When setting up your e-commerce site on Magento, there are many factors to consider. Marketing and product quality are crucial, but a secure and user-friendly payment system is essential. Without it, Magento merchants risk losing customers just as they’re ready to buy.

This is where a reliable payment gateway comes in. It allows customers to pay directly on your Magento site, ensuring the process is both safe and smooth. In this guide, we’ll cover everything you need to know about Magento payments.

How to Accept Payments on Magento

Magento is an e-commerce platform suitable for B2C, B2B, and hybrid businesses. It offers a content management system (CMS), enterprise resource planning (ERP), and customer relationship management (CRM). These tools help streamline customer-facing content for your e-commerce site.

There are two ways of how to start accepting payments with Magento, according to their website as of August 2024.

- Custom integrations

Custom payment integrations let you connect with any payment service provider. They adapt standard order management system (OMS) messages to the specific format required by the provider you’re working with.

- Offline method

Offline payments are suitable if the payment process is handled by an external system outside of the Magento website. In this case, the OMS won’t take any payment actions, as order payments are fully managed outside the OMS.

What Is a Magento Payment Gateway?

As mentioned earlier, to accept payments on your Magento website without using an external offline system, you’ll need to partner with a payment service provider like Noda and integrate a payment gateway.

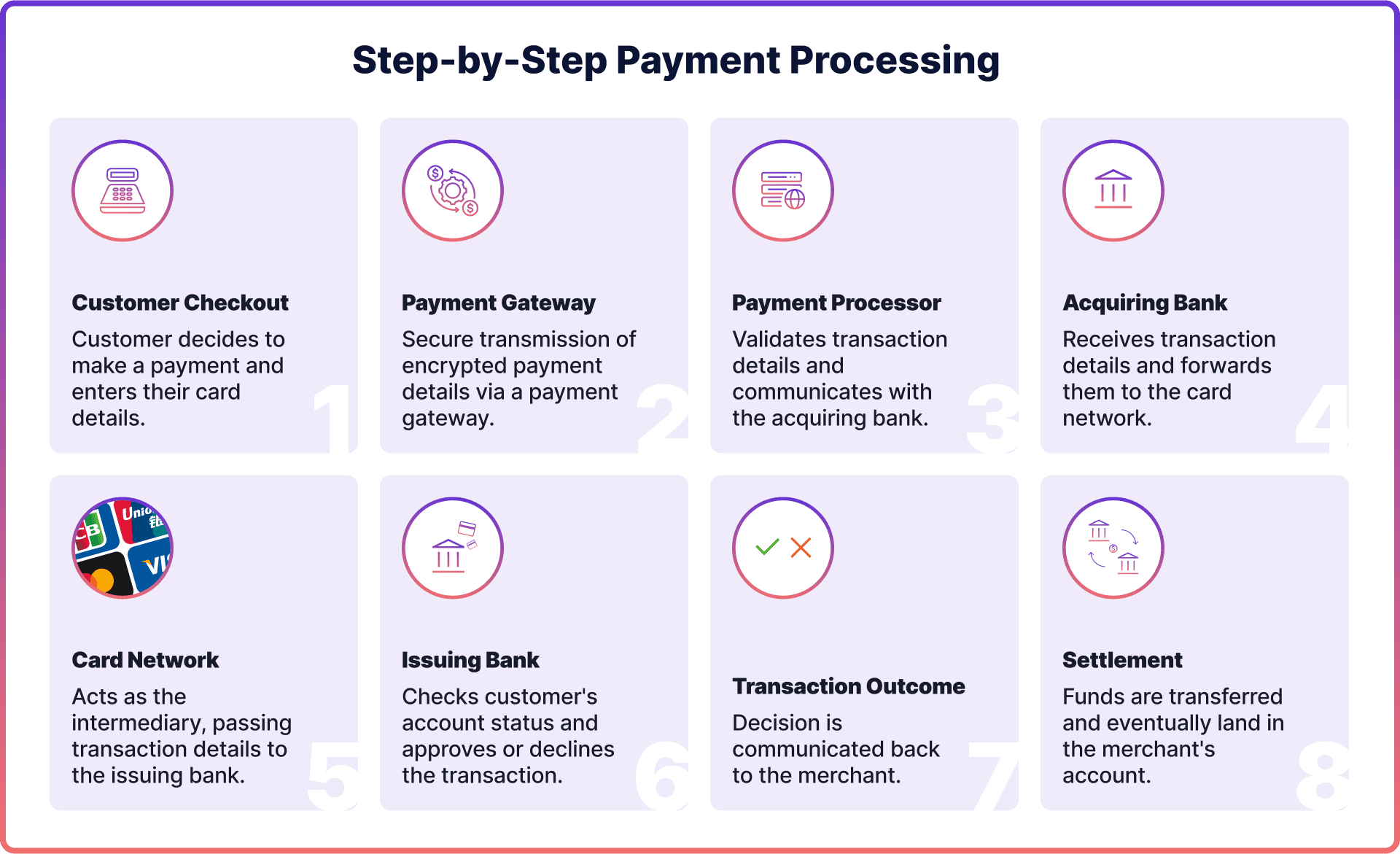

An online payment gateway functions like a card machine in a physical store. It serves as a checkout page that collects customer payment information, encrypts it for security, and connects it to the payment processor.

