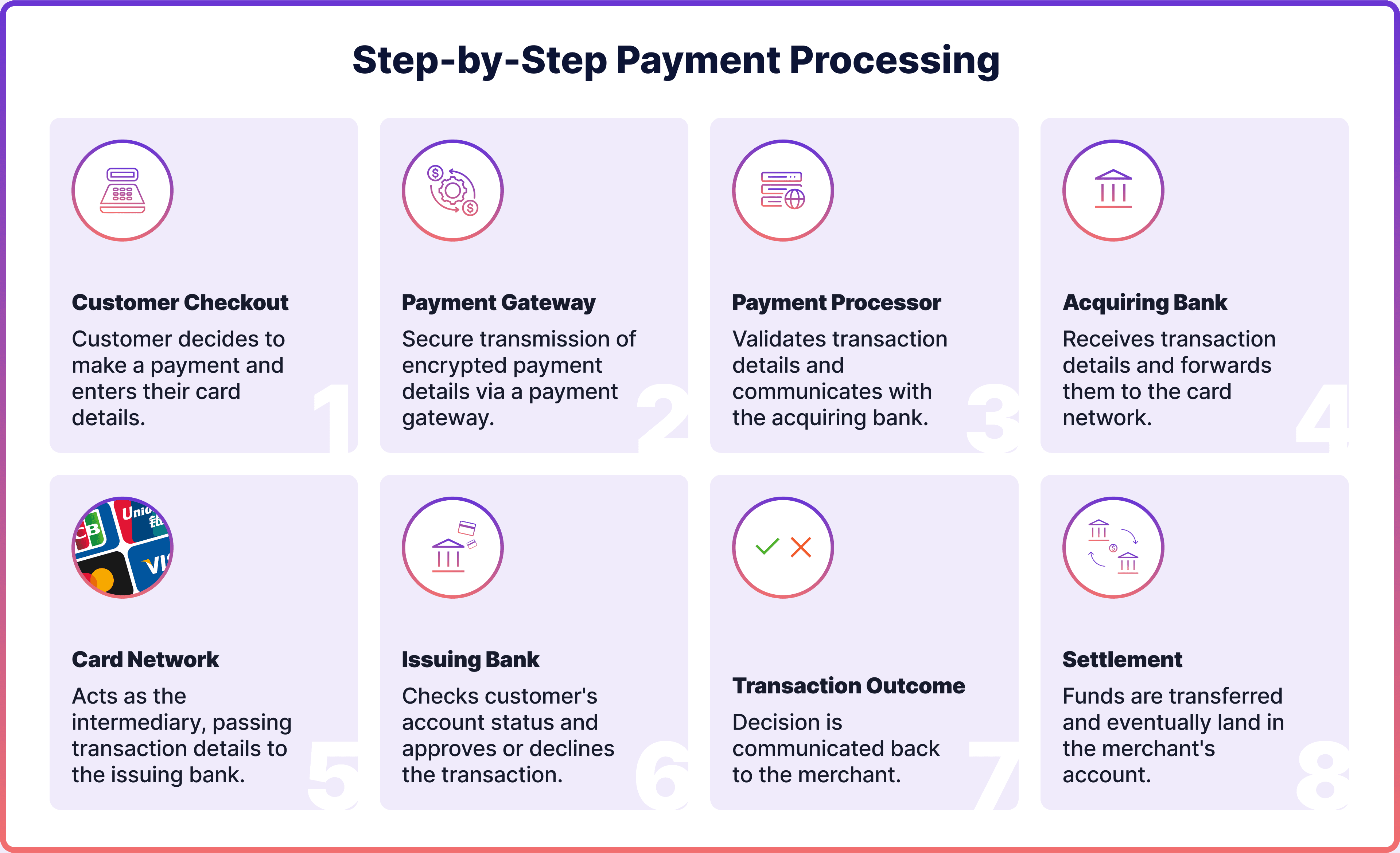

When a customer enters their card details into a payment gateway, the payment processor collects and verifies the information before contacting the acquiring bank.

The acquiring bank sends the transaction details to a card network like Visa or Mastercard, which then contacts the issuing bank. The issuing bank checks the account status and balance to approve the transaction.

Once the issuing bank reviews the transaction, it either approves or declines it. Approved transactions are compiled by the merchant at the day’s end and sent to the payment processor for settlement.