The payment processor then communicates with acquiring and issuing banks to approve or decline the payment and transfer funds to the merchant’s account. Below you can see Magento payment processing flow for card payments.

Types of Magento Payment Gateway Integration

There are two main types of payment gateway integration available via a service provider: redirect and via application programming interfaces (APIs). There are also options of integrating via Magento payment plugins and partnership programmes.

- Redirect

Redirect payment gateways, also known as third-party or hosted gateways, work by redirecting customers to the payment service provider's platform. There, they enter their payment details and complete the transaction before being sent back to the e-commerce website.

These gateways are easy to integrate and offer strong security, but businesses have less control over the customer experience.

- API

API-hosted payment gateways use application programming interfaces (APIs) to allow secure communication between different software.

This integration provides a seamless checkout process directly on the business's website or app, ensuring a smooth and integrated customer experience. However, it requires the business to maintain a secure cardholder data environment to meet data protection standards.

How to Choose the Right Payment Provider

Without a payment gateway, your online store is just a catalogue of products. To help your store grow, selecting the right payment provider is crucial.

An effective payment partner will guide you on how to increase conversions, reduce shopping cart abandonment, reduce chargebacks and optimise user experience. Here are a few other factors to consider when choosing a payment provider.

- Security: Ensure the provider is PCI compliant and uses advanced security features like machine learning-based anti-fraud systems.

- Integration: Choose a provider that guides you through the integration process and helps establish a clear implementation timeline.

- Fees: Look for transparent pricing with reasonable transaction fees.

- Customer Support: Opt for a provider that offers dependable customer support to assist with any issues.

Magento Payment Methods

Apart from the factors above, ensure your provider offers a variety of Magento payment options for customers. Research your target clientelle and their preferences of how to pay with Magento in advance. Make sure to provide popular payment methods that cater to their needs.

Card Payments

Credit and debit cards have been a widely adopted and trusted payment methods since the 20th century, including for e-commerce transactions. To accept card payments, set up a payment gateway with your chosen payment provider (see sections above).

Digital Wallets

Digital wallets (also called e-wallets or mobile wallets) like PayPal, Apple Pay, AliPay, Google Pay, have gained popularity in the last five years. They let customers store payment information securely and make payments with just a few clicks.

According to Statista, digital wallets surpassed cards in popularity in 2022. To accept digital wallets on Magento, you can use your payment provider or Magento’s partnership integrations.

BNLP Payments

Buy Now, Pay Later (BNPL) is a payment option that lets customers buy goods or services immediately and delay payment until later, sometimes with interest or fees. This option is especially popular among Millennials and Gen Z. Well-known providers include Klarna, Afterpay, and Affirm. Magento offers internal integrations to start accepting BNPL payments.

Open Banking Payments

Open banking, often referred to as pay-by-bank or account-to-account (A2A) payments in e-commerce, is an innovative API-based technology enabled by PSD2 regulation. It allows customers to pay directly from their bank accounts and authorise transactions in real-time using their existing banking apps.

Open banking offers a superior user experience, reduces chargebacks, and is cheaper for merchants since no card networks are involved. The process redirects customers from your e-commerce site to their trusted bank's interface to authorise the payment. Funds are then transferred directly from one account to another. The APIs used by banks and payment providers for data sharing are regulated and secure. The data is shared only with the customer’s consent.

Another benefit of open banking is the analytical tools provided by payment providers based on open banking data. These tools can help you optimise your e-commerce marketing, identify high lifetime value clients, and create targeted campaigns.

Open Banking Payments: Magento Plugin with Noda

Noda is a global open banking provider that assists online merchants with payment processing, end-user KYC, LTV forecasting and UX optimisation.

Merchants can install Noda’s Magento plugin to start accepting open banking payments. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches.

Integrating Magento with Noda is quick and simple, requiring no advanced technical skills.

- Step 1: Upload the archive file in the Magento admin panel to install the plugin on your site.

- Step 2: Enter the API keys provided by Noda Hub after you complete the onboarding process.

- Step 3: Your Magento store is now linked with Noda.

We also offer payment processing and payment gateway for merchants, supporting a wide range of currencies for globally-minded clients. Our Know Your Whales (KYW) tool providers valuable user insights for lifetime value forecasting.

Whether you're looking to set up payments, enhance customer verification, optimise payment systems, forecast long-term value clients, or refine user experience, Noda is your partner in growth.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each