Processing of Other Payment Methods

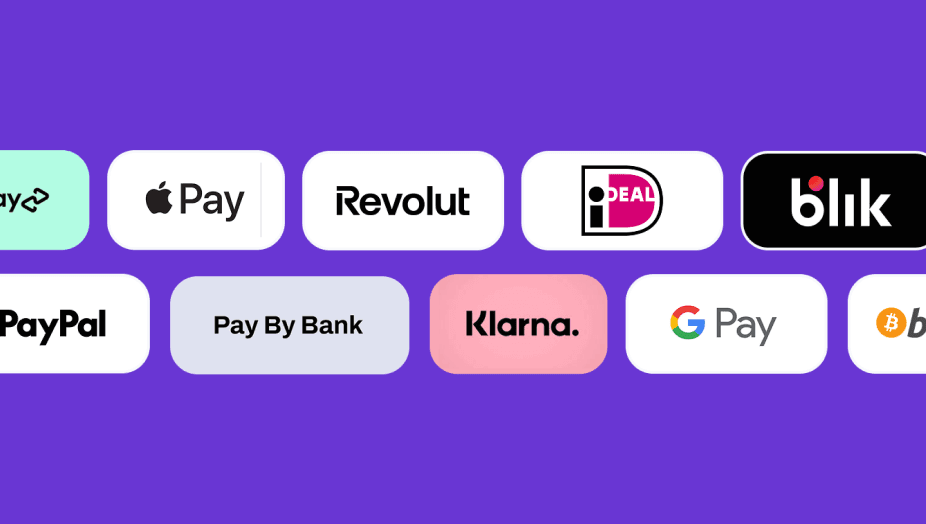

There are many payment methods beyond just cards, and the payment processing flow would vary accordingly. Digital wallets, for example, have become the most popular option globally.

Buy Now Pay Later (BNPL) is rapidly gaining traction, along with account-to-account (A2A) pay-by-bank payments built on the open banking infrastructure. A2A payments avoid card networks, and therefore their flow would be slightly different from cards too.

Understanding your target demographic's preferred payment methods is crucial to make sure your payment processor offers integration with them. Adoption rates vary by region and age group, so make sure to conduct thorough research.

Fraud Prevention

Another essential role of a payment processor is securing transactions. They usually provide an anti-fraud monitoring system, which can be based on rules or machine learning algorithms.

Rules-based algorithms analyse data using the "If x happens, then do y" logic. In-house fraud analysts would typically set and monitor these rules. However, they can miss hidden patterns and struggle to adjust to cybercriminal strategies.

Machine-learning transaction monitoring uses adaptive algorithms trained on millions of data points. Some models mimic human reviewers' actions, learning to distinguish between legitimate and potentially fraudulent transactions. These algorithms typically outperform rules-based by rapidly analysing vast data sets and adapting to new patterns.

Improving Payment Conversions

The ultimate goal of any payment system is to increase successful conversions. A payment processor should help you achieve this, tailored to your current setup and challenges.

For instance, you might be dealing with cart abandonment, a common issue in e-commerce. According to the Baymard Institute, 70.19% of online shopping carts are usually left uncompleted. Some of the key reasons for that are friction at checkout and poor UX, which your payment processor will be able to help with.

Merchants might also face network acceptance issues, where the issuing bank eventually approves the payment. Factors such as customer balance, transaction details, and system availability can impact this. Your payment processor can offer additional verification steps or other tailored solutions to address this problem.

How to Choose a Payment Processor

Selecting a payment processor as a new business or switching providers as an established company is an important decision. Be sure to consider these questions when choosing a provider:

- What features does your business require?

Start by thinking about the payment features you need. For example, would you want the provider to offer a payment gateway connected to the merchant’s account?

Consider the channels and regions you plan to accept payments through and from. For example, you may accept payments as an online store, via invoices with payment links or QR codes offered by B2B payment processors, and mobile in-app purchases. If you plan to offer subscriptions, a recurring payment feature is essential.

Also, think about your customers' preferred payment methods and currencies. Ensure the provider can accommodate these preferences.

- What is the pricing structure?

The pricing structure might include an initiation or start-up fee, an annual fee, a per-transaction fee, or a monthly subscription cost. Determine your budget for the payment system and ensure the provider clearly outlines all costs.

- What is their experience in your industry?

Once you have a list of potential providers, review their experience supporting businesses similar to yours. Check for payment features you identified earlier. Prioritise providers with a solid reputation in your industry as they may have better insights and therefore offer better solutions.

- What’s their integration template?

Integration is key, and your provider should support you throughout the process. Some providers offer integration via APIs, while others provide plugins, hosted payment pages (HPPs) and software development kits (SDKs). Ensure you ask about the integration template and timeline, as well as your objectives and their key UX/UI recommendations.

- What are their compliance policies?

Make sure the provider complies with all relevant regulations and standards. For instance, they should adhere to PSD2 requirements and be PCI DSS certified if they process card payments. This compliance ensures that your transactions are secure and meet industry standards.

Payments & Open Banking with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing service, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

FAQs

Do I need a payment processor?

Yes, a payment processor is essential for businesses to accept online and in-store payments. It ensures smooth transactions and helps secure customer payment information.

How do I choose a payment processor for my business?

To choose the best payment processor for your business, consider the payment features you need, the channels and regions you operate in, and your customers' preferred payment methods. Ensure the provider has relevant industry experience, clear pricing, and robust integration and compliance support.

What are the different types of payment processors?

There are two main types or examples of payment processors: Payment Service Providers (PSPs) and Merchants of Record (MoRs). PSPs have lower service fees and focus on facilitating payments. MoRs have higher fees but offer additional services like tax management, global compliance, and user support, taking full responsibility for sales.

What is the difference between a payment gateway and a payment processor?

A payment gateway serves as the checkout point where customers enter their payment details. A payment processor handles the logistics of transferring that data between the gateway, acquiring banks, card networks, and issuing banks to complete the transaction.

How do I start using Noda?

First, you need to be onboarded with Noda. Just fill out the form, and our sales team will reach out to you soon. We provide seamless onboarding with personalised support from a dedicated manager, who would also help with integration.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants